Michael Saylor’s Strategy Adds 3,081 BTC in $356.9M Purchase

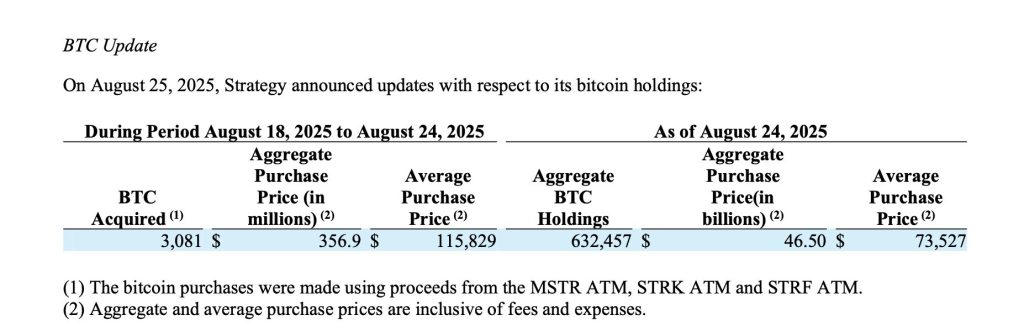

Michael Saylor’s Strategy announced on Monday its expansion of its Bitcoin reserves, confirming the acquisition of 3,081 BTC between August 18 and August 24.

The aggregate purchase cost was approximately $356.9 million, with an average purchase price of $115,829 per bitcoin.

The filing, disclosed in a Form 8-K with the Securities and Exchange Commission (SEC), reflects the company’s continued aggressive stance on Bitcoin accumulation despite elevated market prices.

Total Holdings Surpass 632,000 BTC

With the latest transaction, Strategy’s aggregate Bitcoin holdings have risen to 632,457 BTC. The company’s cumulative investment now totals roughly $46.50 billion, reflecting an average purchase price of $73,527 per bitcoin.

This substantial inventory reinforces Strategy’s position as the single largest corporate holder of Bitcoin globally, eclipsing the reserves of many nations and placing the digital asset at the core of its corporate treasury strategy.

The filing further clarified that the purchases were funded using proceeds from the company’s active at-the-market (ATM) equity offerings, which include multiple preferred stock instruments listed on Nasdaq under the tickers MSTR, STRK, STRF, STRD, and STRC.

Strong Year-to-Date Yield Performance

Alongside the disclosure of new acquisitions, Strategy highlighted its year-to-date Bitcoin yield of 25.4% in 2025. The performance underscores the effectiveness of the firm’s dollar-cost averaging strategy, which has allowed it to accumulate BTC across varied market cycles while steadily reducing its average purchase price.

By maintaining both long-term conviction and opportunistic buying during market fluctuations, the company has managed to capture substantial upside during Bitcoin’s 2025 rally.

Strategy’s management has repeatedly framed its Bitcoin treasury approach as both a hedge against inflation and a foundational bet on the future of digital assets.

Market and Strategic Implications

The latest purchase signals continued institutional confidence in Bitcoin as an asset class, even as the cryptocurrency trades above the six-figure mark.

For investors, Strategy’s relentless accumulation serves as both a market indicator and a corporate case study in digital asset monetization.

As of late August 2025, Bitcoin remains volatile but in demand, with increasing institutional participation through ETFs, trusts, and corporate treasuries.

Strategy’s expanding balance sheet allocation highlights a broader trend: Bitcoin is no longer viewed as a fringe investment but as a core reserve asset for forward-thinking corporations.

With over 632,000 BTC now under its control, Strategy’s market influence is unparalleled. Each quarterly filing will continue to be closely scrutinized by investors, regulators, and market participants eager to gauge how this unprecedented corporate bet on Bitcoin unfolds.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

SEI Technical Analysis Feb 6