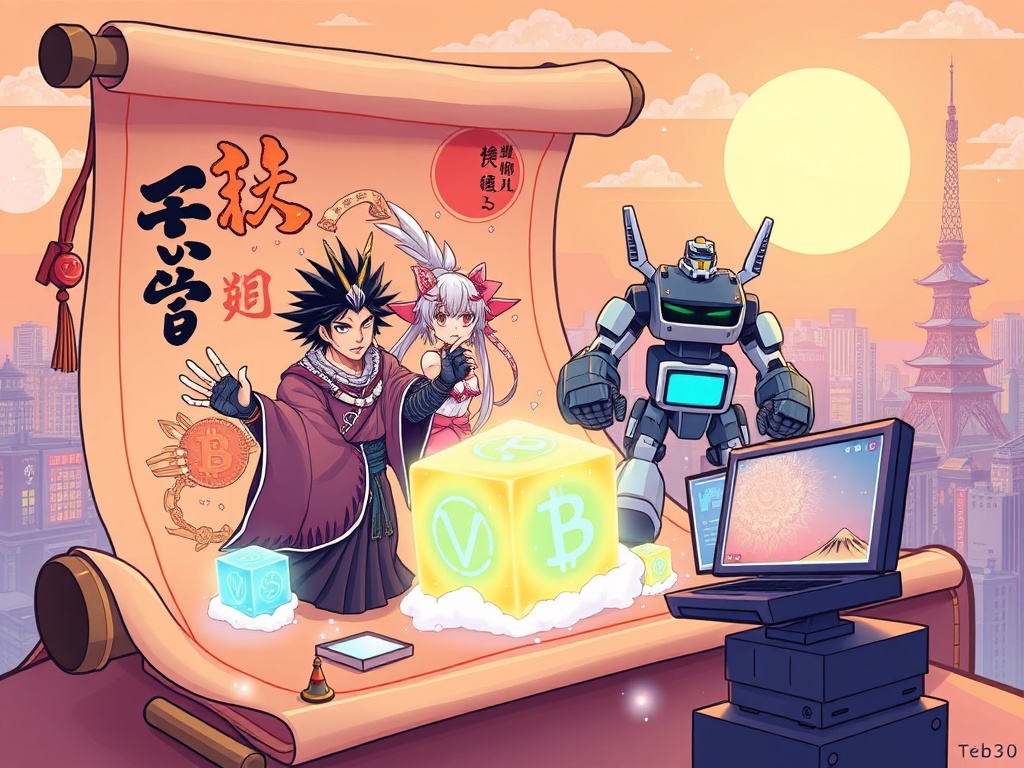

Japanese Animation IP: Animoca Brands Unleashes Web3 Fund for Global Reach

BitcoinWorld

Japanese Animation IP: Animoca Brands Unleashes Web3 Fund for Global Reach

Animoca Brands is making waves in the Web3 space, and their latest move is set to excite fans of Japanese culture worldwide. They have launched a groundbreaking initiative to bring beloved Japanese Animation IP onto the blockchain.

This bold step, a partnership with Antler Ibex Japan, establishes a dedicated Web3 entertainment investment fund. Its core mission is clear: to unlock the immense potential of Japanese Animation IP in the decentralized digital realm. The announcement, made at the WebX conference in Tokyo on August 26, as reported by Cointelegraph, signals a significant shift for the global entertainment industry.

What is This Groundbreaking Web3 Japanese Animation IP Initiative?

Animoca Brands, a recognized leader in blockchain gaming and investments, has joined forces with Antler Ibex Japan. Together, they aim to create a robust ecosystem for Japanese Animation IP within Web3.

This new investment fund will specifically target projects and technologies that can seamlessly integrate iconic characters and stories into blockchain-based platforms. It represents a strategic effort to bridge the traditional world of animation with the innovative possibilities of Web3, offering new avenues for creativity and fan engagement.

Why is Japanese Animation IP So Valuable in Web3?

Sandeep Kashi, a partner investor at Ibex Japan, highlights a compelling truth: a vast majority, perhaps 90% to 99%, of Japanese Animation IP remains untapped in offline markets. This represents an enormous dormant value.

He believes that by bringing this IP on-chain, it can form a powerful foundation for expanding Japanese animation and manga globally. Imagine your favorite characters as unique digital collectibles, playable assets in blockchain games, or integral parts of metaverse experiences.

The Web3 model offers creators unprecedented control and new revenue streams, while fans can gain true ownership and participate more deeply in their favorite franchises. This transforms passive consumption into active participation.

Benefits include:

- New Revenue Streams: Creators can earn royalties from secondary sales of NFTs.

- Enhanced Fan Engagement: Fans gain ownership of digital assets and access to exclusive content.

- Global Reach: Easier international distribution and monetization for beloved characters.

- Creator Empowerment: Direct connection with fans and greater creative control over their works.

The Exciting Future for Japanese Animation IP in Web3

This fund is poised to be a catalyst, propelling Japanese Animation IP into a new era of digital innovation. It’s not just about selling NFTs; it’s about building entire decentralized worlds around beloved franchises.

Consider the possibilities:

- NFTs: Collectible digital art, character skins, or rare in-game items.

- Blockchain Games: Characters as playable assets with verifiable ownership.

- Metaverse Experiences: Immersive virtual worlds where fans can interact with their favorite IP.

- Decentralized Storytelling: Community-driven narratives and content creation opportunities.

However, challenges exist. Navigating complex copyright laws, ensuring widespread user adoption, and overcoming technical hurdles will be crucial. But with Animoca Brands’ extensive expertise, the path forward looks promising for this exciting venture.

The launch of this Web3 entertainment fund by Animoca Brands and Antler Ibex Japan marks a pivotal moment for Japanese Animation IP. By embracing blockchain technology, they are not only unlocking dormant value but also paving the way for a more interactive, engaging, and globally accessible future for anime and manga fans everywhere. This initiative truly stands to revolutionize how we experience and own our favorite digital content.

Frequently Asked Questions (FAQs)

1. What is the main goal of Animoca Brands’ new fund?

The fund’s main goal is to bring Japanese Animation IP on-chain, unlocking its value and expanding its global reach through Web3 technologies.

2. Who are the key partners in this Web3 initiative?

Animoca Brands has partnered with Antler Ibex Japan to launch this Web3 entertainment investment fund.

3. Why is bringing Japanese Animation IP on-chain considered valuable?

An estimated 90-99% of Japanese IP remains unused offline, representing significant dormant value. Bringing it on-chain can create new revenue streams, enhance fan engagement, and facilitate global expansion.

4. What kind of Web3 applications can we expect for Japanese Animation IP?

We can expect applications such as NFTs for digital collectibles, blockchain games featuring IP characters, immersive metaverse experiences, and opportunities for decentralized, community-driven storytelling.

5. What challenges might this initiative face?

Potential challenges include navigating complex copyright laws, ensuring widespread user adoption of Web3 platforms, and overcoming technical hurdles inherent in blockchain development.

If you’re excited about the future of Web3 entertainment and the potential for Japanese Animation IP, share this article with your friends and fellow fans! Let’s spread the word about this groundbreaking development.

To learn more about the latest Web3 entertainment trends, explore our article on key developments shaping Japanese Animation IP‘s future adoption.

This post Japanese Animation IP: Animoca Brands Unleashes Web3 Fund for Global Reach first appeared on BitcoinWorld and is written by Editorial Team

You May Also Like

CME Group to Launch Solana and XRP Futures Options

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise