Dogecoin (DOGE) Price: Whales Accumulate 250 Million Tokens During 7% Weekly Decline

TLDR

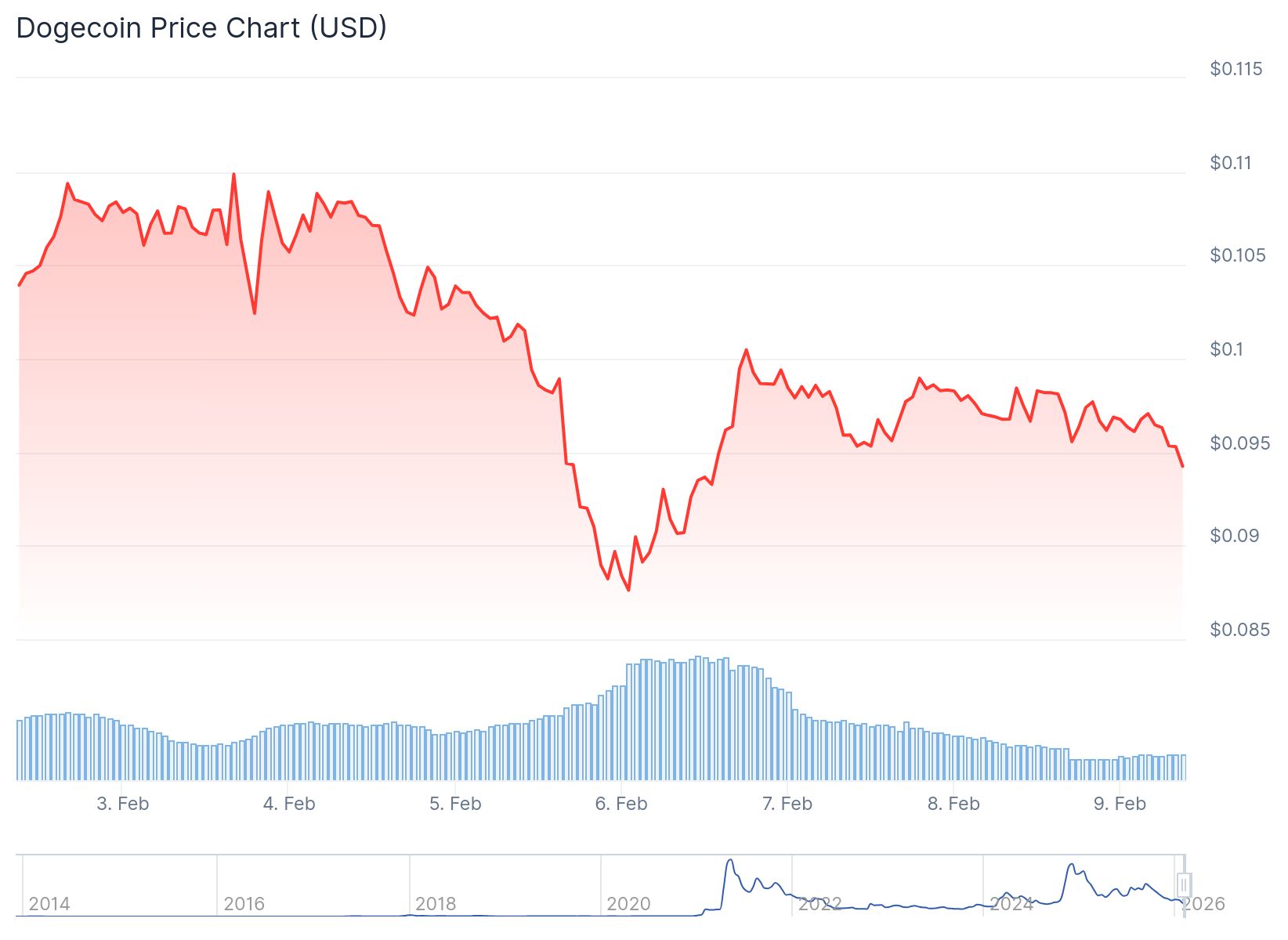

- Dogecoin price trades near $0.095 after falling over 7% last week, with whales accumulating 250 million tokens during recent price dips.

- Large holders with 100,000 to 1 million and 10 million to 100 million DOGE bought during the decline while mid-tier whales sold 110 million tokens.

- The acquisition cost for DOGE has dropped to its lowest level in months as the number of holders increased by 8.2 million.

- Technical indicators show fading bearish momentum with RSI rebounding from oversold territory and MACD lines converging.

- A $1.63 million liquidation cluster sits at $0.11, creating a potential price target if buyers step in with conviction.

Dogecoin price hovers near $0.095 on Monday after declining more than 7% over the previous week. The dog-themed meme coin bottomed at $0.080, just above the weekly support level of $0.078, before staging a Friday rebound.

Dogecoin (DOGE) Price

Dogecoin (DOGE) Price

On-chain data reveals that certain whale groups have been buying DOGE during the recent price drops. This accumulation suggests selling pressure may be easing across the market.

Santiment’s Supply Distribution data shows whales holding between 100,000 and 1 million DOGE tokens have been accumulating. Another group holding 10 million to 100 million tokens has also been buying. Together, these whale groups purchased a total of 250 million DOGE tokens since Thursday.

During the same period, a different whale tier holding 1 million to 10 million tokens sold 110 million DOGE. The data indicates that larger whales took advantage of lower prices to increase their positions.

CryptoQuant data supports this bullish outlook. The platform’s summary shows DOGE’s spot and futures markets displaying large whale orders and buy dominance.

Source: Santiment

Source: Santiment

The number of DOGE holders has grown by roughly 8.2 million. This increase has remained consistent despite recent market volatility. The Mean Dollar Invested Age sits at 53, suggesting coins are not moving aggressively through the network.

Technical Indicators Point to Recovery

The Relative Strength Index currently reads 32 after rebounding from oversold territory. This bounce hints at fading bearish momentum across the market. However, the RSI needs to move above the neutral level of 50 for any recovery rally to gain strength.

The Moving Average Convergence Divergence lines are converging. Red histogram bars below the neutral level are fading, which suggests bearish strength is weakening.

DOGE is currently testing resistance at a previously broken trendline. The price faced rejection at this level during the weekend. If DOGE breaks and closes above this trendline on a daily basis, the recovery could extend toward the February high of $0.110.

Liquidation Cluster Creates Price Target

On-chain liquidation data shows a $1.63 million liquidity cluster around the $0.11 level. Markets often move toward these zones as price action seeks areas of concentrated orders.

Source; Coinglass

Source; Coinglass

DOGE continues to consolidate within a flag structure on the charts. The Stochastic RSI was bouncing from an oversold zone at press time.

The acquisition cost for DOGE has dropped to a local low. Historically, such levels attract sidelined capital as buyers perceive value while sellers hesitate.

If DOGE resumes its downward trend, the price could decline toward Friday’s low of $0.080. A close below this level could push losses toward the next weekly support at $0.078. The primary trend for DOGE remains bearish, meaning any short-term recovery carries the possibility of a brief price increase within a broader downtrend.

The post Dogecoin (DOGE) Price: Whales Accumulate 250 Million Tokens During 7% Weekly Decline appeared first on CoinCentral.

You May Also Like

Crypto whale loses $6M to sneaky phishing scheme targeting staked Ethereum

Why is the Trump-backed WLFI Token Price Up Today?