The Curious Case of the Pentagon Pizza Index: It Accurately Predicts Wars

Some have labeled it pseudoscience, but for decades, this simple little trick has accurately predicted the onset of various global conflicts.

The Unlikely War Oracle: How Pizza Orders Predict Global Conflicts

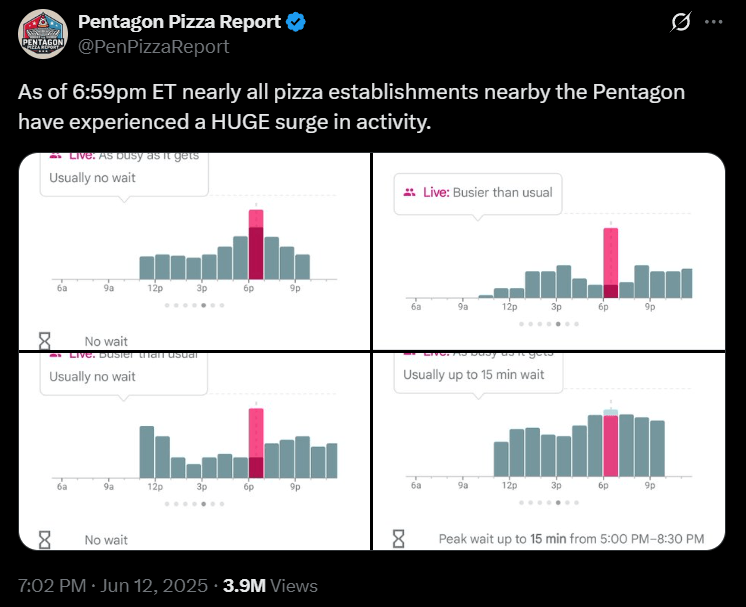

“As of 6:59pm ET nearly all pizza establishments nearby the Pentagon have experienced a HUGE surge in activity,” wrote the Pentagon Pizza Report X account on Thursday, June 12. An hour later, explosions rocked Tehran, Iran’s capital. Israel had just launched a pre-emptive attack on its archnemesis, alleging Iran was secretly building a nuclear weapon that it planned to use against the Jewish nation.

That prediction has given credence to what many consider to be a 1990s urban legend of how pizza order volume in establishments adjacent to the Pentagon, accurately predicts major geopolitical events.

(A surge in Pentagon-area pizza orders preceded Israel’s strike on Iran / @PenPizzaReport)

(A surge in Pentagon-area pizza orders preceded Israel’s strike on Iran / @PenPizzaReport)

When a critical development pops up, Pentagon officials often work late into the night, and it turns out, pizza is their food of choice. It’s greasy, satiating, delicious, and most of all convenient. Sure, sometimes the index is wrong, pizza orders can spike during a football game for example. But despite experts dismissing this convenient form of so-called open-source intelligence (OSINT), they can’t deny that it has accurately predicted multiple global events.

“Pentagon orders doubled up the night before the Panama attack; same thing happened before the Grenada invasion,” one pizza deliverer explained, according to reporting by Time Magazine in August of 1990. “We got a lot of orders, starting around midnight. We figured something was up.” It turns out Iraq, under Saddam Hussein, had invaded Kuwait on August 2, 1990.

As former CNN Pentagon correspondent Wolf Blitzer, once said according to Slate.com, “Bottom line for journalists: Always monitor the pizzas.”

You May Also Like

YouTube Advertising Formats: A Complete Guide for Marketers

SEC clears framework for fast-tracked crypto ETF listings