Bitcoin Hyper ($HYPER) Live News Today: Latest Insights for Bitcoin Maxis (September 8)

Stay Ahead with Our Immediate Analysis of Today’s Bitcoin & Bitcoin Hyper Insights

Check out our Live Bitcoin Hyper Updates for September 8, 2025!

In 2010, Bitcoin was worth a few cents. One year later, it hit $20. In six years, it was $17,000, and now it’s sitting at over $100K, after hitting an ATH of $123K in July.

Historically, if you’d invested in Bitcoin at launch, you’d have an ROI of 188,643,000%. The likes of Mastercard, JP Morgan, and scores of S&P 500 companies are buying Bitcoin in droves. There’s never been anything like Bitcoin before, and investors are waking up to that reality.

However, Bitcoin is getting old for modern standards. No dApps, no smart contracts, and almost non-existent DeFi scalability. It needs an upgrade. And that’s what Bitcoin Hyper ($HYPER) is here to do with Layer-2 technology.

Click to learn more about Bitcoin HyperBitcoin Hyper ($HYPER) is a crypto project planning to launch the fastest Layer-2 chain for Bitcoin. Its goal – to bring Bitcoin’s blockchain to modern standards. This means compatibility with dApps, smart contracts, and seamless DeFi programmability for developers.

The L2 will run on a Canonical Bridge, combined with the Solana Virtual Machine (SVM), for native compatibility with Solana. You’ll be able to build token programs, LP logic, oracles, games, NFT infrastructure, DAOs, and much more. All without reinventing the wheel.

To engage with the L2, you’ll deposit $BTC to a designated address monitored by the Canonical Bridge. The Relay Program verifies the details, and then mints an equivalent number of wrapped $BTC on the L2. You can also withdraw your original $BTC at any time.

If you’re looking for the newest insights on Bitcoin and Bitcoin Hyper, you’re in the right place.

We update this page regularly throughout the day with the latest insider insights for Bitcoin maxis and Bitcoin Hyper fans. Keep refreshing to stay ahead of the pack!

Disclaimer: No crypto investment comes without risk. Our content is for informational purposes, not financial advice. We may earn affiliate commissions at no extra cost to you.

HOW TO BUY $HYPER

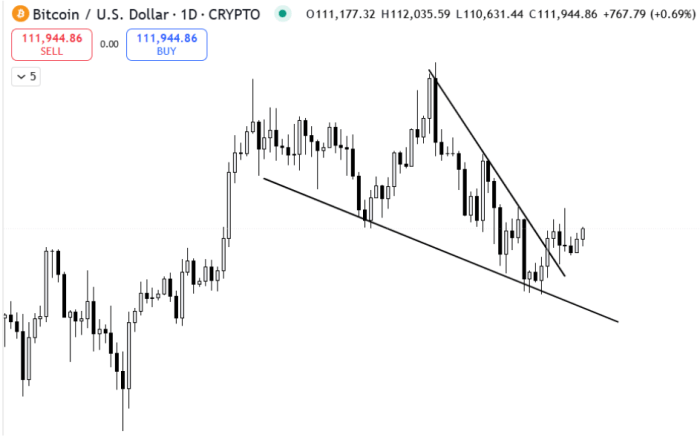

Today’s Bitcoin Technical Analysis

After a solid 2.69% gain last week, Bitcoin has kicked off the second week of September (with a potential Fed rate cut looming) on another positive note: it’s up 0.45% so far today.

More importantly, $BTC is holding last week’s breakout, when it moved out of – and successfully retested – a falling wedge pattern.

This is a strong indication of a genuine momentum shift, suggesting the token could now be gearing up to charge toward its all-time highs. That means we could be in store for at least an 11% run-up from current levels.

Adding to the optimism, several crypto analysts on X have pointed out striking similarities between the 2017 Bitcoin supercycle and what’s unfolding now.

For example, @MerlijnTrader (a prominent crypto voice with nearly 400K followers on X) believes the upcoming supercycle doesn’t just resemble 2017’s rally, but it could actually be 27x bigger.

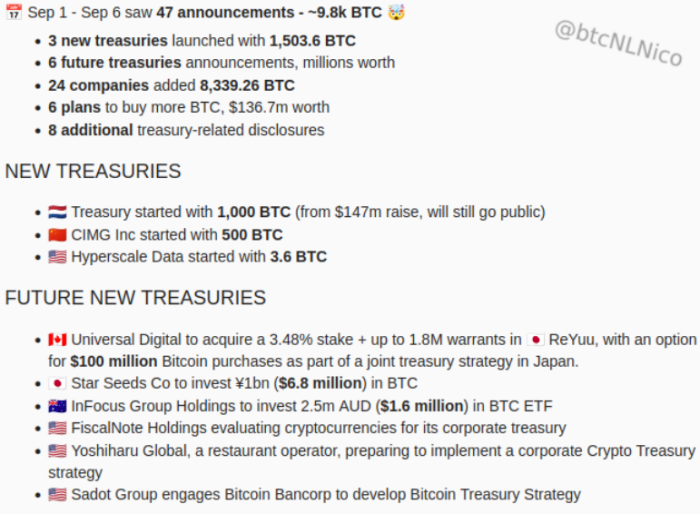

Bitcoin Treasuries Buy 9.800 More $BTC Last Week, Fueling Bitcoin Hyper’s $14M PresaleSeptember 8, 2025 • 10:06 UTC

Bitcoin treasuries have bought 9.800 more $BTC last week, with six of them planning additional buys shortly.

Michael Saylor’s Strategy runs the Bitcoin hoarding game, after accumulating over 636,505 Bitcoins so far, valued at almost $69B.

The growing institutional interest drives Bitcoin into the mainstream and fuels projects like Bitcoin Hyper ($HYPER). As Bitcoin’s Layer 2 upgrade, Bitcoin Hyper promises faster and cheaper Bitcoin transactions, making $BTC a feasible asset for large institutional players and even payment processors.

You can learn how to buy $HYPER right here.

Strategy CEO Michael Saylor Joins Bloomberg 500 ListSeptember 8, 2025 • 10:06 UTC

Michael Saylor’s Bitcoin strategy is paying off handsomely as his net worth reached $7.37B, putting him at number 491 of the Bloomberg Billionaires Index.

Of his net worth, $6.72B is tied to his stake in Strategy, the Bitcoin treasury company he heads. The company is the largest of its kind, with its 636,505 $BTC holdings and a 25.7% yield so far this year.

Along with Strategy, other Bitcoin treasury companies now hold over 1M $BTC, which accounts for nearly 5% of the total supply of the world’s most valuable cryptocurrency.

With the available supply shrinking and growing institutional interest, Bitcoin is expected to become increasingly valuable in the foreseeable future.

This has a ripple effect on projects that build on the Bitcoin ecosystem, particularly those that help make transactions faster and cheaper.

One such project is Bitcoin Hyper ($HYPER), which aims to develop a Bitcoin Layer 2. Running on a Solana Virtual Machine (SVM), it delivers speed and low costs not possible with the main Bitcoin blockchain.

Read ‘What is Bitcoin Hyper’ and learn how it takes Bitcoin to the next level.

Authored by Leah Waters, Bitcoinist — https://bitcoinist.com/bitcoin-hyper-live-news-september-8-2025/

You May Also Like

Mystake Review 2023 – Unveil the Gaming Experience

Strategic Move Sparks Market Analysis