Solana DeFi grew 259% in a single month, JUP and RAY saw substantial growth, can the prosperity based on MEME last?

Author: Frank, PANews

The governance tokens of several DeFi projects in the Solana ecosystem have seen a sharp increase. In the past half month, the price of JUP has increased by 57%, RAY has increased by 102%, and ORCA has also increased by 33%. Does the DeFi product of the Solana ecosystem seem to be the first track to radiate after the MEME craze? Are these obvious increases specifically from MEME coins or are there other reasons? PANews conducted an investigation on this.

80% of transactions come from MEME

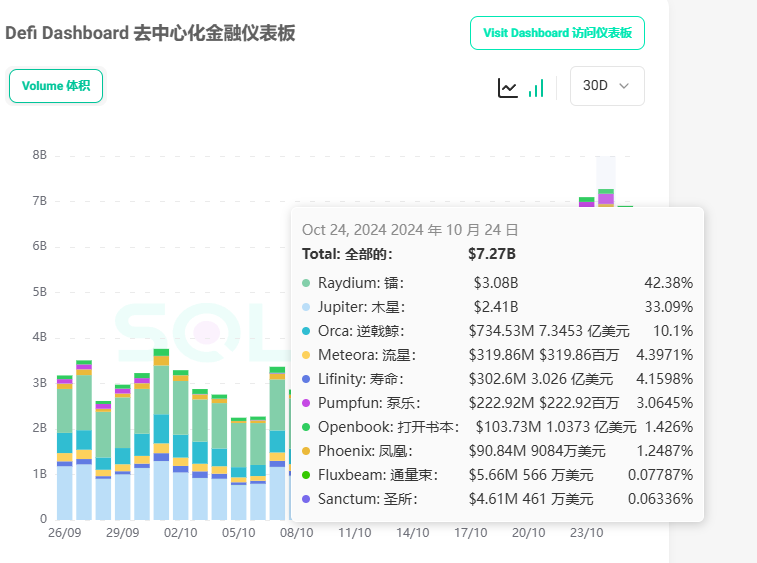

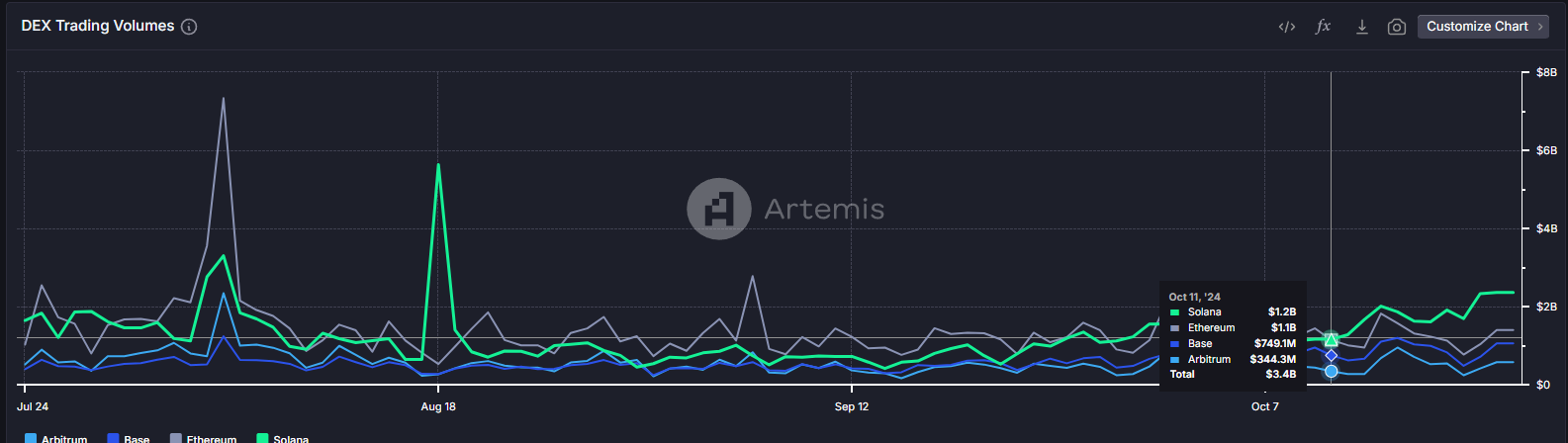

Overall, the rise of DeFi tokens in the Solana ecosystem is inseparable from changes in data. In the past month, the DeFi data on the Solana chain has seen a significant increase. On September 24, the transaction volume of DeFi was US$2.8 billion. As of October 24, this figure increased to US$7.27 billion, a monthly increase of 259%. At present, Solana's DeFi transaction volume has far exceeded Ethereum, becoming the public chain with the largest transaction volume.

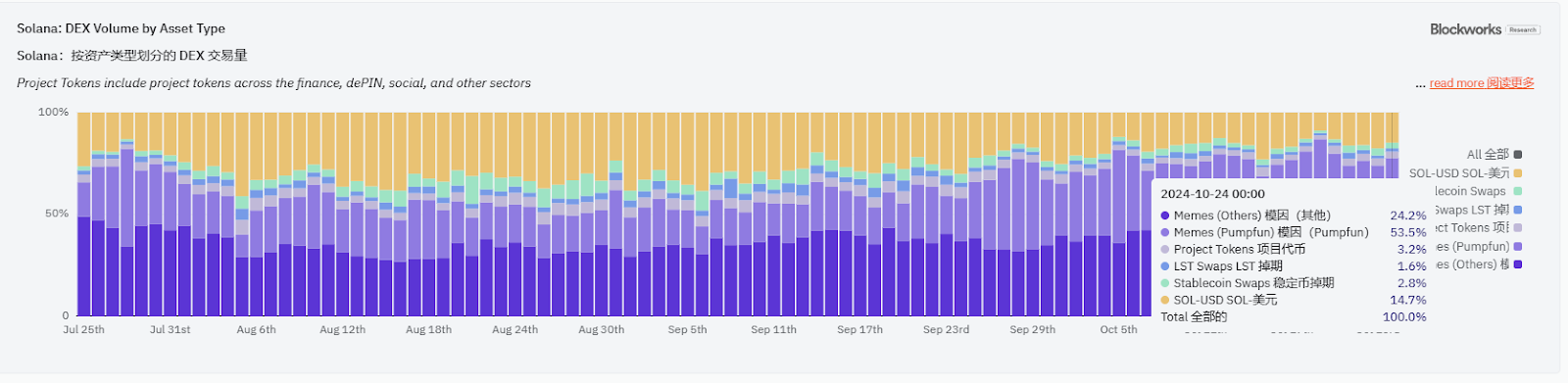

Among them, nearly 80% of the transaction volume comes from MEME coins. According to blockworks data, on October 24, 53.5% of Solana DEX transaction volume came from Pump.fun-related MEME, and 24.2% came from other MEME transactions. Raydium is undoubtedly still the biggest beneficiary, with a market share of 65.9%.

The changes in multiple data indicate that the main changes in Solana came on October 11. The recently popular GOAT was created on October 10 and soared 153 times on October 11, becoming the new generation of MEME king. Overall, MEME coin is still the biggest driving force for Solana DeFi.

Large investors contribute 70% of the transaction volume, and 10U Ares contribute about one ten-thousandth.

In terms of the number of addresses, data on October 23 showed that there were approximately 4.48 million active addresses with less than $10, accounting for 83% of the total 5.38 million active addresses, while the number of transaction addresses with more than $500,000 was only 26,000, accounting for about 0.4%.

But more people does not mean more power. On October 23, addresses with more than $500,000 on the Solana chain contributed $3.11 billion in trading volume, accounting for more than 73% of the total DEX trading volume on that day, while addresses with less than $10 contributed only $580,000 in trading volume, accounting for about one ten-thousandth of the total.

But in summary, on Solana, 0.4% of the large accounts contribute more than 73% of the transaction volume, while the retail accounts, which account for more than 83%, contribute about 0.1% of the transaction volume.

Retail investors’ transactions are concentrated on Raydium. 84% of the transaction volume of addresses with transaction volume less than $10 occurs on Raydium, while the transaction volume of addresses with transaction volume exceeding $500,000 is mainly concentrated on DEXs such as Raydium and Orca. Another data shows that 74% of the transaction volume of DEX on the Solana chain comes from MEME coin transactions. Therefore, it can be seen that most of the funds of large investors on Solana are also used to speculate on MEME.

Jupiter's actions continue to promote growth, Rayium relies on MEME to win

Specifically for these DEX products, these changes do not seem to all come from MEME. PANews analyzed several major Solana DEX products.

As the largest DEX aggregator on Solana, Jupiter's movements have always been one of the important indicators leading Solana's on-chain activities. Since October, Jupiter has been making frequent moves. First, on October 8, it announced the launch of a new mobile terminal. The main update activity is zero platform fees and built-in chain function. The built-in chain function supports multiple payment methods such as Apple Pay and credit cards. In particular, the payment function of Apple Pay and credit cards is considered to be a new fiat currency channel after its launch.

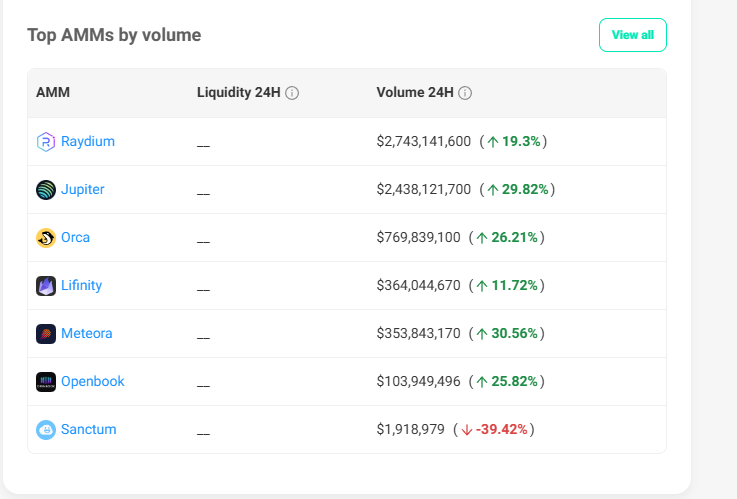

Then on October 17, Jupiter announced the launch of Solana Memecoin terminal "Ape Pro". The biggest update of this project is to achieve MEV protection, which can greatly improve the sandwich attack phenomenon. In addition, the third quarter active equity staking reward application will be opened on October 21. Multiple updates or rewards have caused Jupiter's trading volume to surge from US$790 million on October 6 to US$2.4 billion on October 24, and the trading volume increased by 3 times within the month. As the data grew, the price of the token JUP also rose by 57% from October 11 to October 24, ahead of many other mainstream tokens.

Rayium's governance token has also performed well recently. From October 10 to October 24, the maximum increase reached 102%. From the news level, Rayium has not released any major actions. The main growth still comes from the data level. First, the GOAT token created on October 10 once again brought the MEME craze back to the Solana ecosystem. With the explosive growth of the GOAT token, the transaction volume brought by this project alone is close to 1.5 billion US dollars. Since October 10, Rayium's trading volume has begun to rise exponentially from about 1 billion US dollars per day. By October 24, Rayium's daily trading volume has exceeded 3 billion US dollars. On the 23rd, Rayium officially announced that the total trading volume exceeded 300 billion US dollars. Among them, it earned 620 million US dollars for liquidity providers, and stated that it would spend 50 million US dollars to repurchase RAY tokens.

Orca's market share has been severely squeezed in the past six months. At present, DEX users on Solana are basically concentrated on Rayium. Half a year ago, the market share of Orca and Rayium was basically around 35%, and the two companies accounted for more than 70% of the trading volume. But as Pump.fun becomes more and more popular, it continues to bring new trading volume to Rayium. Orca's market share is currently only between 10 and 15%. From the user structure, Orca's trading volume is basically maintained by large users. On October 23, another one-click coin issuance platform GoFundMeme selected Orca as the trading pool after the breakthrough curve. Orca officials made a long introduction to GoFundMeme. It can be seen that Orca seems to be hoping to regain its original market share by supporting another MEME launch platform.

In addition to the major DEXs mentioned above, the growth of Lifinity is also worth noting. Lifinity is an active market maker on Solana, using oracles as a key pricing mechanism. Since October 14, Lifinity's on-chain transaction volume has increased by about 3 times in half a month from less than 100 million US dollars per day. By October 23, the transaction volume had increased to 363 million US dollars. In terms of trading popularity, Lifinity's main trading pairs are still concentrated on the trading pairs of SOL pledge tokens and stablecoins. Sandglass, the yield agreement launched by Lifinity, announced on October 24 that Sandglass currently provides more than 9% fixed income on USDC. Perhaps the recent data growth is related to such high-yield products.

In general, Solana's DeFi ecosystem growth is still driven by the recently popular AI-themed MEME coin. Although the TVL data has also increased, the overall change is not large. The growth of data is certainly a good thing, but if it only stays at the market prosperity achieved by the liquidity of MEME speculation, how long it can last may be a question worth thinking about. However, MEME fever seems to have become a periodic outbreak event on Solana. Who knows what will bring growth to the next round of "MEME+"?

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Cloud mining is gaining popularity around the world. LgMining’s efficient cloud mining platform helps you easily deploy digital assets and lead a new wave of crypto wealth.