Strategy Meets Requirements for S&P 500 Inclusion, Awaits Committee Decision

TLDR

- Strategy has met all technical requirements for S&P 500 inclusion with $92 billion market cap and positive earnings

- Despite meeting criteria, final approval requires S&P US Index Committee’s vote based on “holistic” assessment

- High stock volatility (96% in 30-day price swings) could present a challenge for committee approval

- Strategy would join Coinbase and Block as only the third crypto-related company in the S&P 500

- Final rebalancing announcement expected on September 5, with changes effective from September 19

Michael Saylor’s Strategy corporation is on the verge of potentially joining the S&P 500 stock market index, according to recent reports from market analysts. The company, which holds more Bitcoin than any other public company, has already met the technical requirements for inclusion in this key benchmark of America’s largest corporations.

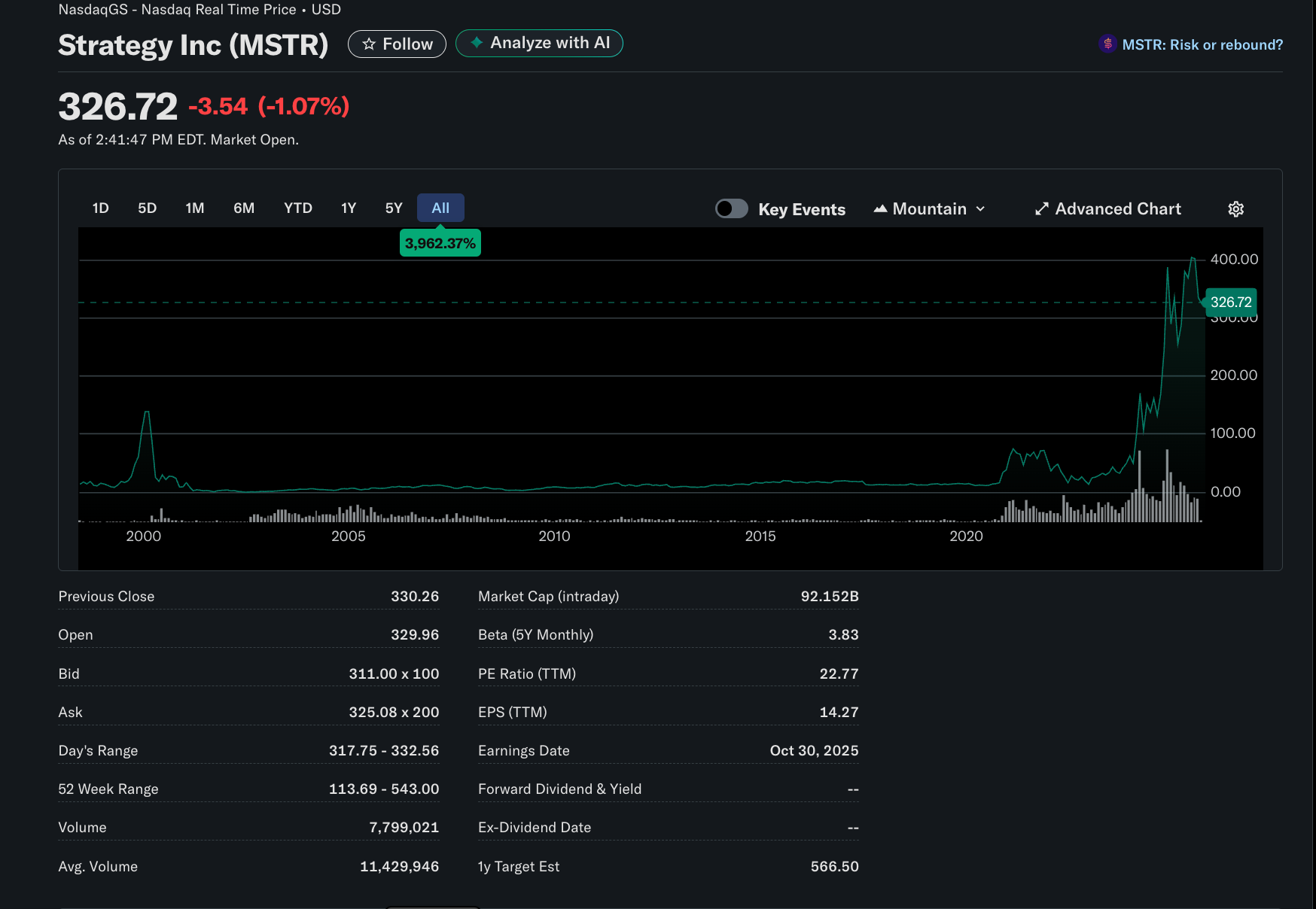

Market analyst Jeff Walton has forecast a 91% chance that Strategy will join the index as the company now meets all standard requirements. According to Nasdaq data, Strategy has trading volumes of several million shares daily and a market capitalization exceeding $92 billion at the time of writing.

The company has also reported positive generally accepted accounting principles (GAAP) net income over the last four quarters totaling more than $5.3 billion. These metrics put Strategy well above the minimum thresholds required for S&P 500 consideration.

Strategy is already listed on the Nasdaq 100, which tracks the 100 largest companies by market capitalization on the tech-focused Nasdaq exchange. This existing inclusion in a major index strengthens its case for S&P 500 membership.

Source: Yahoo Finance

Source: Yahoo Finance

The Final Hurdle: Committee Approval

Despite meeting all technical criteria, Strategy still faces one major obstacle: approval from the US Index Committee. This committee, consisting of 10 voting members each with equal voting rights, makes decisions based on a simple majority vote.

The committee takes what it describes as a “holistic” view of prospective candidates. This means that even companies meeting all numerical requirements can still be denied inclusion based on other factors.

According to S&P Global methodology, companies must have a market capitalization of at least $22.7 billion. They need a liquidity ratio of 0.75 or more, calculated as annual trading volume divided by market capitalization.

Companies must also show a trading volume of at least 250,000 shares per month. The sum of a company’s net income over the last four quarters must be positive, with the most recent quarter showing a profit.

Strategy easily clears these bars, but could face challenges due to its business model. As the world’s largest Bitcoin treasury company, Strategy currently holds 636,505 BTC in its corporate treasury, according to BitcoinTreasuries.

One potential concern for the committee could be the sustainability of Strategy’s crypto treasury model. Another issue might be the company’s high stock volatility, with 30-day price swings averaging 96%.

Impact on Crypto Markets

If approved, Strategy would be only the third crypto-related company to join the S&P 500. Coinbase became the first crypto company included in the index in May 2025, followed by Block, Jack Dorsey’s technology company, which joined in July.

Companies featured in the S&P 500 index attract passive investment flows as index funds must purchase their shares. For crypto companies, this can indirectly boost crypto markets while further connecting digital assets to traditional financial systems.

The S&P 500 is rebalanced quarterly to reflect changes in market capitalization and other factors. It represents the 500 largest publicly traded companies in the United States and serves as a key benchmark for the overall U.S. stock market.

Bloomberg News reported that Strategy has “in theory, secured profitability that meets the current S&P 500 rules for index inclusion.” The report also noted that Strategy was already included on a list of 26 candidates for regular rebalancing recently selected by U.S. financial services firm Stephens.

The final decision on Strategy’s inclusion is expected soon. According to reports, the S&P Dow Jones Indices committee plans to announce the results of their regular rebalancing on September 5, with any changes taking effect from September 19.

Strategy’s potential inclusion reflects the growing mainstream acceptance of cryptocurrency-related businesses. As Bloomberg News noted, Coinbase’s recent addition to the index “is a sign that the influence of the cryptocurrency industry is growing.”

The post Strategy Meets Requirements for S&P 500 Inclusion, Awaits Committee Decision appeared first on Blockonomi.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Silver Price Crash Is Over “For Real This Time,” Analyst Predicts a Surge Back Above $90