$13M Raised and Counting: Can Bitcoin Hyper Supercharge BTC?

Bitcoin is still the king of crypto: a $2T asset, and the world’s most recognized digital brand. Beneath its dominance, though, cracks are showing. Critics point to its slow transaction speeds, high network fees, and limited scalability.

These challenges reduce Bitcoin’s practicality in a space that’s increasingly driven by DeFi, NFTs, and Web3 applications.

That’s where Bitcoin Hyper ($HYPER) steps in. Marketed as a “next-gen Bitcoin Layer 2,” the project aims to boost the Bitcoin network with faster speeds, lower costs, and smooth dApp integration. Its pitch has resonated with investors, having raised over $13M in its presale and attracting attention across the market.

In this article, we’ll break down the issues Bitcoin is facing and the solutions proposed by Bitcoin Hyper ($HYPER). And, of course, we’ll talk about the financial firepower driving $HYPER’s viral presale.

The Bitcoin Bottleneck: Problems in 2025

Despite its strong dominance, Bitcoin’s core infrastructure is aging, which limits its use beyond being the powerful store of value it has become known for: “digital gold.”

The most pressing issue Bitcoin faces is its transaction throughput. Bitcoin can process roughly 7 transactions per second (TPS). Its closest rival, Ethereum, processes roughly three times as many at 21 TPS, with a theoretical maximum of 120 TPS currently, with a goal of this figure rising to 100K TPS in the future, as part of its Surge roadmap.

Global payment giants like Visa and Mastercard can process up to 65,000 TPS. Combined with the fact that Bitcoin’s average block time is around 10 minutes, it becomes clear why BTC struggles to compete not just with real-time settlement systems, but also with its closest crypto competitors.

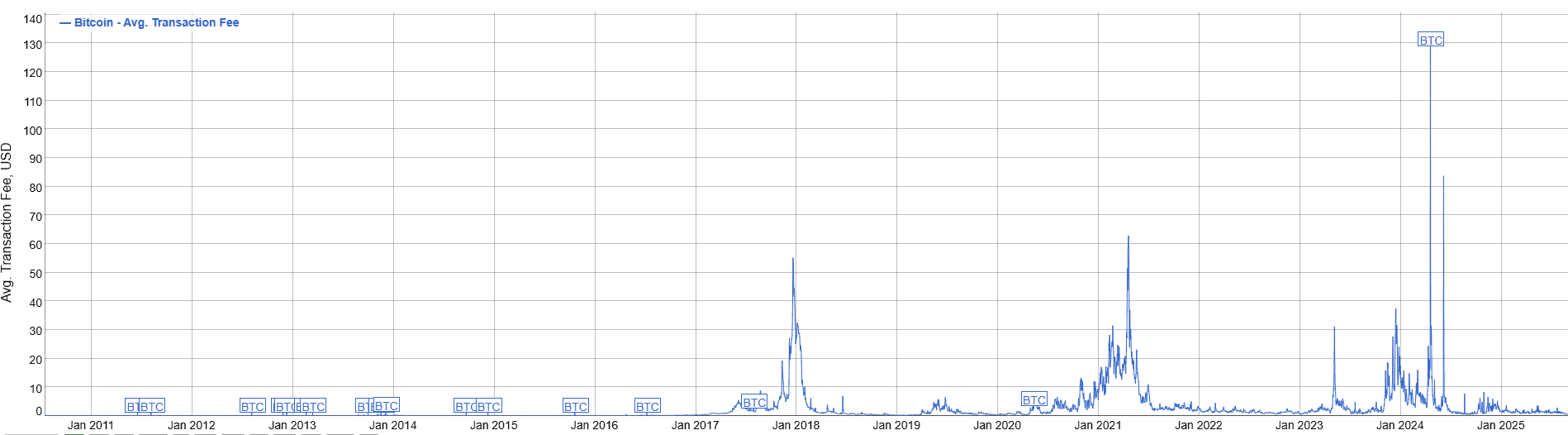

Bitcoin’s second core issue is its fees. When the mempool gets congested during periods of heavy demand, fees regularly spike from $10 to over $50 per transaction, often pricing out regular users attempting smaller transfers. Indeed, on April 20, 2024, average fees saw a historical spike to $128.

The problems don’t end there. Bitcoin’s governance system is also slow. Since miners control consensus, major protocol upgrades can take years to implement, let alone gain adoption. This causes BTC to lag behind Ethereum, Solana, and other programmable chains that push updates more rapidly.

Finally, Bitcoin’s DeFi gap remains significant. The absence of native smart contracts has resulted in most DeFi and tokenization occurring on other ecosystems.

The macro view: Bitcoin remains king as digital gold. However, as a daily utility network, it appears increasingly outdated and surpassed. Without a modern Layer 2, BTC risks being sidelined by faster, more versatile blockchains.

Bitcoin Hyper: The Solution (Core Utility)

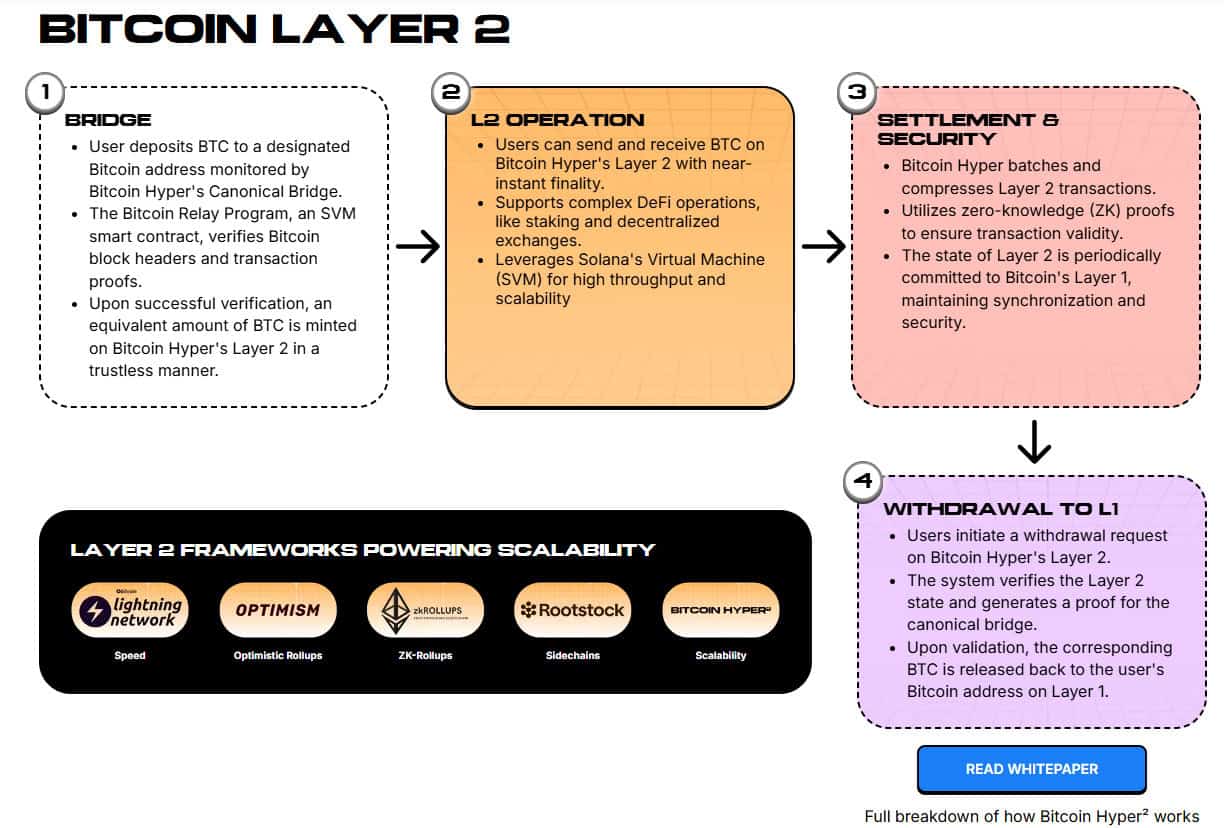

Bitcoin has long been criticized for its speed and scalability issues, and Bitcoin Hyper ($HYPER) is positioning itself as the fix. Rather than replacing Bitcoin, Hyper acts as a Layer 2 rollup chain, combining the high throughput of the Solana Virtual Machine with Bitcoin’s powerful security backbone.

Bitcoin Hyper aims to do for Bitcoin what Arbitrum, Base, and Optimism do for Ethereum: take on a huge chunk of its workload and unlock a substantially improved capacity for processing transactions.

Scalability: While Bitcoin itself processes just 7 TPS, Hyper rails are engineered to handle thousands of transactions per second, making huge strides toward closing the gap with traditional finance rails.

Low fees: Instead of paying upwards of $10 fees per transaction, Bitcoin Hyper will enable transfers for a fraction of a cent, paid in $HYPER, making microtransactions practical again.

Smart contracts: Bitcoin Hyper extends Bitcoin’s use cases by supporting DeFi protocols, staking, NFTs, and tokenized assets, all secured by Bitcoin’s battle-tested consensus layer. This turns BTC into a lot more than just digital gold: it becomes a programmable financial platform.

Interoperability: Hyper isn’t locked in a silo. Its architecture enables seamless bridging with Ethereum, Solana, and other major crypto ecosystems, positioning it as a hub for cross-chain liquidity.

Bitcoin Hyper doesn’t compete with Bitcoin; it supercharges its utility. By making BTC scalable, cheap, and programmable, Hyper could accelerate Bitcoin’s adoption curve far beyond what its Layer 1 alone can offer.

Learn more about Bitcoin Hyper and its goals: read the whitepaper here.

Why Hyper Could Push Bitcoin Higher

Bitcoin’s strength has always been its role as digital gold: a store of value unmatched both within crypto and outside of it. But if Bitcoin gains scalable payments and DeFi through Bitcoin Hyper ($HYPER), its value proposition expands dramatically. Bitcoin will become more than just a vault; it will have the foundation for an active financial ecosystem.

There’s a clear precedent for this, too. Ethereum’s meteoric rise following DeFi Summer in 2020 was driven by infrastructure that enabled lending, staking, and NFTs. Hyper could trigger a similar wave for Bitcoin, but on an even larger scale, thanks to BTC’s $2T+ brand recognition.

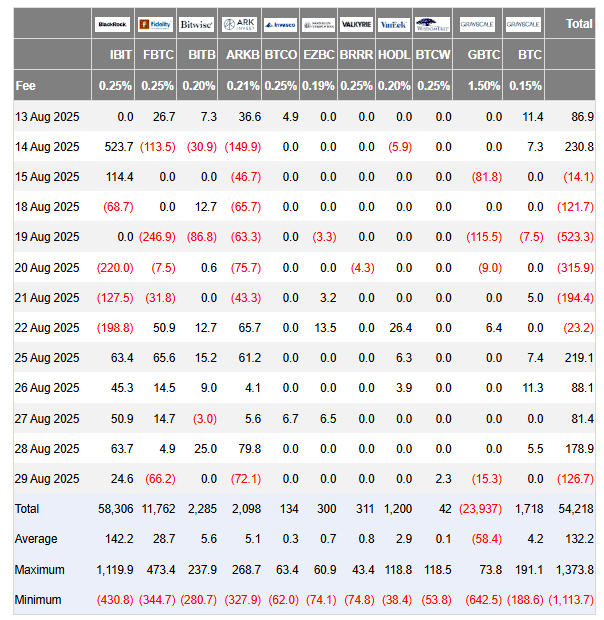

Institutions are already circling. BlackRock and VanEck ETFs have poured billions into Bitcoin exposure in 2025, and analysts at CryptoQuant cite the surging exchange BTC outflows as a sign of long-term accumulation. However, without scalable rails, much of this capital just sits idle.

That’s where Hyper comes in. Stablecoins, ETFs, and institutional flows need fast, cheap, and programmable rails. And this is exactly what Hyper offers. For investors, this makes $HYPER essentially a leveraged play on Bitcoin’s next adoption cycle: BTC provides the anchor, while Hyper powers the engine.

Bitcoin Hyper’s Viral Presale and Investor Momentum

While Bitcoin Hyper pitches itself as core infrastructure, its financial momentum is already undeniable. The presale has already raised over $13M, with contributions growing each week as investors scramble to secure discounted entry before the next stage. This surge has firmly placed Hyper in the “viral presale” category.

Community traction has amplified this hype. On Telegram and X (formerly Twitter), $HYPER has trended under hashtags like “next 100x BTC alt,” echoing the retail mania we’ve seen before in early Polygon or Arbitrum phases. The appeal is simple: a low-cost Layer 2 with Bitcoin branding is a story that resonates.

$HYPER tokenomics make the proposition even sweeter. Presale participants benefit from tiered discounts, staking rewards, and positioning before exchange listings. For many investors, $HYPER doubles as a hedge against Bitcoin’s volatility, particularly during historically weak periods like September.

This mirrors the path of other infrastructure presales that went on to capture billions post-launch. The key difference? Hyper’s direct tie to Bitcoin, giving it both narrative strength and viral energy.

The $HYPER presale is a rare early opportunity that won’t last long: join the presale while you still can!

Bitcoin Hyper’s Opportunity

Bitcoin may still reign as the #1 crypto asset, but its limitations – slow speeds, high fees, and lack of scalability – are becoming impossible to ignore. That’s where Bitcoin Hyper ($HYPER) steps in, offering a solution that could transform BTC from digital gold into a true Web3 infrastructure layer.

By providing fast, affordable transactions and DeFi-ready smart contracts, $HYPER connects Bitcoin’s legacy reputation with modern utility. The over $13M raised in the presale, and still counting, demonstrates that investors are paying attention.

Suppose you want exposure to Bitcoin’s brand, but with the upside potential of an early-stage infrastructure play. In that case,$HYPER is one of the most compelling opportunities heading into the latter half of this bull market cycle.

Don’t miss out on the Bitcoin Hyper presale!

You May Also Like

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?