Which Meme Coin Will Explode First: PEPENODE or Dogecoin? Here’s What Traders Think

The meme coin scene is getting crazy competitive these days. Everyone’s trying to figure out which project will moon next, and two very different coins keep coming up in conversations: PEPENODE and Dogecoin.

You’ve probably heard of Dogecoin – it’s been around since 2013 and has that cute Shiba Inu dog as its mascot. But PEPENODE? That’s the new kid on the block trying to shake things up with some pretty wild ideas about gaming and virtual mining.

Here’s the thing, though – they couldn’t be more different if they tried. And that’s exactly why traders are so split on which one could deliver bigger gains.

PEPENODE vs Dogecoin: Completely Different Animals

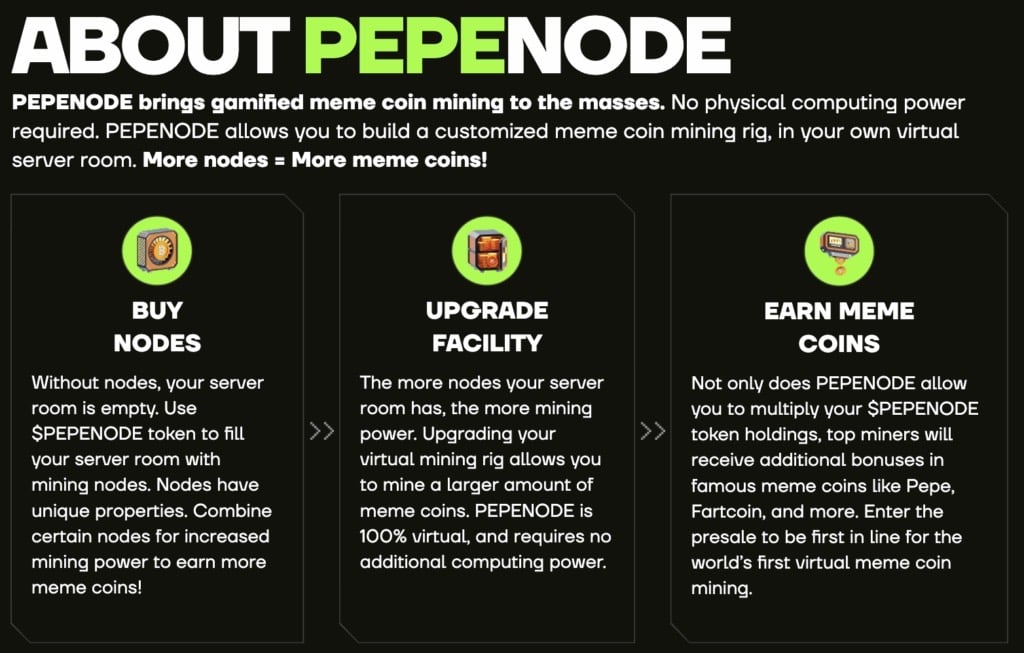

Let’s discuss what makes these two so distinct. PEPENODE is basically trying to turn crypto into a video game. Users can set up virtual mining nodes and actually play around with them to earn tokens. These aren’t real mining rigs – they’re digital setups that simulate the whole mining experience without any of the actual hardware or electricity bills.

Dogecoin took a much simpler approach. It started as a joke (seriously, the creators made it in just a few hours), but somehow became one of the most recognizable cryptocurrencies out there. No fancy games, no complex mechanics – just a fun coin that people actually use to buy stuff and tip content creators online.

The economic models are polar opposites too. PEPENODE burns about 70% of the tokens people spend on upgrades, which means fewer coins exist over time. Dogecoin does the exact opposite – it creates about 5 billion new coins every year, which keeps people spending instead of hoarding.

Why PEPENODE Is Getting People Excited

So what’s all the fuss about PEPENODE? Well, it’s trying something nobody else has really nailed yet. The virtual mining nodes let players build up their digital mining operations and watch their earnings grow in real-time. Think of it like those idle clicker games, but with actual crypto rewards.

Early buyers get better equipment too, which is smart marketing if you ask me. The people who jump in during the presale get more powerful nodes that mine faster than the ones available later. And get this – they’re offering staking rewards with estimated returns over 3500%. That’s either going to be incredible or completely unsustainable.

The deflationary part is interesting because every time someone upgrades their setup, tokens disappear forever. This should make the remaining tokens more valuable as the game grows.

Visit PEPENODE Presale

Dogecoin’s Got That Old-School Appeal

Now, before anyone writes off Dogecoin as yesterday’s news, remember what happened in 2021. This “joke” coin hit nearly 74 cents and had a market cap bigger than many Fortune 500 companies. That didn’t happen by accident.

The Dogecoin community is something special. These people have funded Olympic teams, built water wells in Africa, and supported disaster relief efforts. They’ve proven that a cryptocurrency can have a real social impact beyond just making people rich.

Plus, Dogecoin actually works as money. You can buy a Tesla with it, pay for basketball tickets, and tip people on social media. The transactions are fast and cheap, which makes it practical for everyday use. Not many cryptocurrencies can say that.

What Traders Are Saying

Talk to traders about these two coins and you’ll get very different opinions. The PEPENODE crowd thinks the gaming angle is brilliant. They argue that giving people something to do with their tokens creates stickiness – users won’t just dump and run if they’re actively playing a game.

The Dogecoin believers point to proven staying power. This coin has survived multiple bear markets, regulatory scares, and celebrity drama. It’s still here, still trading, still growing its user base. That kind of resilience is rare in crypto.

Some technical analysts love PEPENODE’s small market cap because it means bigger percentage moves are possible. Others prefer Dogecoin’s liquidity and widespread exchange listings. Both arguments make sense depending on your risk tolerance.

PEPENODE’s Roadmap Looks Ambitious

The PEPENODE team has laid out a pretty detailed roadmap for the next year. They’re starting with the presale and off-chain gaming, then moving to the official token launch with DEX and CEX listings.

After that comes the big transition – moving all the mining gameplay fully on-chain for transparency. The final phase introduces real meme coin rewards like PEPE and Fartcoin, plus mobile apps and partnerships with other meme projects. It’s ambitious, but each phase builds on the last one logically.

How to Get In on PEPENODE

If PEPENODE sounds interesting, you can buy tokens during the presale for $0.0010325 each. The project accepts ETH, BNB, USDT, and even credit cards through their official website. There’s also an option to stake your tokens right away for additional rewards during the presale period.

JOIN THE PEPENODE ($PEPENODE) PRESALE NOW

Website | (X) Twitter | Telegram

The post Which Meme Coin Will Explode First: PEPENODE or Dogecoin? Here’s What Traders Think appeared first on 99Bitcoins.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy