Stellar Foundation Moves 2.7B XLM to Improve Transparency and Fund Allocation

- The Stellar Foundation announced that it had moved 2.7 billion XLM from the Growth 3 account to an Assets and Liquidity account.

- The Growth accounts still hold 6.3 billion XLM, while products and innovation accounts hold 4.5 billion XLM.

The Stellar Foundation has moved over 2.7 billion XLM tokens from the network’s Growth 3 account to the Assets and Liquidity account to fund its efforts in creating equitable access to the global financial system.

The transfer was in line with SDF’s new framework, published last year, in which it pledged to use the XLM it controls to promote the growth of the Stellar ecosystem. It added that the update allowed it to clearly define which wallets are dedicated to development, growth, product, innovation, and assets and liquidity.

The announcement came in a week when Almanax, an AI-powered Web3 security platform supported by SDF, revealed that it had launched the second version of its automated security software. Vesseo Wallet, a digital wallet built on Stellar for users in Brazil and Argentina, also revealed that it had integrated Blend Capital, the largest DeFi protocol on the network.

OpenZeppelin, one of the top Web3 security companies in the market, then debuted its Role Manager feature on Stellar, allowing developers to manage their app’s onchain access controls in seconds.

SDF Doubles Down on Stellar Development

Since updating its mandate last year, SDG has doubled down on its efforts to promote the growth and adoption of the Stellar blockchain. As CNF reported, in its 2026 roadmap, the organization committed to “scale what already works, strengthen what’s proven, and invest where the network must be ready next.”

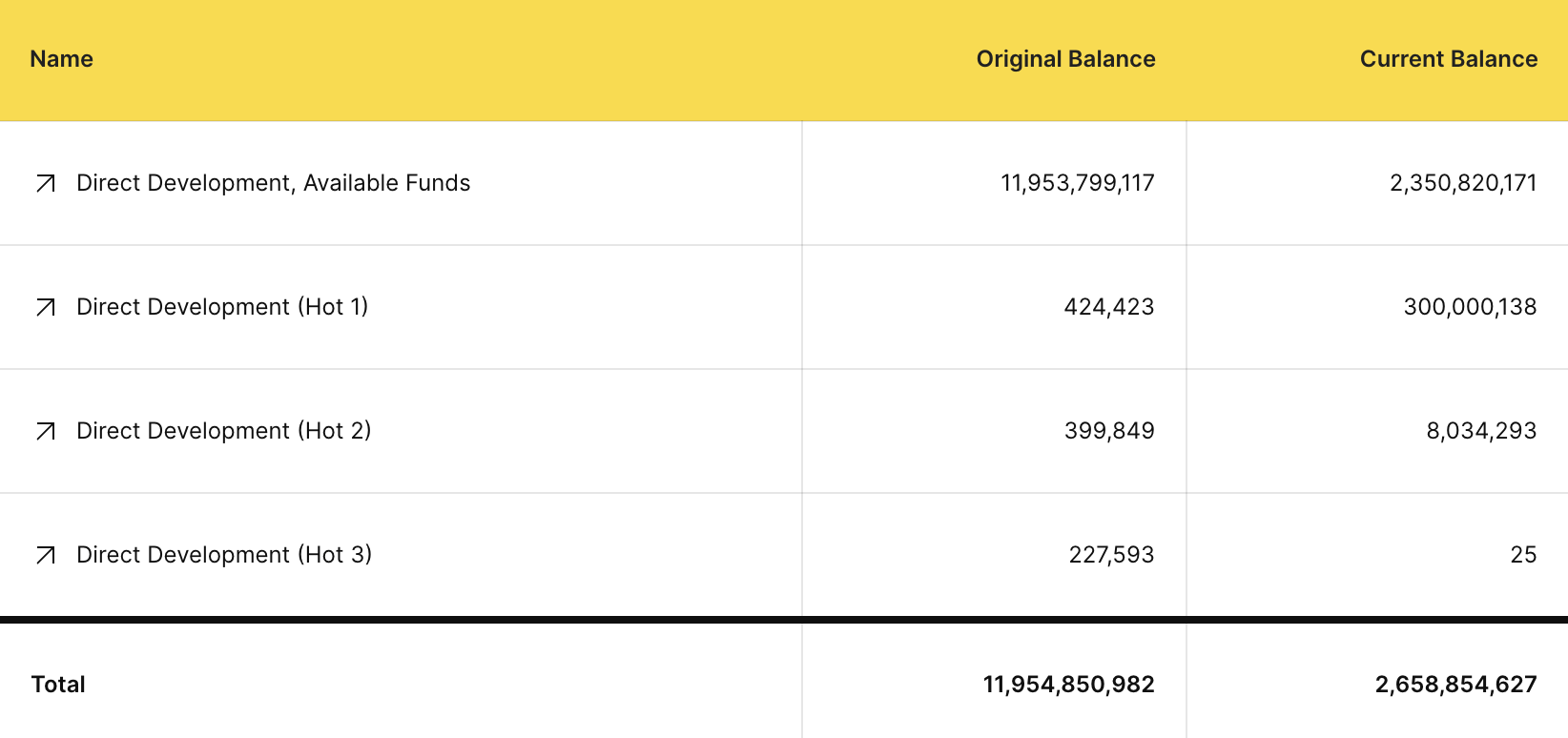

As of Feb. 6, the organization revealed it held 2.658 billion XLM under its wallet, worth $422 million at current prices. Originally, it had received 11.95 billion XLM and has spent most of it in boosting adoption and supporting developers building dApps on the network. This stash is also used to pay salaries for the organization’s employees.

Image courtesy of Stellar.org.

Image courtesy of Stellar.org.

Its growth wallets hold 6.29 billion XLM, worth just under $1 billion at current prices, spread across four wallets. The growth fund goes to initiatives that seek to increase the number of developers, accounts, types of assets, volume, and velocity of transactions.

SDF also taps the growth fund to support initiatives like hackathons, meetups and research grants. These activities aim to attract developers and fuel engagement. The fund also helps these projects reach the masses, as SDF explains:

XLM trades at $0.1582, dipping 3% in the past day after it was unable to maintain momentum that had taken the token to $0.1707.

]]>You May Also Like

XRP Ignites As Spot Volume Skyrockets

Eric Trump bets Fed rate cut will send crypto stocks skyrocketing