2026-01-30 Friday

Crypto News

Indulge in the Hottest Crypto News and Market Updates

XRP-linked Ripple rolls out treasury platform after $1 billion GTreasury deal

Finance

Share

Share this article

Copy linkX (Twitter)LinkedInFacebookEmail

Share

Author: Coindesk2026/01/30 20:44

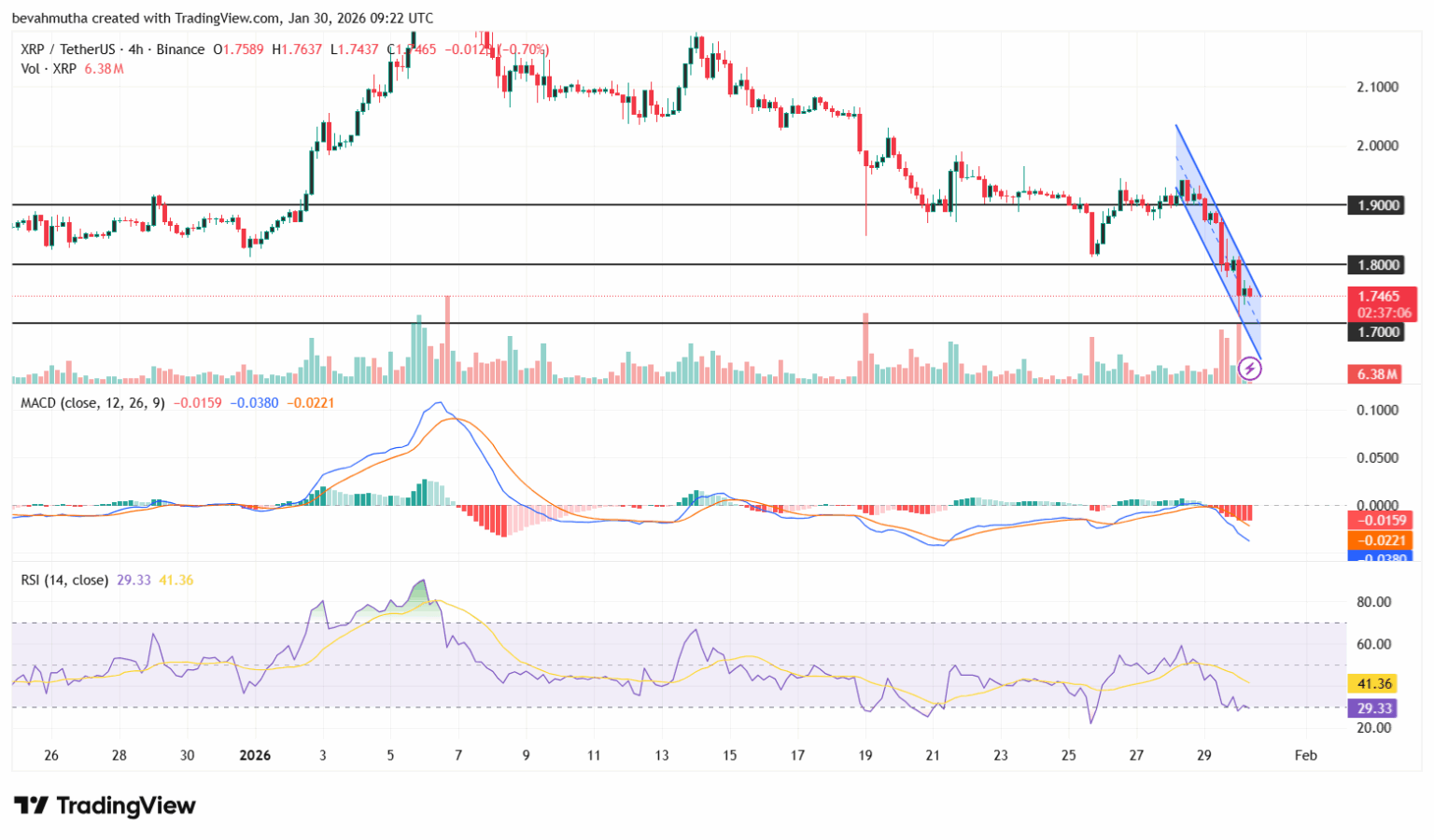

XRP Price Forecast: Testing Key Support Levels Amid Ongoing Decline

TLDR XRP has experienced a 6.7% decline in the past 24 hours, trading at $1.7572. The coin faces resistance at the 9-period Simple Moving Average around $1.8247

Share

Author: Coincentral2026/01/30 20:28

XRP Price at $126? CNBC Mistakes XRP for Solana

During the CNBC Crypto World show, an on-air graphics error showed the XRP price surging 6,500% all the way to $126. The post XRP Price at $126? CNBC Mistakes

Share

Author: Coinspeaker2026/01/30 20:26

SUI Price Prediction: Targets $1.47-$2.00 Range by February Amid Technical Consolidation

The post SUI Price Prediction: Targets $1.47-$2.00 Range by February Amid Technical Consolidation appeared on BitcoinEthereumNews.com. Rongchai Wang Jan 29,

Share

Author: BitcoinEthereumNews2026/01/30 20:24

Vitalik Buterin Outlines $45M ETH Plan for Privacy, Open Hardware

Ethereum co-founder Vitalik Buterin announced a personal commitment to fund privacy-preserving technologies, open hardware, and verifiable software systems, earmarking

Share

Author: Crypto Breaking News2026/01/30 20:22

What is the 3 6 9 rule of money? A practical guide to emergency funds

The 3 6 9 rule of money offers a simple way to think about emergency savings. It groups common recommendations into three practical tiers so you can pick a starting

Share

Author: Coinstats2026/01/30 20:15

The U.S. Has Not Been Taken Advantage Of Since WWII

The post The U.S. Has Not Been Taken Advantage Of Since WWII appeared on BitcoinEthereumNews.com. A typical family in 1957. (Photo by Lambert/Getty Images) Getty

Share

Author: BitcoinEthereumNews2026/01/30 20:03

Stellar Price Prediction: XLM Risks Further Drop to $0.14 as Bearish Outlook Persists

Highlights: The Stellar price is in the red, currently exchanging hands at $0.19, marking a 6% decrease today. The Bitcoin data show an intense bea

Share

Author: Coinstats2026/01/30 20:02