Bitcoin Spikes to a 2-Month High: Dead-cat-bounce or $100k Next? Experts Insights

The post Bitcoin Spikes to a 2-Month High: Dead-cat-bounce or $100k Next? Experts Insights appeared first on Coinpedia Fintech News

Bitcoin (BTC) price surged to a two-month high of over $97.7k on Wednesday, January 14, 2026. The flagship coin has extended the new year’s gains during the past few days, signaling a potential bullish outlook in the near future catalyzed by robust cumulative fundamentals.

Why Is Bitcoin Price Rising Today?

Capitulation of Retailers Amid Renewed Demand from Whales

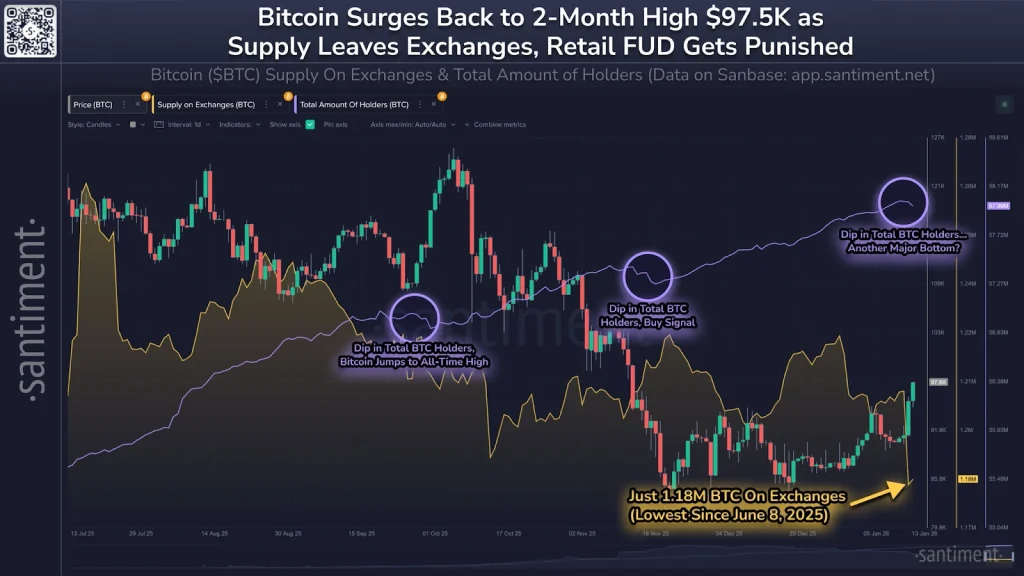

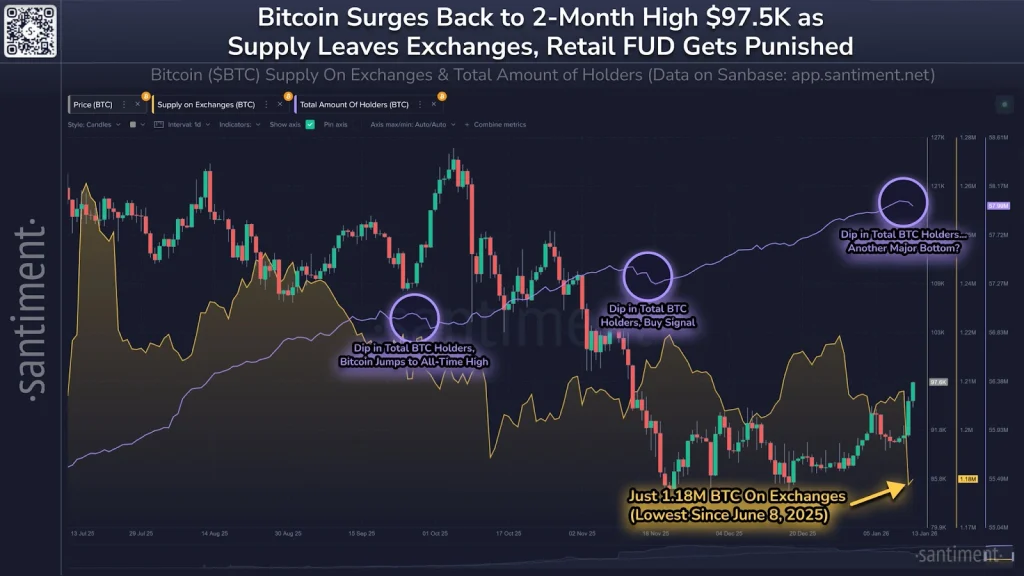

Bitcoin price rallied to a new local high catalyzed by the capitulation of retail traders amid the renewed demand from whales. According to market data from Santiment, more than 47k BTC holders capitulated in the last three days despite its notable decline in crypto exchanges.

Source: X

Meanwhile, the U.S. spot BTC ETFs recorded a net cash inflow of over $750 million on Tuesday, the highest since October 6, 2025.

Potential Gold and Stocks Markets Topout

Bitcoin price rallied on Wednesday partially fueled by the rising capital rotation from gold and the stock market. During the last 24 hours, more than $360 billion was wiped out from the U.S. stock market.

Meanwhile, Gold price has formed a potential reversal pattern since October 2025, which is characterized by a bearish divergence of its daily Relative Strength Index (RSI).

Technical Tailwinds

Following the notable Bitcoin price rebound on Wednesday, the flagship coin has potentially invalidated bearish sentiment from the camp of the four-year cycle. Crypto analyst @CyclesWithBach on X stated that BTC price is headed to a new all-time high after rebounding from a prior resistance level.

Source: X

What’s Next?

After closing 2025 down around 10%, Bitcoin price is expected to record palpable gains in 2026 catalyzed by robust fundamentals. Furthermore, Bitcoin demand from institutional investors, led by spot BTC ETFs and treasury companies, has reduced its circulating supply amid its notable regulatory clarity globally.

As such, Binance Co-founder Changpeng Zhao (CZ) is of the camp that expects BTC price to hit $200k in the near term. The macro bullish outlook for Bitcoin will be influenced by the rising global supply of money.

You May Also Like

Talos Extends Series B to $150M With Strategic Institutional Investors

Headwind Helps Best Wallet Token