Hellish bull market: Star traders lose 700 million in floating profits, and survival is not based on luck

By Jia Huan, ChainCatcher

The 2025 bull market was like a hellish ordeal. On one hand, the crypto market, after losing $1.3 trillion in three months, rebounded, accompanied by wild volatility and countless margin calls. On the other hand, Bitcoin soared from a low of $40,000 in early 2024 to over $120,000, continuously breaking new highs.

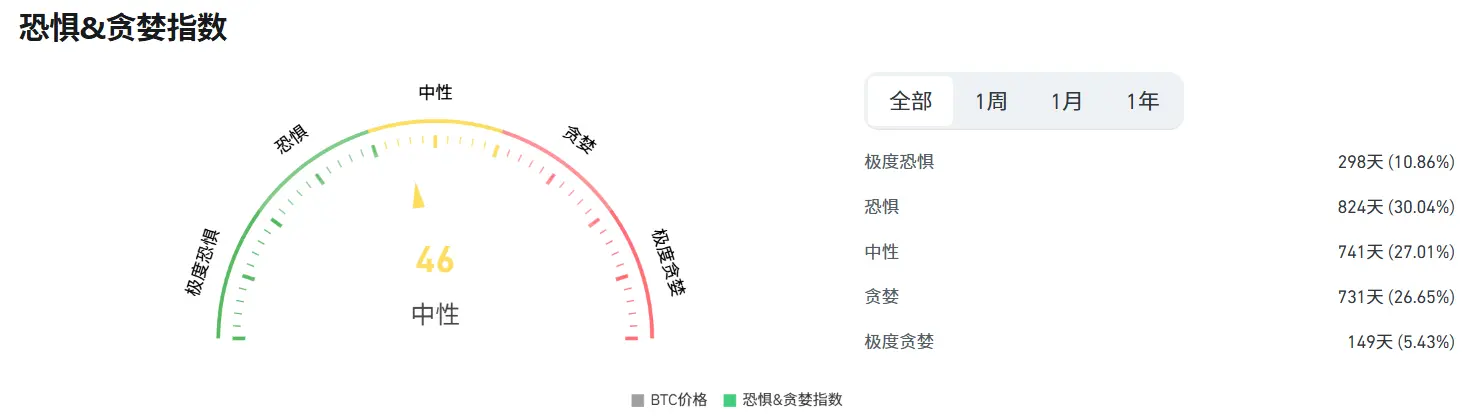

In terms of market sentiment, traders are mainly greedy (46.85%), with significant fear and neutral periods. They are facing a volatile trading environment and strong FOMO emotions.

As X user Sha Po Lang said: This bull market is as difficult as hell, and only true believers can reap the fruits of victory!

This article will focus on star traders in the crypto market, revealing the cruel side of the market through their gains and losses, as well as our response strategies.

Can star traders also lose all their money?

This hellish bull market isn't just a test for ordinary investors; it's also a test for star traders. They're often known for their high-risk, high-return strategies, but their experiences also highlight the brutality of the market. Below is a list of several well-known star traders: some specialize in long positions, some in short-term trading, some start with small capital, and some are extremely sensitive to macroeconomic trends. Yet, invariably, they all end up losing money or even going bankrupt.

1. James Wynn

● Trading Style: Bold and aggressive, primarily long PEPE and BTC. Good at capturing early opportunities in high-potential tokens, often adding to positions during price fluctuations. Frequently shares positions on social media to attract attention, but also attracts whales, with his position rebounding after hitting his stop-loss price multiple times.

● Peak performance: Achieved over 10,000 times profit through PEPE in the early stage, holding 1.23 billion BTC long orders; within 70 days, the floating profit increased from 0 to 87 million US dollars

● Losses: Multiple liquidations resulted in a loss of all profits and a loss of $23 million

2. Insider Brother qwatio

● Trading style: Sensitive to macroeconomic events, good at short-term operations, high winning rate. He has opened positions before key time points like an "insider trader" many times.

● Peak performance: Soared from $3 million in principal to $26 million; once made a profit of $2.15 million in 40 minutes, quickly doubling the profit by capturing the macro fluctuations of BTC and ETH

● Losses: Accounts ultimately returned to zero; $25.8 million lost in 3 hours due to leveraged short position liquidation; total losses reached over $28 million

3. AguilaTrades

● Trading style: Enthusiastic about high leverage and rolling positions, preferring BTC and ETH. Win rate relies on market trends, but neglects position diversification and emotion management, often returning to heavy positions immediately after losses.

● Peak performance: From $300,000 in principal to $41.7 million

● Loss: Loss of $37.6 million, with only $30,000 left in the account

In addition, there are star traders such as Jason Leo, whose floating profits went from 700 million to zero, and suffered heavy losses in this hellish bull market.

Lessons from Gains and Losses: Restraint and Rationality: The Ultimate Rules for Surviving a Bull Market

Amidst the turbulent bull market, the trading performance of star traders serves as a mirror, revealing the harsh reality of the crypto market and serving as a reminder that only by restraining greed and maintaining a rational strategy can we survive. User X, Web3 Philosopher, commented: "Many people are actually gambling, but mistakenly believe they are trading. Many are actually gamblers, but claim to be traders."

Gamblers are on the left and traders are on the right. The two seem to be only a fine line apart, but in fact there is a world of difference between them.

The former often relies on luck and emotions, buying heavily at market highs and panic selling at market lows, ignoring timing and position control. The latter views the market as a battlefield and develops rigorous strategies: using technical analysis, fundamental research, and stop-loss mechanisms, diversifying the portfolio, and maintaining emotional neutrality.

The three star traders introduced above also reached the altar, but in the end they all experienced a dramatic turn from the peak to zero because of their "red eyes".

In a bull market, locking in profits is a key strategy to prevent wealth evaporation. Market volatility is volatile, and while prices can surge from lows, a pullback can often wipe out all gains. Promptly locking in principal provides a layer of insurance for your position, allowing you to leverage your profits and ensure long-term market survival.

At the same time, we should strengthen emotional management. The emotions here do not only mean not getting carried away when suffering heavy losses, but also staying restrained and calm, analyzing where the strategy went wrong, and then making adjustments and starting over; it also means not showing off large orders, keeping a low profile, trading smartly, and protecting your funds from whale snipers.

In this hellish bull market, glory and traps coexist. There is never a shortage of opportunities to make money in the cryptocurrency circle. What is lacking are investors who have restraint and rationality. Only they can survive the frenzy of greed and have the last laugh.

You May Also Like

Eric Trump bets Fed rate cut will send crypto stocks skyrocketing

Vlna BitcoinFi boomu sa začína s HYPER