Polymarket Eyes Funding At $10B Valuation, US Relaunch, As Kalshi Nears Fundraising At $5B

Polymarket is weighing new financing at a valuation as high as $10 billion alongside plans for a relaunch in the US, while competitor Kalshi is nearing a $5 billion fundraising.

According to a report by Business Insider that cited sources familiar with the matter, Polymarket has considered one offer that would value the company at $9 billion, and another that “offered a term sheet valuing Polymarket as high as $10 billion.”

That would be a huge jump in valuation for the company, which raised funding at a $1 billion valuation early in the summer, the article said.

Polymarket raised $200 million in June, led by Peter Thiel’s Founders Fund, the venture firm that was an early backer of projects such as OpenAI, Paxos and Palantir.

Polymarket Looks To Re-Enter The US Market

Polymarket is a decentralized platform that lets users trade event outcomes without a centralized bookmaker. It gained prominence during the 2024 US presidential election, where its market accurately predicted that Donald Trump would win.

Polymarket processed over $8 billion in wagers during the US election campaign, generating more online traffic than sports betting giants FanDuel, DraftKings and Betfair.

In 2022, Polymarket was barred from serving US users after a settlement with the Commodity Futures Trading Commission (CFTC). But in July it bought the Florida-based derivatives exchange QCX for about $112 million, paving for a potential to re-entry into the US market.

The CFTC issued a no-action letter to QCX earlier this month, which grants retail relief from certain federal reporting and record keeping requirements for event contracts.

Polymarket CEO Shayne Coplan commented on that decision on X at the time, saying it gives the platform a “green light to go live in the USA.”

Kalshi Nears Fundraising At $5 Billion Valuation

Meanwhile, The Information reported that Polymarket rival Kalshi is closing on a new funding that would value it at about $5 billion.

In June, Kalshi secured $185 million at a $2 billion valuation, with Paradigm leading that funding round. Other investors included Sequoia, Multicoin, Neo and Bond Capital.

Kalshi ranks among the most active prediction markets, alongside Polymarket, in terms of trading volumes and monthly active users.

The platform started gaining momentum following a 2024 court ruling that allowed it to offer political-event contracts. The CFTC had appealed the ruling, but ended up voluntarily dropping this appeal in May this year.

Kalshi is still facing legal scrutiny in a few US states over whether some of its event contracts constitute gambling rather than permissible derivatives.

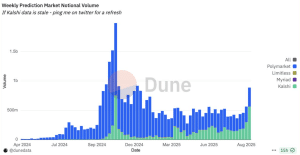

Since the US presidential election ended, both Polymarket and Kalshi have seen their active user bases shrink.

Despite that, market watchers say that momentum is shifting in the predictions market space, mainly fueled by the start of the National Football League season. Market analyst Tarek Mansour noted this week that Kalshi processed $441 million in volume since kickoff.

Weekly prediction market notional volume (Source: X)

Competition in the space is also heating up as more companies push to get a share of the growing predictions market space. These companies include Coinbase, Crypto.com and Underdog, who are either exploring or rolling out their own platforms.

You May Also Like

Where is the Bottom for Bitcoin?

Mysterious whales are accumulating these cryptocurrencies after market crash