Are Weak ETF Inflows Holding LINK Price Back? Is It Gonna Hit $8?

The post Are Weak ETF Inflows Holding LINK Price Back? Is It Gonna Hit $8? appeared first on Coinpedia Fintech News

The LINK price remains capped and under bearish pressure despite there being strong signs of sustained accumulation and a growing narrative that positions Chainlink as foundational infrastructure for on-chain finance. While exchange balances continue to fall and enterprise adoption accelerates, LINK price USD action suggests the market is still struggling with short-term demand constraints, and LINK ETF’s declining inflows kind of proves that.

LINK Crypto’s Infrastructure Narrative Continues to Expand

Fundamentally speaking, Chainlink crypto is a very strong asset and can be viewed as one of the top blue-chip projects in the industry. As it is increasingly viewed as the backbone of on-chain finance, similar to how Microsoft’s operating systems ruled early enterprise computing.

By setting data, interoperability, and security standards, Chainlink is kind of enabling financial institutions to transition from traditional digital systems toward onchain infrastructure.

This project’s efforts demonstrate that global finance is gradually migrating onto the blockchain. If that shift accelerates, Chainlink’s role will be supreme, similar to what Nvidia, Microsoft, and even Apple have, which’s a standardized middleware layer that could become indispensable. This factor alone is reinforcing long-term utility beyond speculative cycles.

Exchange Balances Signal Silent Accumulation

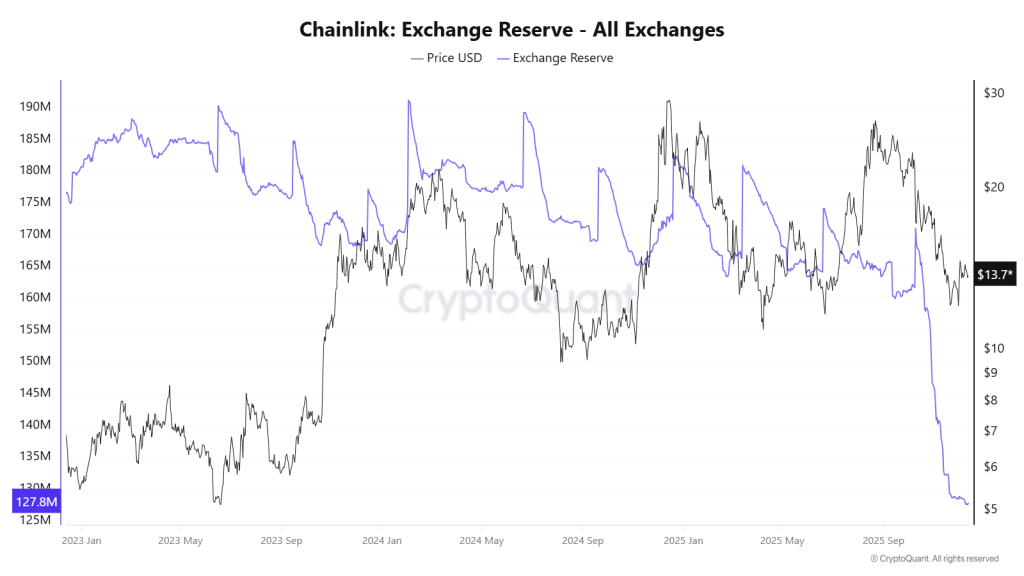

Not just verbally, it’s growing; even on-chain data shows a notable decline in LINK exchange balances, which suggests that accumulation is happening. On October 13, exchanges held approximately 167 million LINK tokens, a figure that has since dropped like a falling knife to 127.8 million LINK.

Such a sharp reduction is an open book example of how LINK crypto tokens are being bought every day, while retail keeps discarding it due to sector-wide pessimism. The big and wise investors are involved in this game, making long-term investments rather than short-term trades.

However, the LINK price chart has not reflected this accumulation, because if it does rise, the smart money won’t be able to buy at discounts more easily. Instead, they deliberately chose for its price to bleed slowly, so the more the decline, the better their profits will be in the future, which only the wise can understand.

That shows that retail distribution is being absorbed by larger participants. This dynamic explains why selling pressure persists without sharp breakdowns, keeping the LINK price USD suppressed but structurally supported.

ETF Flows Fail to Reinforce Buying Pressure in LINK Price

Despite the introduction of a LINK ETF early December 2025, institutional flows have remained underwhelming. Total cumulative net inflows currently stand near $52.67 million, with recent inflows failing to cross even $10 million during December. While there have been no notable outflows so far, the lack of sustained inflows signals limited conviction from traditional capital.

Without stronger ETF participation, LINK price forecast models remain constrained, as spot accumulation alone has not been sufficient to drive upside momentum. Continued stagnation could risk eventual outflows, which would add further downside pressure.

Technical Structure Shows Rising Risk

From a technical perspective, LINK price is losing alignment with its ascending trendline. This weakening structure increases the probability of further downside if demand does not materialize. If the current trend persists, LINK price prediction scenarios point toward a potential test of the $8 region.

At the same time, the divergence between long-term accumulation and short-term technical weakness highlights the broader tension within the market. While Chainlink’s fundamentals continue to strengthen, price action remains dependent on renewed demand and institutional participation.

You May Also Like

PEPE Price Prediction: Consolidation Phase Expected Before Potential 35% Rally to $0.0000097

Shiba Inu & Cronos Face Uncertainty, While Zero Knowledge Proof Boosts Global Reach with with $22M FC Barca Deal!