Polychain-Backed Yala Stablecoin YU Crashes to $0.20 After Protocol Attack

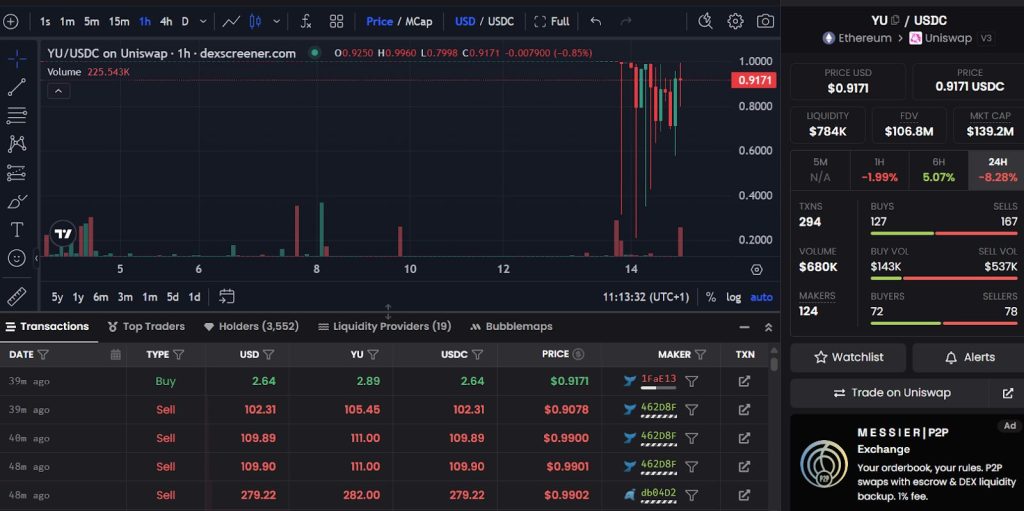

The Yala stablecoin (YU), a Bitcoin-native over-collateralized stablecoin backed by Polychain, lost its dollar peg around 5:14 UTC+8 today following a protocol attack that sent YU crashing to $0.2074 before recovering to $0.917.

The Yala team promptly addressed the incident on X (formerly Twitter), confirming the attack and its impact on the YU stablecoin’s price stability.

“Our protocol recently experienced an attempted attack that briefly impacted YU’s peg,” the team said.

“Assets Remain Safe”- Yala Stablecoin Team Scrambles to Restore Trust

Yala Co-founder Vicky Fu disclosed that the team is now working with external security specialists, including SlowMist and Fuzzland, to investigate the breach.

The team assured users that all assets remain secure while they focus on restoring stability and strengthening protocol security.

After the announcement, YU, designed to maintain a stable $1 value, fluctuated between $0.798 and $0.996.

Source: DexScreener

Source: DexScreener

Currently, only $784,000 in USDC liquidity exists in the YU stablecoin pool on Ethereum.

The Yala team has temporarily disabled the Convert and Bridge functions to ensure complete stability during system improvements.

In a September 14 X post, the team stated, “All other protocol functions remain unaffected, and user assets remain safe. We’ll share more updates once maintenance is complete.”

A stablecoin’s core function is maintaining a 1:1 “peg” to fiat currency value; without this peg, the fundamental purpose fails.

YU operates as an over-collateralized stablecoin, meaning it’s backed by digital asset reserves (BTC) that exceed the stablecoin’s own value.

With YU still struggling to maintain its peg, Yala faces a critical period for securing user trust and industry confidence.

At roughly $140M market cap, YU remains small compared to established stablecoins like Tether (USDT) and Circle (USDC), which hold $170 billion and $73 billion market capitalizations, respectively.

Even newer stablecoins like Ethena (USDe) and WLFI (USD1) command $13.5 billion and $5.8 billion valuations, respectively.

However, YU’s peg struggles aren’t the first of their kind in the crypto market.

Even Tether’s USDT temporarily lost its dollar peg in 2023 when two major trading pools became heavily imbalanced.

Tether CTO Paolo Ardoino explained that volatile stablecoin markets create opportunities for attackers to exploit liquidity pool imbalances.

More recently, in April, synthetic stablecoin sUSD, long pegged to the U.S. dollar within the Synthetix ecosystem, dramatically lost its peg, dropping to $0.68.

Unlike YU, sUSD didn’t face an attack. Instead, its depeg resulted from the protocol’s transition to new debt and collateralization mechanisms under SIP-420, designed to improve capital efficiency.

Rather than enhancing efficiency, the code upgrade accidentally dismantled key mechanisms that previously maintained sUSD’s dollar peg.

Why Do Billion-Dollar Stablecoins Keep Losing Their Peg?

In October 2023, TrueUSD, a major fiat-collateralized stablecoin, lost its peg after announcing suspended minting activities through technology partner Prime Trust.

Many TUSD holders interpreted the minting suspension as evidence that the company couldn’t maintain adequate fiat collateral backing.

The dramatic collapse of terraUSD (UST) and the entire Terra (LUNA) ecosystem in 2022 continues to cast doubt on stablecoin reliability.

Terra founder Do Kwon and the Luna Foundation Guard spent up to 80,000 bitcoin, worth approximately $9.2 billion, in an attempt to defend UST’s dollar peg before ultimately failing.

Former People’s Bank of China Governor Zhou Xiaochuan has now warned that stablecoins face a one-in-three collapse probability over the next decade due to crisis-induced arbitrage failures.

He cautioned that even fully-backed stablecoins can amplify risk through deposit-lending, collateralized financing, and asset trading activities.

Zhou criticized inadequate reserve custody standards, citing Facebook’s early plans to self-custody Libra assets as a problematic design.

While the Hong Kong Stablecoin Ordinance and U.S. GENIUS Act address some concerns, Zhou noted that regulatory gaps remain.

He recommended compiling actual circulation data to assess redemption risks, calling current oversight frameworks “far from sufficient.”

You May Also Like

Dramatic Spot Crypto ETF Outflows Rock US Market

Remittix Success Leads To Rewarding Presale Investors With 300% Bonus – Here’s How To Get Involved