Litecoin Treasuries and New ETFs Push Institutional Holdings Past 3.7M LTC

- Demand for Litecoin comes through ecosystem upgrades, such as record adoption of the MWEB privacy and storage layer and ongoing development of LitecoinVM.

- LTC price continues to flirt with $83.5 while analysts await a potential breakout above $100 in the near term.

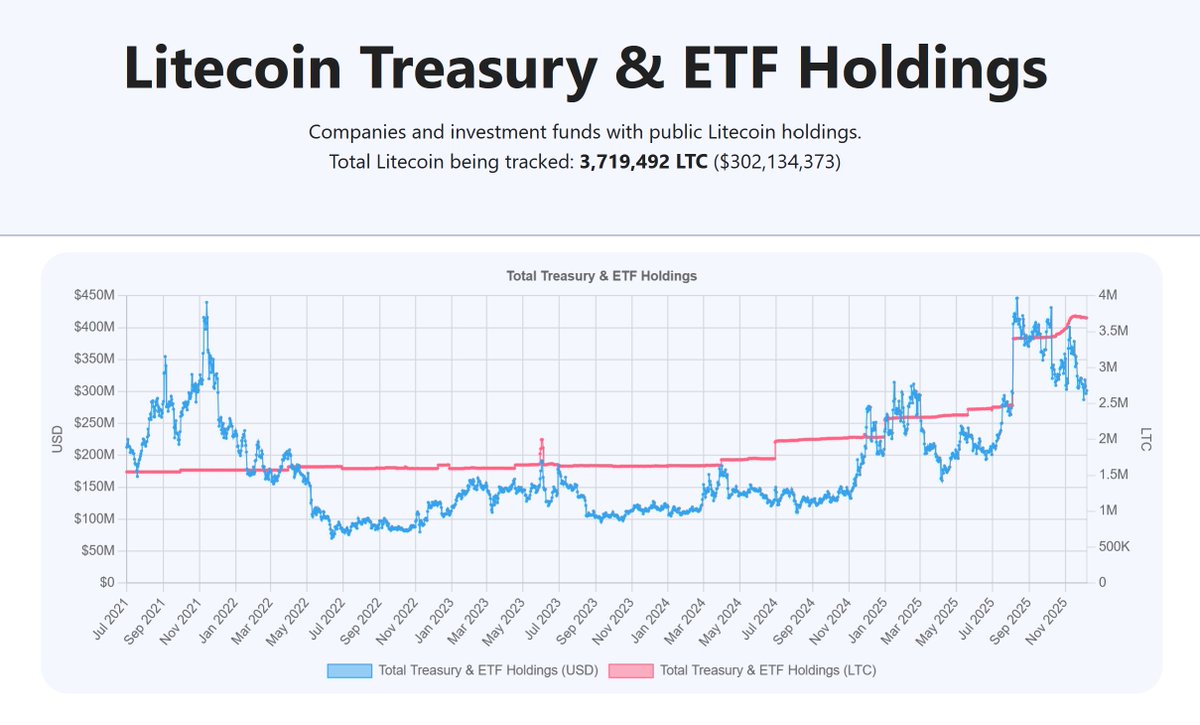

More and more public-listed firm are getting comfortable with having Litecoin as a treasury asset. Latest data shows these firms and investment firms collectively hold over 3.7 million LTC. This shows a surge of one million LTC since August. Furthermore, the launch of the LTC ETF by Canary Capital brings greater legitimacy to the product.

Litecoin Treasury and ETH Holdings Surge

Public investment vehicles and corporate treasuries have increased their LTC exposure over the past two months. On-chain data shows that, along with asset manager Grayscale, corporate players like LiteStrategy and Luxxfolio, have increased their Litecoin treasury, as reported by CNF.

Source: Litecoin Foundation on X

Source: Litecoin Foundation on X

Another major reason behind the rising LTC demand is that the blockchain is putting greater focus on privacy matters. The Litecoin Foundation also announced that the volume of LTC pegged into the MWEB network has reached a new all-time high. The Foundation said the milestone reflects increasing adoption of MWEB as a trusted optional privacy and storage feature within the Litecoin ecosystem.

Source: Litecoin Foundation

Source: Litecoin Foundation

On the other hand, developers behind LitecoinVM are working to upgrade the blockchain’s economic architecture. The project introduces new funding mechanics that seek to improve capital efficiency and establish predictable, sustainable yield pathways, replacing the short-term liquidity patterns that are common in other ecosystems.

According to the team, the framework could support estimated yields of 7–11 percent on native LTC without altering Litecoin’s base-layer design. It also outlines a foundation for bringing decentralized finance capabilities to one of the industry’s longest-standing proof-of-work networks.

The initiative effectively adds a new economic layer atop LTC. It combines MWEB privacy features, PoW security, and the programmability introduced through LitVM to position LTC as a yield-generating asset for the first time.

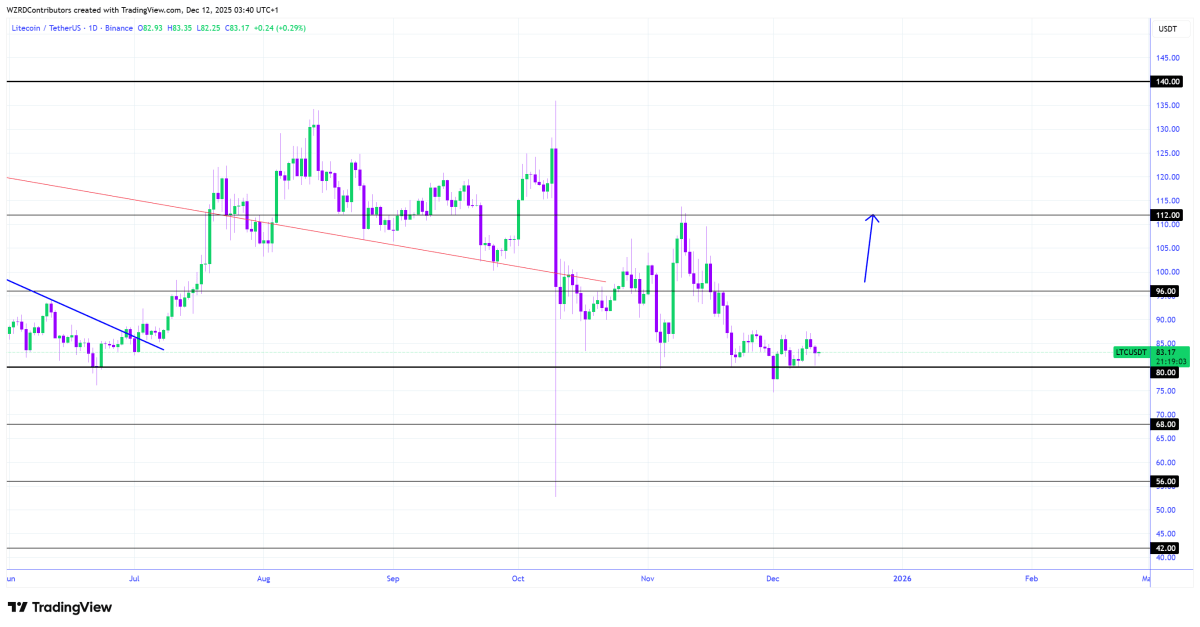

Will LTC Price Rally to $100 Soon?

Litecoin’s native cryptocurrency LTC continues to flirt with $83.5, trading almost flat on the weekly chart. Over the past month, the LTC price has dropped 17% amid strong selling pressure in the market.

Source: CRYPTOWZRD on X

Source: CRYPTOWZRD on X

Analyst CryptoWZRD reported that Litecoin ended the daily session with an indecisive close. The analyst noted that there’s a clear lack of directional momentum. He added that traders will need to vote for more constructive price action before identifying the next trading setup.

Another market commentator, Master, suggested that Litecoin is approaching a bottom amid heightened price compression. He noted that this sets the stage for a new all-time high ahead.

]]>Ayrıca Şunları da Beğenebilirsiniz

Will the 10% Rally Build Into a Bigger Run?

‘Groundbreaking’: Barry Silbert Reacts to Approval of ETF with XRP Exposure