Fed Rate Cuts: IMF Urges Strategic Caution for Economic Stability

BitcoinWorld

Fed Rate Cuts: IMF Urges Strategic Caution for Economic Stability

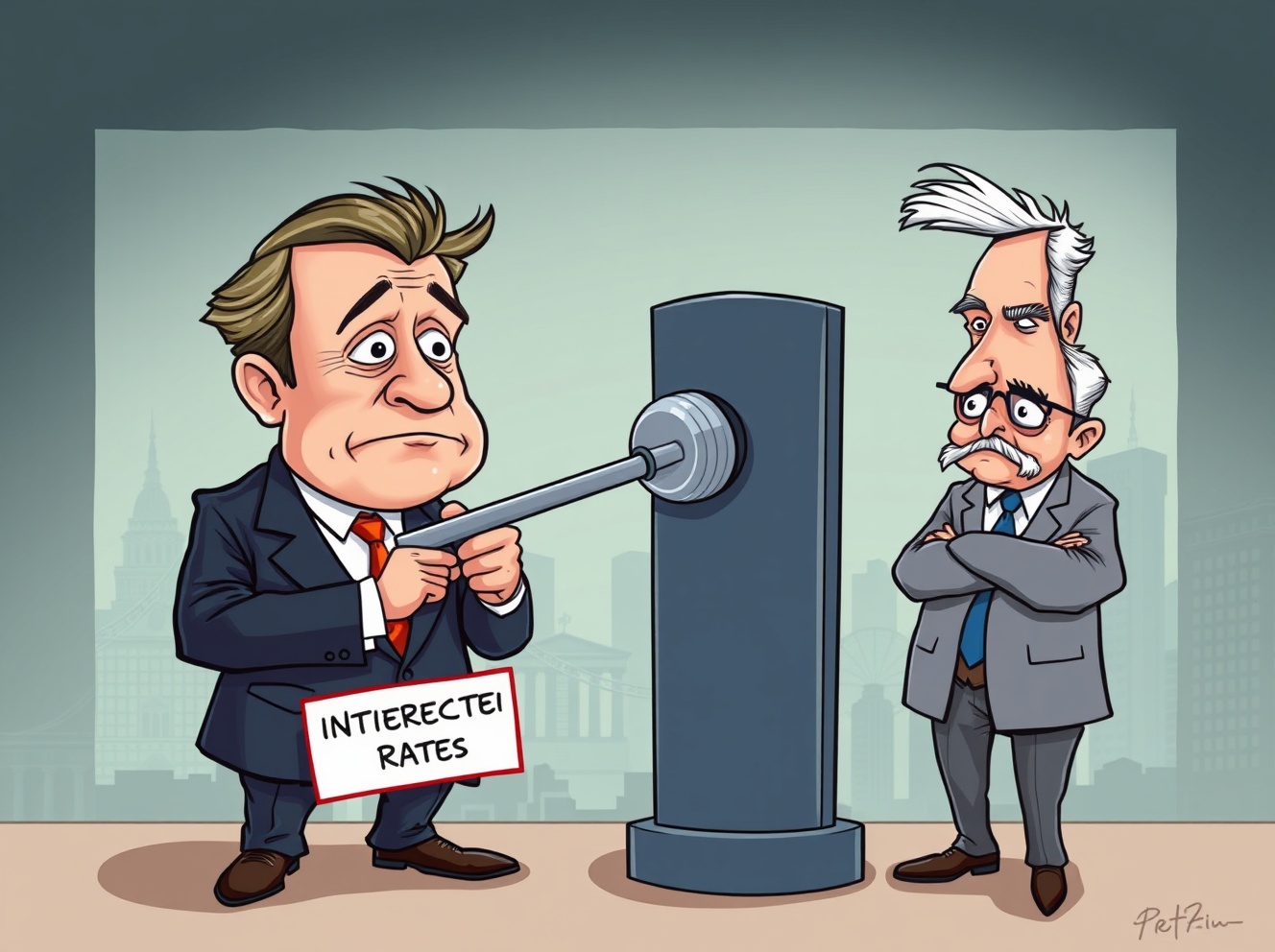

The financial world is keenly observing the International Monetary Fund’s (IMF) latest advice to the U.S. Federal Reserve. Their message is clear: while there’s room to lower interest rates, the Fed should proceed with immense caution regarding any potential Fed rate cuts. This guidance arrives at a pivotal moment, as global markets eagerly anticipate shifts in monetary policy that could profoundly impact everything from everyday finances to the dynamic cryptocurrency landscape.

Why the IMF Advises Caution on Fed Rate Cuts?

The IMF’s recommendation stems from a careful assessment of the current economic environment. While the U.S. economy has shown remarkable resilience, the battle against inflation isn’t entirely over. Cutting rates too quickly could risk reigniting price pressures, undoing the progress made.

The IMF believes that gradual and cautious Fed rate cuts are appropriate, but only when supported by robust economic data. Their perspective highlights the delicate balance the Federal Reserve must strike between fostering economic growth and maintaining long-term price stability.

What Are the Risks and Rewards of Early Fed Rate Cuts?

The decision to adjust interest rates is a complex tightrope walk for the Federal Reserve. Each move carries significant implications for both domestic and global economies.

Potential Rewards of Rate Cuts:

- Stimulated Economic Growth: Lower borrowing costs can encourage consumer spending and business investment.

- Reduced Recession Risk: Easing monetary policy can help avert or soften an economic downturn.

- Support for Asset Markets: This includes traditional stocks and, potentially, higher-risk assets like cryptocurrencies.

Potential Risks of Premature Fed Rate Cuts:

- Inflation Resurgence: The primary concern. If inflation is not fully tamed, early cuts could send it soaring again.

- Market Exuberance: Excessive liquidity can lead to asset bubbles and unsustainable market growth.

- Loss of Credibility: The Fed’s reputation for managing inflation effectively could be damaged if it acts too soon.

The IMF’s advice underscores the necessity for data-driven decisions, ensuring that any move towards Fed rate cuts is justified by clear economic indicators rather than mere market sentiment.

How Do Fed Rate Cuts Impact the Cryptocurrency Landscape?

For many cryptocurrency investors and enthusiasts, the Federal Reserve’s monetary policy is a crucial external factor influencing market movements. Generally, lower interest rates tend to make ‘risk-on’ assets, such as cryptocurrencies, more attractive.

When traditional investments like bonds offer lower returns, investors often seek higher yields or growth potential elsewhere, leading to increased capital flowing into digital assets. However, a cautious approach to Fed rate cuts implies that this potential influx might be slower or more measured than some might anticipate.

It also signals continued economic vigilance, which can temper speculative enthusiasm and encourage a more stable, albeit slower, growth trajectory for the crypto market. Understanding this intricate interplay is vital for anyone navigating the volatile world of digital currencies.

Navigating Future Fed Rate Cuts: Key Considerations

As the Federal Reserve contemplates its next steps, what should investors and market watchers pay close attention to?

Key Indicators to Monitor:

- Inflation Reports: Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) will be critical.

- Employment Figures: Job growth, unemployment rates, and wage inflation provide insights into labor market health.

- GDP Growth: Overall economic output will indicate the strength of the economy.

- Fed Communications: Statements from FOMC members and the Fed Chair offer direct insights into their thinking on future Fed rate cuts.

The IMF’s call for caution serves as a timely reminder that patience and careful observation are paramount. Rash decisions based on speculative headlines could prove costly in an environment of measured monetary policy adjustments.

The IMF’s counsel to the Federal Reserve regarding Fed rate cuts is a clear signal for a measured and thoughtful approach. While the prospect of lower interest rates might seem appealing, the overarching goal remains sustained economic stability and controlled inflation. This cautious stance will undoubtedly shape market dynamics, including the cryptocurrency space, for the foreseeable future. Investors and observers alike must remain informed and adaptable to these evolving monetary policy signals.

Frequently Asked Questions (FAQs)

Q1: What is the IMF’s main recommendation to the Fed regarding interest rates?

The IMF recommends that the U.S. Federal Reserve should proceed cautiously with any potential Fed rate cuts, emphasizing a gradual approach even though there is room to lower rates.

Q2: Why is the Fed being advised to be cautious on rate cuts?

Caution is advised primarily to prevent a resurgence of inflation and to ensure that the U.S. economy maintains its stability. Cutting rates too soon could undermine progress made in controlling prices.

Q3: How do interest rate changes typically affect cryptocurrency markets?

Generally, lower interest rates make ‘risk-on’ assets like cryptocurrencies more attractive to investors, as returns on traditional, safer investments may decrease. Conversely, higher rates can make them less appealing.

Q4: What economic indicators should I watch for clues about future Fed decisions on rate cuts?

Key indicators include inflation reports (CPI, PCE), employment data (job growth, unemployment rate), and GDP growth figures. Statements from Federal Reserve officials are also crucial.

Q5: Could cautious Fed rate cuts impact global economies?

Yes, U.S. monetary policy has significant ripple effects globally. A cautious approach to Fed rate cuts can influence global capital flows, currency valuations, and the monetary policies of other central banks, affecting economies worldwide.

If you found this analysis on the IMF’s advice for Fed rate cuts insightful, please share it with your network! Your support helps us deliver timely and relevant financial news.

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

This post Fed Rate Cuts: IMF Urges Strategic Caution for Economic Stability first appeared on BitcoinWorld and is written by Editorial Team

You May Also Like

SOL Treasury Company Forward Industries: Market Turmoil Offers Opportunity to Consolidate Other Treasury Companies

CME Group to launch options on XRP and SOL futures