Bitcoin ETFs Bleed $817M as BTC Crashes to 9-Month Low – Is the Worst Over?

Bitcoin spot exchange-traded funds (ETFs) experienced one of the biggest one-day reversals of the year on January 29, as investors pulled out nearly $818 million from U.S.-based products as the Bitcoin price dropped to its lowest spot in nine months.

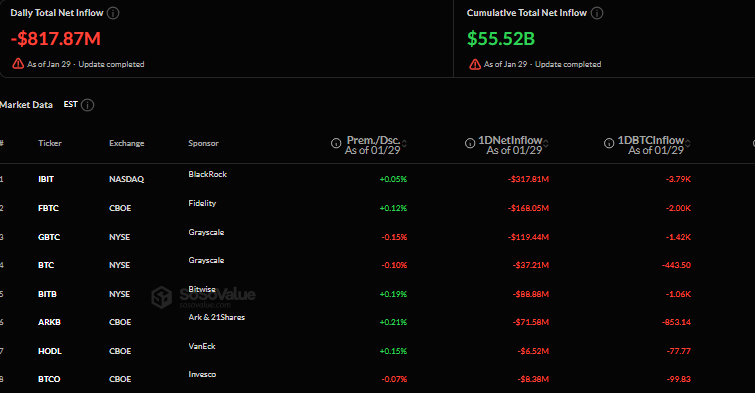

Sosovalue data shows that spot Bitcoin ETFs recorded net daily outflows of $817.87 million on January 29, erasing gains from earlier in the month and pushing January into negative territory overall.

Source: Sosovalue

Source: Sosovalue

Despite the heavy withdrawals, cumulative net inflows since the launch of spot Bitcoin ETFs remained substantial at $55.52 billion, showing how large the market has grown even amid recent volatility.

IBIT Leads Daily Bitcoin ETF Outflows as January Turns Negative

BlackRock’s iShares Bitcoin Trust remained the largest product by assets, holding $64.90 billion, but it also led the day’s withdrawals. IBIT recorded $317.81 million in net outflows, equivalent to roughly 3,790 BTC.

Fidelity’s FBTC followed with $168.05 million in outflows, while still maintaining cumulative inflows of $11.27 billion and total assets of $16.10 billion.

Grayscale’s GBTC continued its longer-term pattern of redemptions, reporting a $119.44 million daily outflow.

Since converting to an ETF, GBTC has seen cumulative net outflows of $25.70 billion, though it still holds $13.42 billion in assets.

Other issuers too fell, with Bitwise BITB losing $88.88 million, ARK 21Shares ARKB losing $71.58 million, and smaller drops in VanEck, Invesco, and other funds.

There were other minor ETFs that recorded zero flows, indicating there were neither net creations nor redemptions in the session.

The heavy daily pullback followed a volatile stretch throughout January. After strong inflows earlier in the month, including more than $840 million on January 14, sentiment deteriorated rapidly.

ETFs recorded large outflows on multiple days, including $708.71 million on January 21 and $483.38 million on January 20.

On a weekly basis, the trend was clearly negative, with nearly $1 billion in net outflows for the week ending January 29.

The entirety of January ended with net outflows approximated to be $1.1 billion, and this trend was also characterized in December 2025.

Crypto and TradFi Slide Together as Risk Appetite Fades: BTC Slid Below $84,000

The ETF sell-off unfolded alongside a sharp downturn in the broader crypto market, with Bitcoin sliding as low as $81,200, breaking below the $84,000 support level that had held since mid-November.

The drop marked Bitcoin’s weakest price since November and came as Ether, Solana, and XRP ETFs also recorded net outflows.

Total crypto market capitalization fell about 6% on the day, while forced liquidations cleared more than $1.8 billion in leveraged positions, mostly from long traders.

Market weakness was not confined to crypto, as the traditional market was affected, with gold falling sharply after recently reaching record highs, while equity markets also declined.

Analysts pointed to a mix of macro factors, including renewed tariff threats from U.S. President Donald Trump and concerns around artificial intelligence-related tech stocks following a steep drop in Microsoft shares.

They also pointed to lingering uncertainty after the Federal Reserve held interest rates steady while signaling patience on future easing.

CryptoQuant analysts described Bitcoin’s decline as relatively moderate compared to moves in traditional markets, noting that gold and silver experienced steeper corrections.

Data showed that open interest on major exchanges had climbed back above levels seen before a major October liquidation event, showing a continued appetite for leverage despite recent volatility.

Bitcoin’s Fear and Greed Index dropped to 16, a level typically associated with extreme fear and capitulation.

As Bitcoin sentiment weakens, analysts warn bearish conditions could persist with lower price targets.

Analysts noted a potential retest of the 200-week SMA near $57,974, a level historically seen as long-term value.

You May Also Like

DBS, Ripple, and Franklin launch tokenized loans 24/7 on XRPL

Pound Sterling softens below 1.3700 as Trump picks Warsh for Fed