Robinhood Soars 6% After S&P 500 Inclusion As Michael Saylor’s Strategy Misses Out

Robinhood Markets Inc. (HOOD) surged 6% in after-hours trading after being added to the S&P 500 stock index, while Michael Saylor’s Strategy Inc. (MSTR) missed out despite meeting the index’s inclusion criteria.

The S&P 500 changes will take effect on September 22. Currently, only two other crypto-linked companies, Coinbase (COIN) and Block (XYZ), are listed in the index.

Robinhood is a digital trading platform with growing crypto ambitions. Its crypto business generated revenue of $160 million in the second quarter this year, or 16% of the total. Crypto revenue was down from $252 million in the previous quarter.

Strategy Shares Plunge

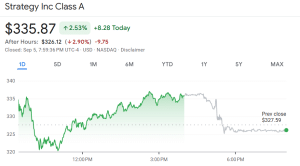

Strategy fell almost 3% in after-hours trading, bringing its monthly loss to more than 12%, according to Google Finance.

MSTR share price (Source: Google Finance)

Strategy’s snub came after the leading Bitcoin treasury company posted one of the strongest quarters in its history, with $10 billion in net income.

“Why wasn’t $MSTR allowed into the S&P 500 Index despite meeting all the criteria?” asked Bloomberg ETF analyst Eric Balchunas in a post on X. “Because the ‘Committee’ said no. You have to realize SPX is essentially an active fund run by a secret committee.”

Nasdaq’s New Position On Crypto Treasuries Not An Issue, Says Strategy

Strategy remains listed on Nasdaq, an exchange that is tightening requirements for companies that use debt financing to purchase crypto, a move that Strategy pioneered.

According to a report by The Information earlier this week, Nasdaq has started requiring shareholder votes for some deals and is also pushing for more disclosures. This could lead to the index suspending trading or even delisting some companies that fail to comply, according to the report, which cited insiders familiar with the matter.

Strategy responded to the news on X, saying that Nasdaq’s new position on digital asset treasury formations does not affect Strategy, its ATMs or other capital market activities.

The tightening review comes after a wave of new companies are starting to raise capital from investors through equity sales in order to grow a crypto treasury. Since the beginning of the year, 154 US-listed companies have announced plans to raise approximately $98.4 billion to buy crypto.

Strategy is the leading crypto treasury firm with 636,505 BTC worth $70.57 billion on its balance sheet, according to data from BiTBO. The company’s most recent buy was on Sept. 2, when the firm bought 4,048 BTC for $449.3 million.

You May Also Like

The UA Sprinkler Fitters Local 669 JATC – Notice of Privacy Incident

3 Paradoxes of Altcoin Season in September