What makes the decentralized prediction market TrueMarkets different from Vitalik spending 32 ETH to mint NFTs?

Author: Nancy, PANews

Although Polymarket faces strict scrutiny and challenges from US regulators, it has become famous for its accurate predictions of the US election and has successfully ignited the popularity of the prediction track. Behind the rise of Polymarket, there is no lack of strong support from Ethereum co-founder Vitalik Buterin. Now, another decentralized prediction market TrueMarkets has also won the favor and endorsement of Vitalik.

On November 19, according to Patun’s monitoring, the address marked as “vitalik.eth” on the chain has bridged 32 ETH from the Ethereum chain to Base and minted 400 Patron NFTs.

Vitalik's "selling goods" behavior immediately attracted the attention of the market. OpenSea data shows that in the past 24 hours, more than 3,300 Patron NFTs were sold, with sales of approximately 703 ETH, ranking first in the market's daily trading volume. As of the time of writing, the floor price of Patron NFT has also risen to 0.23 ETH, more than 2.8 times the minting price (0.08 ETH).

According to reports, Patron NFT was launched by TrueMarkets, a decentralized binary prediction market based on Base that allows users to predict the outcomes of real-world events. It aims to break the information asymmetry associated with global news, allowing people to express real-time emotions about the likelihood of potential outcomes. TrueMarkets plans to release the V1 version by the end of this year.

The operating mechanism of prediction platforms such as Truemarkets and Polymarket is roughly the same at its core. They simplify complex event predictions into two answers of "yes/no", and create a binary trading market based on this. The answers of both parties will be adjusted in real time according to the odds of the results perceived by the market, and traders and market makers provide liquidity to maintain the balance and stability of the market. When the result of the event is finally revealed, the tokens matching the correct answer will be redeemable at a value of $1, otherwise they will lose all value.

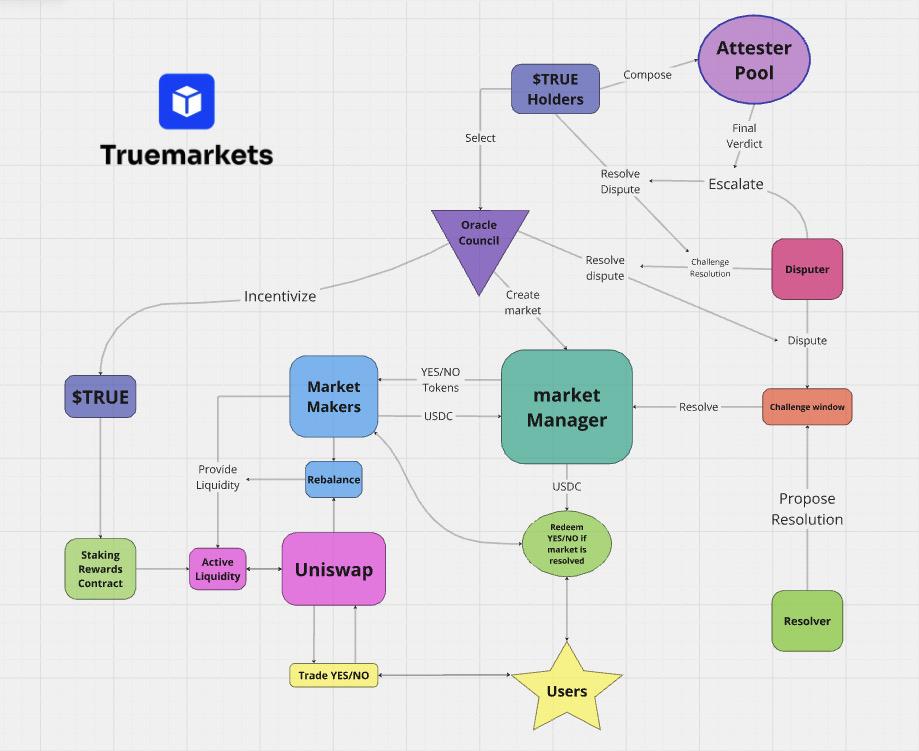

But Truemarkets also has its unique features. According to Millie, the TrueMarkets project director, in most other prediction markets, minting prediction tokens is usually limited to whitelisted users. Truemarkets will eventually be permissionless, and market creation will be achieved by AI Agent. And all transactions on Truemarkets are completed directly on the chain through Uniswap V3, including transactions, liquidity provision, and market creation. At the same time, Truemarkets uses an oracle established through the protocol to parse market results. The oracle is combined with a decentralized jury pool, etc. to achieve accurate decision-making in a transparent way.

It is worth mentioning that TrueMarkets has also opened a challenge window, during which anyone can object to the proposed solution. In order to prevent manipulation and ensure the orderly operation of the oracle, TrueMarkets introduced the important role of Disputer. Specifically, when a prediction result causes controversy, the Disputer can challenge it by paying a deposit of US$250 and explaining the reasons for the doubt. If the challenge is accepted, the Disputer can not only recover the deposit, but also receive corresponding rewards. In order to ensure fairness and justice, TrueMarkets has set up a three-stage arbitration mechanism, including preliminary proposed challenges, oracle committee decision doubts and token holder voting disputes. At each stage, the Disputer needs to pay different questioning costs, which are US$250, US$5,000 and a wallet holding 250,000 platform tokens TRUE.

In addition, although Polymarket was exposed to be conducting token airdrops, the platform has not explicitly stated that it will issue its own tokens. TrueMarkets has announced its own token economics and will launch a TGE (token generation event) at the end of this year.

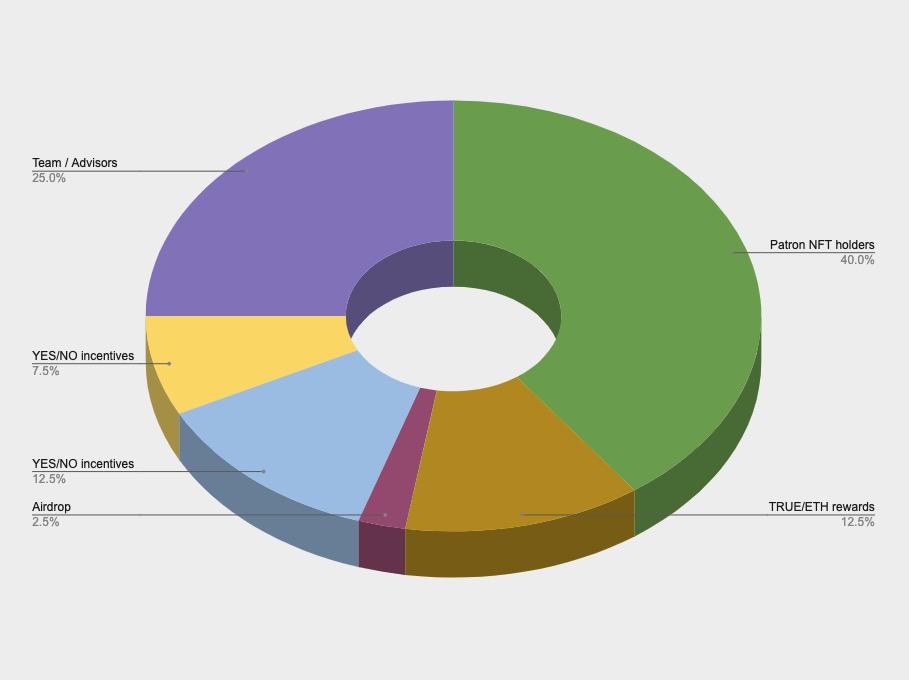

According to reports, TRUE is a multi-functional utility token in TrueMarkets, which can be used to control protocol fees and governance, etc. The total supply of TRUE is 100 million, of which 40.3% are used to distribute to Oracle Patron NFT (15,071) and Truth Seeker Patron NFT (59) holders, each NFT corresponds to 2666.67 TRUE tokens; 2.2% are used for airdrops to Discord and beta users, etc.; 7.5% are used for market incentives; 12.5% will be allocated to TRUE/ETH liquidity providers (LP) on Base within two years; 12.5% are allocated to oracle incentives; the remaining 25% will be allocated to the TrueMarkets team and consultants, and will be unlocked linearly within two years.

“Once prediction markets reach a critical mass, a strong feedback loop is formed. The wider their audience, the more accurate the predictions. The election was a turning point for prediction markets because the event proved that such platforms are the most accurate indicators and major sources of news. Looking ahead, the world is expected to rely more and more on prediction markets for news and entertainment, and the more people participate, the stronger the prediction capabilities of prediction markets will be.” Millie said this about the prospects for the development of prediction markets.

You May Also Like

Trump foe devises plan to starve him of what he 'craves' most

3 Crypto Trading Tips That Work