ETF

Share

A crypto ETF is a regulated investment fund that tracks the price of one or more digital assets and trades on traditional stock exchanges like the NYSE or Nasdaq.Following the success of Bitcoin and Ethereum ETFs, the 2026 market now includes Solana ETFs and diversified Altcoin Baskets. ETFs serve as the primary vehicle for institutional capital and retirement funds (401k/IRA) to enter the Web3 space. This tag tracks regulatory approvals, AUM (Assets Under Management) inflows, and the impact of Wall Street on crypto liquidity.

39750 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

eurosecurity.net Expands Cryptocurrency Asset Recovery Capabilities Amid Rising Investor Losses

2026/02/06 17:24

The $1 Billion Liquidation: Bitcoin’s Brutal Moves

2026/02/06 17:18

PA Daily News | Bitcoin plunges 15.48% in a single day, marking the largest drop since the FTX crash; MSTR reports a net loss of $12.4 billion in Q4 2025.

2026/02/06 17:15

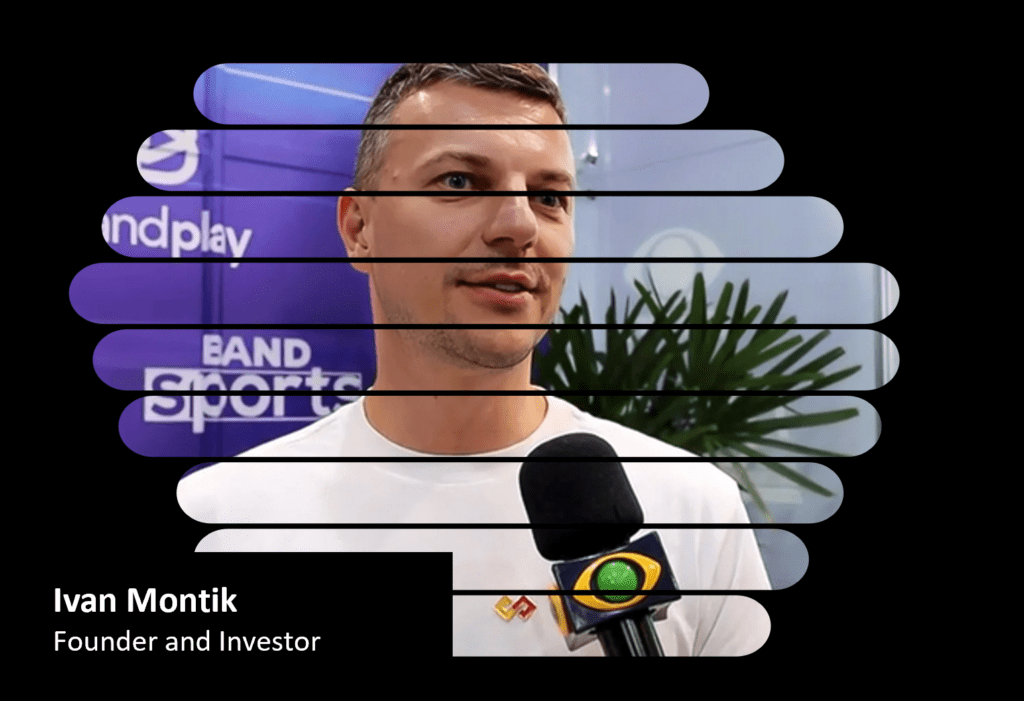

THE WIRECARD SMOKING GUN: SoftSwiss Founder Ivan Montik Unmasked in Munich Court as Judge Flattens PSP Denials

2026/02/06 17:04

What Triggered the Latest Bitcoin and Altcoin Crash?

2026/02/06 16:45