Christie’s shuts down NFT department under new CEO Bonnie Brennan

United Kingdom-based auction house Christie’s is shutting down its dedicated non-fungible token department as part of a strategic decision to “reformat digital art sales.”

- Christie’s has closed its dedicated NFT department, folding operations into its 20th and 21st-century art division.

- Two staffers, including VP of Digital Art Nicole Sales Giles, were laid off at the end of August.

- The decision is part of a broader strategic restructuring under new CEO Bonnie Brennan.

According to a Sep. 8 report from Now Media, the news was confirmed by Christie’s former VP of Digital Art, Nicole Sales Giles, who was let go, along with another staffer, at the end of August.

A Christie’s spokesperson added that the move was a “strategic decision to reformat digital art sales,” under the vision of the auction house’s new CEO Bonnie Brennan, who took charge in February this year.

Christie’s first entered the NFT market back in March 2021 and has since played a key role in pushing digital collectibles into the mainstream, especially due to its reputation as one of the oldest auction houses in the world. Over the years, the auction house has enabled some of the biggest sales in the history of the NFT market.

Among them were two landmark works by digital artist Mike “Beeple” Winkelmann’s portfolio, Everydays: The First 5000 Days, which fetched $69.3 million, and Human One, which sold for $28.9 million.

Beyond sales, Christie’s was also an active supporter of the NFT ecosystem during its formative years. It launched its own on-chain auction platform, Christie’s 3.0, partnered with crypto-native platforms like OpenSea, and even embraced emerging formats such as Bitcoin Ordinals, hosting its first Ordinals auction in October last year.

Christie’s will not stop selling NFTs

Although the auction house is winding down its core NFT team, it will continue offering digital artworks with the larger “20th and 21st-century art category,” the Christie’s spokesperson said.

Further, at least one digital art specialist will also be kept on staff, and as of press time, its online auctioning platform remains live.

The exact reason why Christie’s has decided to put NFTs on the sidelines was not disclosed, but the crypto community speculates that it may have something to do with dwindling NFT sales and an overall slowdown across the global art market.

NFT markets have had a sloppy last year, and the drawdown extended throughout the first half of 2025, with several popular NFT collections posting weak trading volumes and sales numbers. Last week itself saw one of the steepest weekly drops in sales volume in recent months, with a 22.65% drop.

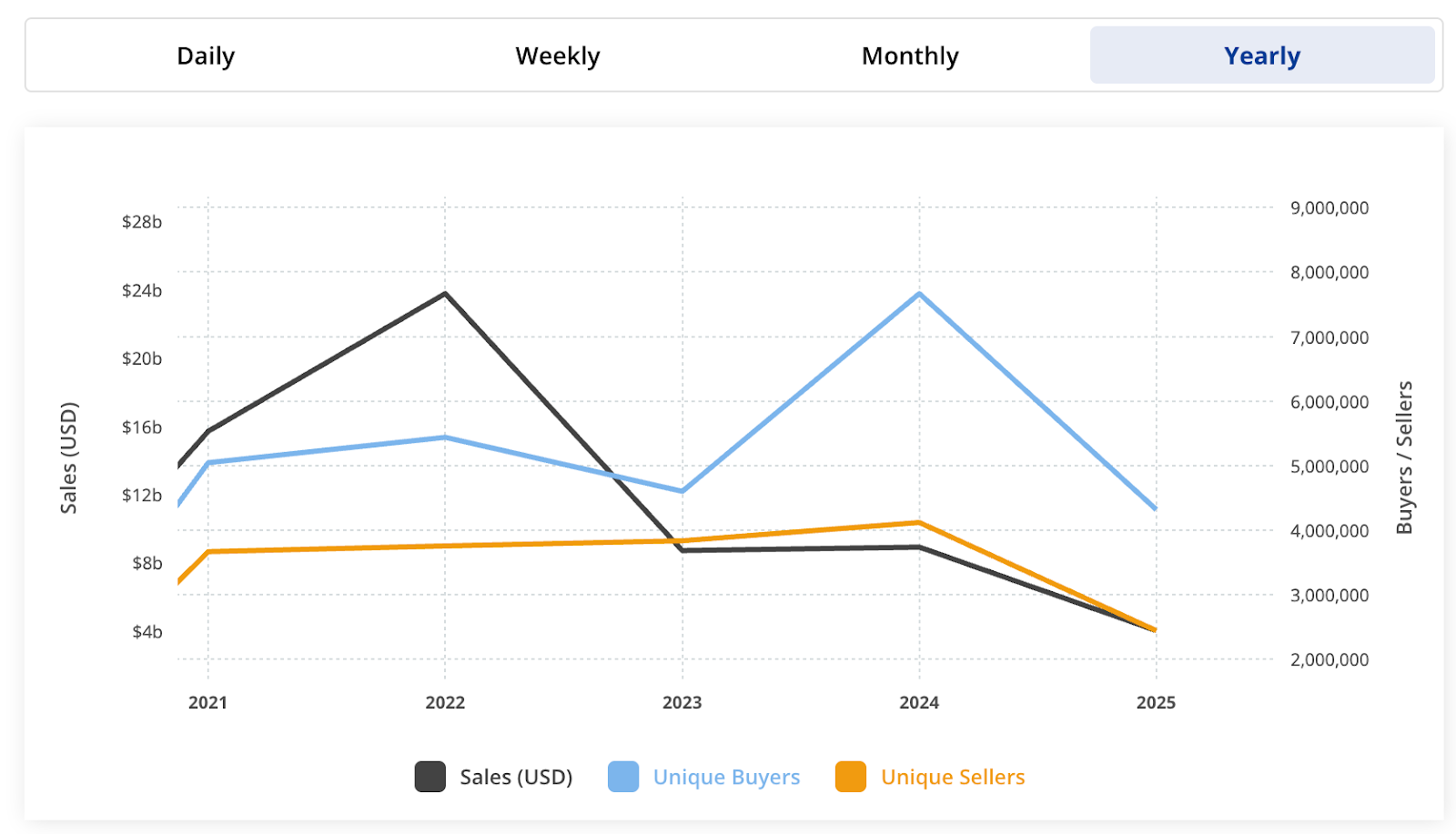

According to data from Crypto Slam, since the start of 2024, NFT sales volume alongside the number of market participants has continued to decline.

And it’s not just the NFT market that may have influenced Christie’s decision, according to Fanny Lakoubay, a digital art adviser and curator, who speculated that it may have stemmed from the “current art market contraction.”

“Auction houses can’t justify a whole department when it brings in less revenue than the others, even with some recent successful sales,” Lakoubay said.

You May Also Like

United States Building Permits Change dipped from previous -2.8% to -3.7% in August

DBS lists Franklin Templeton’s sgBENJI token and Ripple’s RLUSD stablecoin on its exchange