NFT

Share

NFTs are unique digital identifiers recorded on a blockchain that certify ownership and authenticity of a specific asset. Moving past the "PFP" craze, 2026 NFTs emphasize utility, representing everything from IP rights and digital fashion to RWA titles and event ticketing. This tag explores the technical standards of digital ownership, the growth of NFT marketplaces, and the integration of non-fungible tech into the broader Creator Economy and enterprise solutions.

12583 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Robinhood (HOOD) Stock Jumps 14% on Market Rally and Analyst Upgrades

2026/02/07 20:44

Pi Network Targets Open Mainnet 2026, Millions Prepare as Utility and Migration Accelerate

2026/02/07 20:41

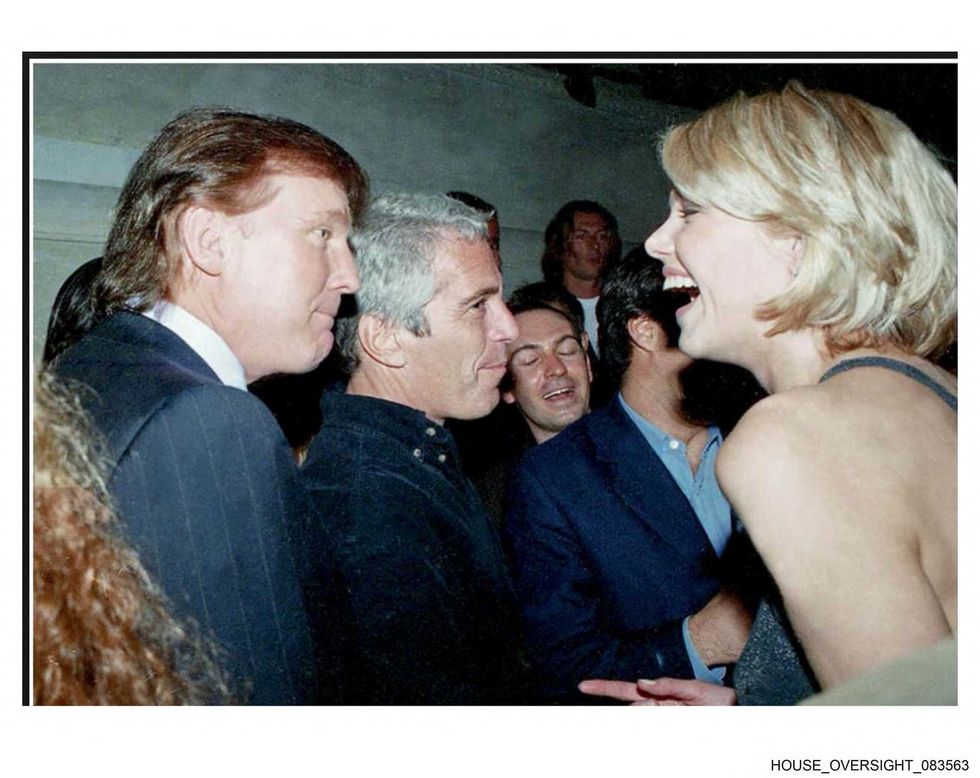

Trump named in explosive tip regarding Epstein’s death: ‘Authorized murder’

2026/02/07 20:37

Trump Administration Approves New Crypto-Friendly Bank

2026/02/07 20:37

XRP eyes $3 amid whale buying – Reversal or relief rally?

2026/02/07 20:19