Africa’s PR costs are soaring; ex-CNN anchor Zain Verjee has an AI fix

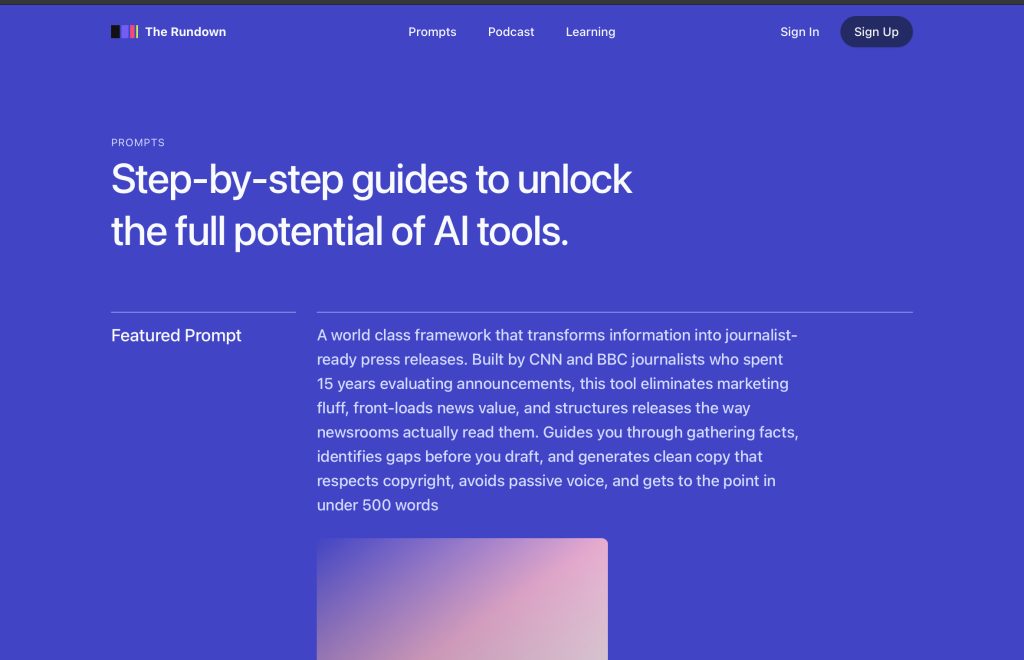

The Rundown Studio, a communications technology company co-founded by former CNN anchor Zain Verjee, has launched an AI-powered prompt library designed to help communications teams in emerging markets cut the cost of traditional public relations services.

The platform gives users direct access to newsroom-tested frameworks without relying on expensive agency retainers. It includes 12 specialised tools for corporate communications teams, newsrooms, and investors. These tools cover Tier 1 media pitches, newsroom standard press releases, full 30-minute television scripts, and best practice frameworks for communications teams working across Africa. The platform launched with free and paid tiers.

The launch comes at a time when traditional PR services remain costly and out of reach for many organisations across Africa. In several African markets, small businesses spend up to $1,500 monthly on basic media retainers, while more established firms pay between $5,000 and $15,000 monthly. Larger international campaigns can cost upwards of $20,000 monthly.

These high costs, combined with staffing and structural challenges within many agencies, mean startups, nonprofits, and growing companies are often unable to access professional communications support. The Rundown Studio says its system is designed to close this gap by offering cheaper, structured alternatives powered by AI.

Image Source: The Rundown Studio.

Image Source: The Rundown Studio.

“This addresses a fundamental market failure,” Verjee said. “Communications teams in Nairobi, Lagos, and Accra have the same deadline pressures as teams in New York or London, but they do not have the same access to world-class expertise. Traditional agencies charge enterprise rates for work that can now be systematised through frameworks that keep humans in control.”

She added that the tools are not designed to replace professionals but to support them. “These are not generic AI prompts. They are workflows built from 20 years of combined newsroom and corporate communications experience, designed specifically for the resource constraints and cultural contexts of emerging markets,” Verjee said.

Cofounder and product strategist, Thomas Brasington, said the product challenges the traditional billable-hours model used by many PR agencies. “We are testing whether you can deliver the strategic thinking of a senior communications consultant through structured frameworks, with the professional still making every final decision,” he said.

The tools were developed by former journalists from organisations including CNN, BBC, and Sky News. The company said the system analyses source material against current news cycles and generates newsroom-calibrated outputs.

The launch follows The Rundown Studio’s earlier release of The Newsroom Blueprint, an AI verification handbook developed with security and intelligence researcher Candyce Kelshall and the Canadian Association for Security and Intelligence Studies, as well as its Embedded podcast series featuring LinkedIn executive Aneesh Raman and Mastercard AI counsel Rashida Richardson.

Ayrıca Şunları da Beğenebilirsiniz

Will the 10% Rally Build Into a Bigger Run?

‘Groundbreaking’: Barry Silbert Reacts to Approval of ETF with XRP Exposure