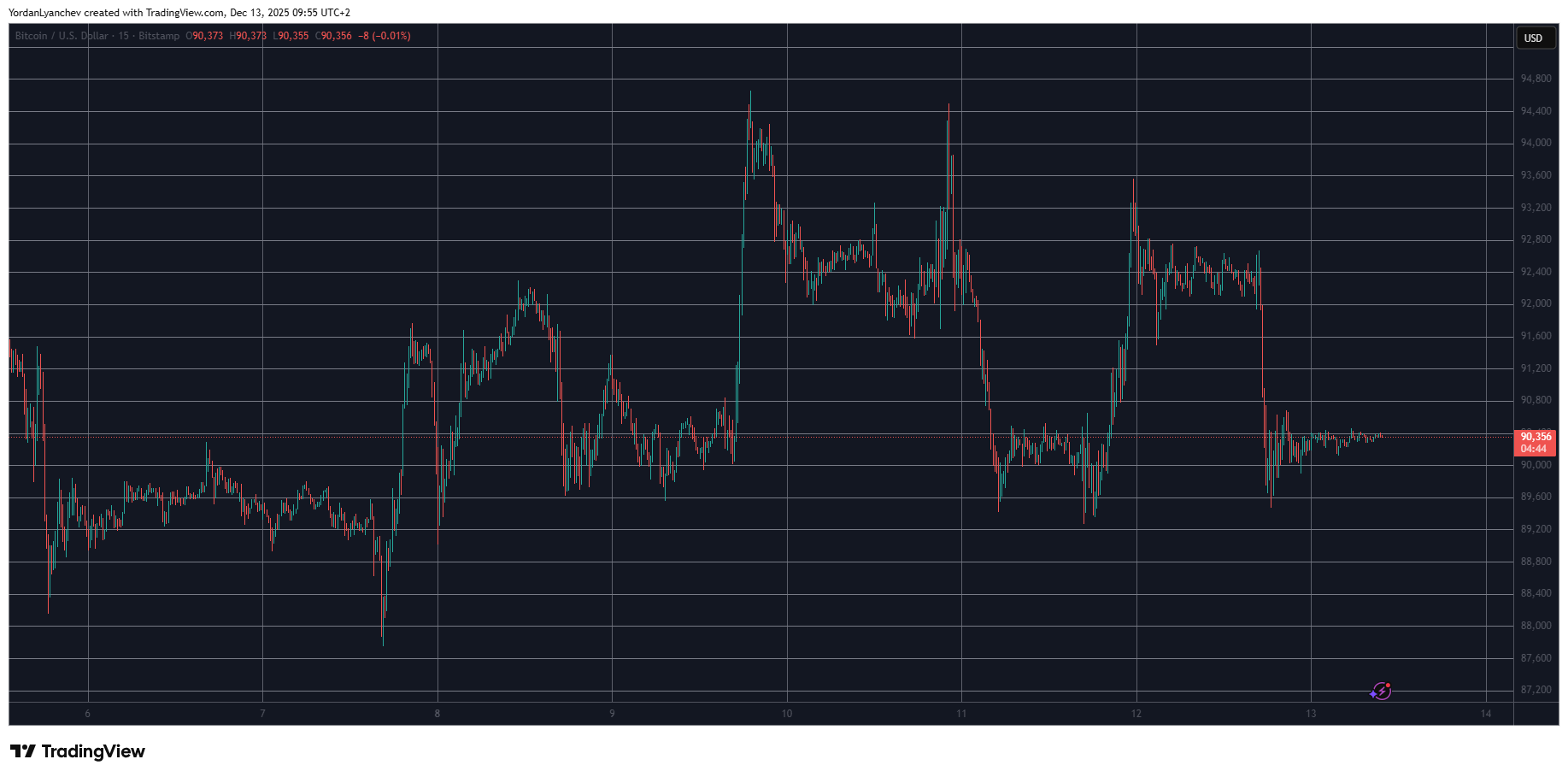

Bitcoin Holds Steady at $90K Despite Trump’s Latest Big Statements

Bitcoin’s price tumbled on Friday afternoon by several grand, but it managed to find some relief at $90,000 and has remained there ever since, even though the US President made some major statements.

The first involved the key interest rates in the country, which have been frequently related to the price of BTC, as each development on that front tends to move the cryptocurrency in either direction. The POTUS suggested that the rates could be at 1% or even lower next year, which would mean significant reductions from the 3.50% – 3.75%.

Later on, Donald Trump warned that the US would start land strikes against drug operations in Latin America, and in Venezuela in particular. Nevertheless, he noted that the Maduro-led nation is not the only supposed perpetrator, and added that “people that are bringing in drugs to our country are targets.”

His latest remarks came after the US initiated numerous attacks against what he referred to as drug-smuggling boats in international waters off the coast of South America.

The US has reportedly killed over 80 people with its strikes in the region, and just recently seized an oil tanker near Venezuela.

Despite both of these major statements from Trump, BTC’s price remains relatively stable at just over $90,000. In general, rate reduction hints tend to pump the asset, while military strikes do the opposite, but the cryptocurrency remains calm, at least for now.

BTCUSD Dec 13. Source: TradingView

BTCUSD Dec 13. Source: TradingView

The post Bitcoin Holds Steady at $90K Despite Trump’s Latest Big Statements appeared first on CryptoPotato.

Ayrıca Şunları da Beğenebilirsiniz

Those Who Missed XRP Now Eye Apeing ($APEING) as One of 2025’s Next Crypto to Hit $1

This U.S. politician’s suspicious stock trade just returned over 200% in weeks