Daily Market Update: Stock Futures Rise as Investors Await Key Inflation Data After Strong Jobs Report

TLDR

- January jobs report showed 130,000 new jobs added, beating analyst forecasts and complicating Federal Reserve rate cut expectations

- Friday’s Consumer Price Index data is forecast to show inflation declining to 2.5% year-over-year from December’s reading

- CME FedWatch tool indicates 94.6% probability the Fed will hold rates steady at 3.50%-3.75% range

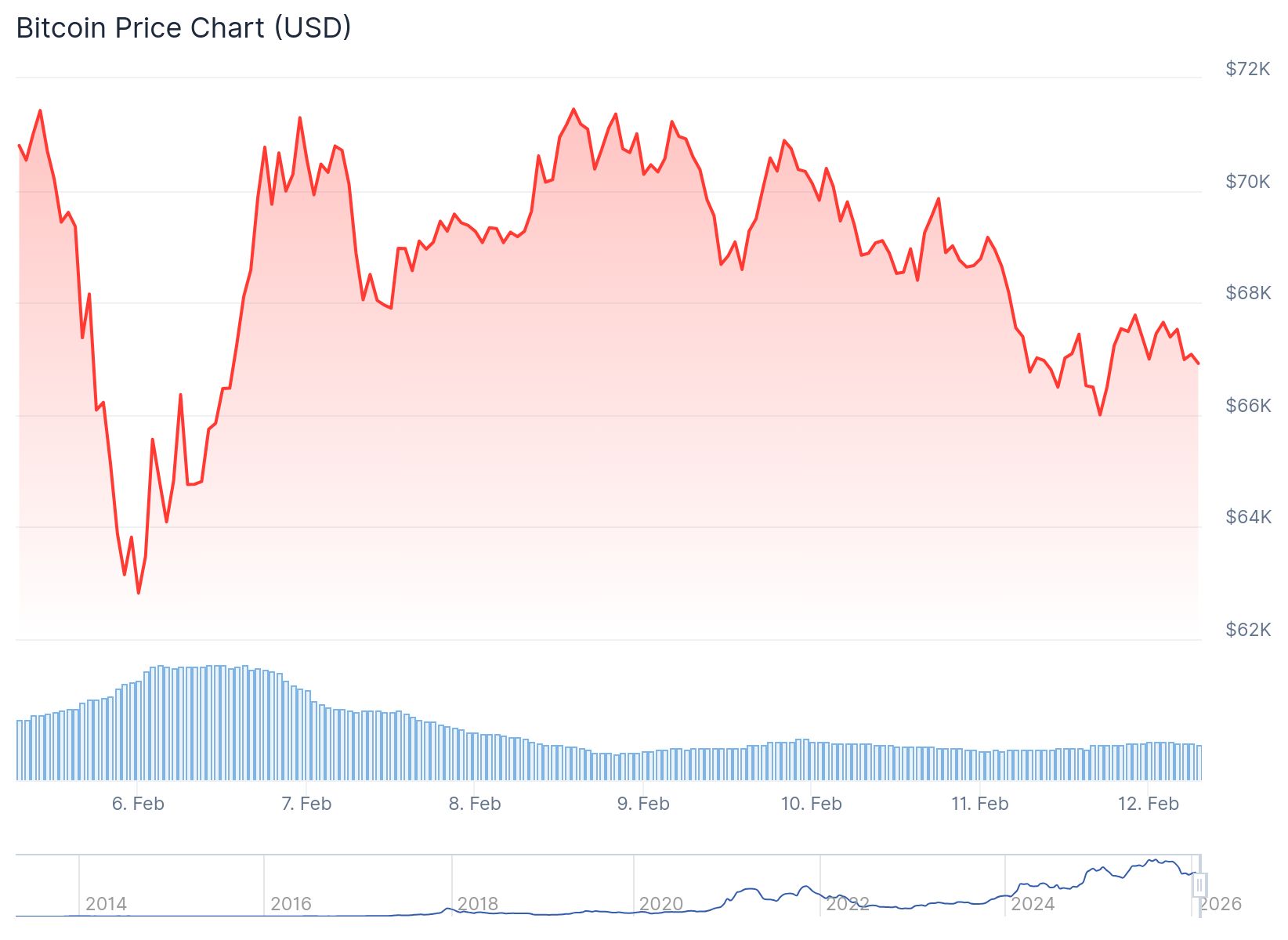

- Bitcoin trades at $67,200 while consolidating between $62,822 and $72,000 following recent selloff

- Stock futures climbed Thursday morning with Dow, S&P 500, and Nasdaq futures all posting gains

Stock futures moved higher Thursday morning as investors processed a stronger-than-expected January jobs report. The report showed the U.S. economy added 130,000 new jobs last month, beating analyst predictions.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Futures tied to the Dow Jones Industrial Average rose around 0.2% while S&P 500 futures gained similar ground. Nasdaq 100 futures climbed 0.1% in early trading.

The positive futures action followed a choppy Wednesday session on Wall Street. All major indexes ended little changed after the jobs data release.

Markets initially climbed following the highly anticipated jobs report. However, the strong hiring numbers complicated expectations for Federal Reserve policy.

The January employment data came after year-end reports for 2025 were revised down. These revisions showed a slower pace of job growth last year than previously reported.

Investors now focus on Friday’s Consumer Price Index report. The delayed inflation data was pushed back due to a partial government shutdown.

Inflation Data Takes Center Stage

The January CPI reading is forecast to show inflation declining to 2.5% year-over-year. This would represent a 0.2% decrease from December’s figure.

Derek Lim, head of research at crypto market-making firm Caladan, called the inflation metric more important than employment data. Lower than expected inflation would increase pressure on the Fed to cut rates sooner.

Lower Fed policy rates generally ease financial conditions and lower discount rates. This environment historically supports both equities and cryptocurrencies during periods of strong liquidity.

A hotter-than-expected inflation reading could reinforce a higher-for-longer rate regime. This scenario would put pressure on risk assets across the board.

CME’s FedWatch tool currently shows a 94.6% probability the Fed will maintain rates at 3.50%-3.75%. Market expectations have shifted following the surprise payrolls data.

Tim Sun, Senior Researcher at HashKey Group, explained that good economic news acts as bad news for markets at this stage. Strong employment suggests the economy remains resilient, giving the Fed no urgent reason for early easing.

Market Reaction and Outlook

Bitcoin trades at $67,200, down 0.5% over the past 24 hours. Ethereum remains flat at $1,970 according to CoinGecko data.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The leading cryptocurrency has consolidated between $62,822 and $72,000 over the past week. Volatility has remained subdued following late January and early February selloffs.

Sun noted that interest rate futures were rapidly repriced following the jobs data. Expectations for rate cuts were compressed and pushed back to the second half of the year.

The researcher suggested sell-side pressure may be nearing exhaustion. From a price action perspective, the pace of decline is decelerating.

In after-hours trading, Cisco Systems tumbled roughly 7% after missing profit expectations. McDonald’s slipped modestly despite topping earnings estimates.

Friday’s earnings calendar features reports from Coinbase, Applied Materials, and Rivian. A softer inflation reading would build hopes that price pressures are easing while economic growth remains intact.

The post Daily Market Update: Stock Futures Rise as Investors Await Key Inflation Data After Strong Jobs Report appeared first on CoinCentral.

You May Also Like

New Gold Protocol's NGP token was exploited and attacked, resulting in a loss of approximately $2 million.

Adoption Leads Traders to Snorter Token