Worldcoin Price Today: WLD Holds $0.90 as Buyers Target $1.15 Breakout

Recent trading activity shows consistent accumulation, with both retail buyers and larger holders playing a role in stabilizing the market. As conditions improve, attention is shifting to whether the memecoin can extend this strength into a broader recovery.

Market Structure Points to Steady Momentum

In a recent X highlight, Worldcoin has maintained stability within a narrow range, defending the $0.88–$0.91 support zone. This level has become a critical area where buyers consistently step in to prevent deeper losses. The chart structure shows signs of a potential reversal pattern, suggesting that sentiment is slowly shifting back toward the upside.

Source: X

Repeated retests of support have highlighted the importance of this range, as each bounce adds weight to the argument that a base is forming. Such patterns often precede larger price moves when momentum aligns with liquidity inflows. For the asset, holding this zone keeps the possibility of a recovery rally toward $1.15 in play.

Weekend trading sessions have also shown increased activity, with altcoins benefiting from renewed interest. The coin appears positioned to take advantage of this environment, provided that buying pressure continues to sustain demand at current levels.

Price Action Shows Signs of Recovery

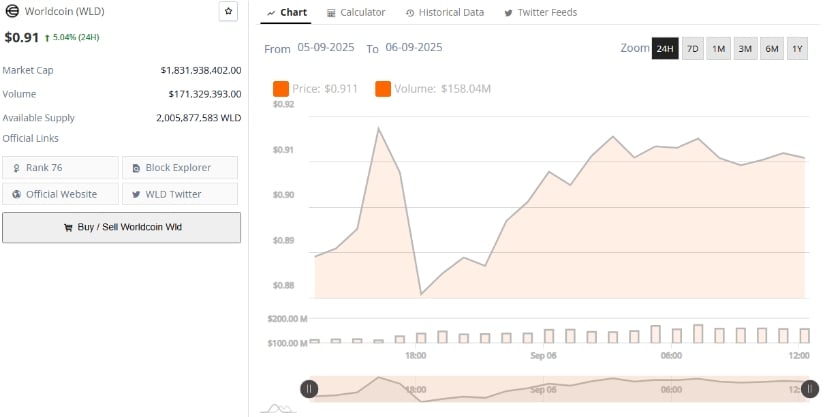

At the time of writing, the coin was trading at $0.911 with a daily gain of over 5%. Market cap stood at $1.83 billion, placing the asset among the top 80 cryptocurrencies. Trading volume reached $171.3 million, showing that liquidity remains robust and interest levels are holding steady.

Source: BraveNewCoin

The last 24 hours reflected a clear bounce, with price dipping as low as $0.88 before recovering toward the $0.91 level. This rebound shows how quickly demand returns whenever the token tests lower levels, signaling a strong defense from active buyers. Such reactions reduce the risk of a sharper decline and highlight underlying market confidence.

Supply data also shows stability, with 2 billion tokens in circulation. Consistent accumulation trends reinforce the narrative that buyers continue to see value in holding the coin even during phases of consolidation.

Technical Indicators Highlight Key Levels Ahead

On the other hand, Worldcoin’s technical indicators point to a cautious but constructive outlook. The Bollinger Bands are tightening, often a precursor to higher volatility, suggesting that price could soon make a decisive move. Meanwhile, the Relative Strength Index remains near 45, indicating that the market is neutral and not facing immediate overbought or oversold pressure.

Source: TradingView

Large holders, often referred to as whales, have shown steady accumulation in the $0.90 range. Their activity has reduced selling pressure and created a stronger support base for the coin. Historically, such whale behavior has often been followed by extended price growth.

The next challenge lies at the $0.92–$0.95 resistance area, which has capped previous rallies. A break above this level could set the stage for an attempt toward $1.15, giving buyers fresh momentum to drive the market higher. Until then, defending the $0.90 base remains the most important factor for maintaining stability.

You May Also Like

The Channel Factories We’ve Been Waiting For

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets