Custody Service Business Research Report 2026: $75+ Bn Opportunities, Trends, Competitive Landscape, Strategies, and Forecasts, 2020-2025, 2025-2030F, 2035F

Key opportunities in the custody services market include increasing digital asset demand, adoption of digital custody solutions, enhanced focus on real-time reporting, regulatory compliance, and expansion of multi-asset custody. This growth is driven by institutional investment and evolving asset management needs.

Dublin, Feb. 06, 2026 (GLOBE NEWSWIRE) -- The "Custody Service Market Report 2026" has been added to ResearchAndMarkets.com's offering.

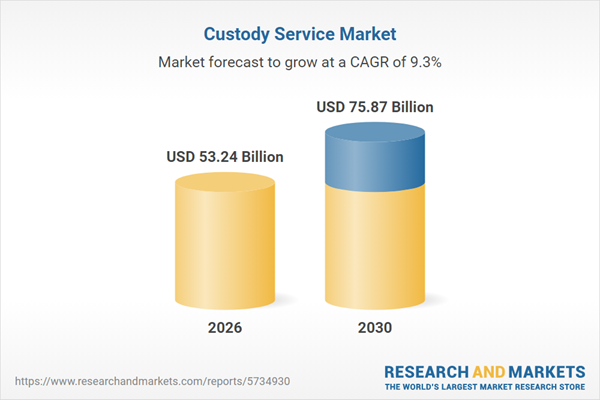

The custody service market has experienced significant expansion in recent years. It is projected to grow from $48.84 billion in 2025 to $53.24 billion in 2026, with a compound annual growth rate (CAGR) of 9%. This growth has been driven by the expansion of global capital markets, increased institutional investment, complex asset portfolios, demand for safekeeping services, and development of centralized depository systems.

Looking to the future, the market is expected to continue its upward trajectory, reaching $75.87 billion by 2030, at a CAGR of 9.3%. Key factors fueling this growth include heightened demand for digital custody solutions, a focus on real-time reporting and transparency, the expansion of alternative asset custody, and increased outsourcing of post-trade operations. Emergent trends include a demand for integrated custody and asset servicing platforms, adoption of securities lending services, automated settlement and reporting systems, multi-asset custody capabilities, and robust data management to comply with regulations.

A significant driver of this growth is the burgeoning demand for digital assets, propelled by the adoption of cryptocurrencies and interest in decentralized finance (DeFi). Custody services have become essential in providing secure storage and management solutions for these assets to ensure safety and compliance. For instance, in February 2023, the ETC Group noted that NFT sales on major blockchains nearly reached $1 billion, marking a 33.83% increase across the top chains. This demand, particularly in the metaverse, continues to drive the custody services sector.

Major companies in the sector are prioritizing technological advancements by integrating blockchain support into their digital asset custody infrastructures. For example, Standard Chartered PLC launched a digital asset custody service in the UAE in September 2024, licensed by the Dubai Financial Services Authority, allowing clients to store major cryptocurrencies securely. This marriage of traditional custodial expertise with advanced technology helps address the operational challenges associated with legacy systems.

Furthermore, Apex Group Ltd's acquisition of the custody and investment accounting business of Trustees Executors Ltd in October 2024 highlights strategic expansions in the industry. This move strengthens Apex Group's investment operations in New Zealand by offering a comprehensive range of services, including access to innovative ESG and sustainability offerings.

Leading entities in the custody service market include JPMorgan Chase & Co., HSBC Holdings plc, Citigroup Inc., and BNP Paribas among others. Geographically, North America led the market in 2025, followed by Western Europe. The regions covered in the market report include Asia-Pacific, South East Asia, Europe, North and South America, Middle East, and Africa, with countries like Australia, Brazil, China, and the USA being significant contributors.

The market comprises revenues generated by entities through services such as settlement, safekeeping, and reporting of marketable securities and cash. The value includes related goods offered by service providers, traded between entities or sold to end consumers, and is a reflection of sales, grants, or donations in the specified markets.

Report Scope

Markets Covered:

- By Service: Core Custody Services; Ancillary Services

- By Type: Equity; Fixed Income; Alternative Assets; Other Types

- By End User: Asset Managers, Banks, Pension Funds, Insurance Companies, Corporations, Sovereign Wealth, High-Net-Worth Individuals, Retail Platforms

Subsegments:

- Core Custody Services: Asset Safekeeping, Securities Settlement, Asset Servicing, Corporate Actions Processing

- Ancillary Services: Fund Accounting, Proxy Voting, Cash Management, Tax Reporting

Key Companies Mentioned: JPMorgan Chase, HSBC, Citigroup, Wells Fargo, BNP Paribas, UBS, and more.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 250 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value (USD) in 2026 | $53.24 Billion |

| Forecasted Market Value (USD) by 2030 | $75.87 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

Key Technologies & Future Trends

- Fintech, Blockchain, Regtech & Digital Finance

- Digitalization, Cloud, Big Data & Cybersecurity

- Industry 4.0 & Intelligent Manufacturing

- Artificial Intelligence & Autonomous Intelligence

- Internet of Things (IoT), Smart Infrastructure & Connected Ecosystems

- Increasing Demand for Integrated Custody and Asset Servicing Platforms

- Rising Adoption of Securities Lending Services

- Growing Use of Automated Settlement and Reporting Systems

- Expansion of Multi-Asset Custody Capabilities

- Enhanced Focus on Regulatory-Compliant Data Management

Companies Featured

- JPMorgan Chase & Co.

- HSBC Holdings plc

- Citigroup Inc.

- Wells Fargo & Company

- BNP Paribas

- UBS AG

- State Bank of India

- Groupe Caisse d'Epargne

- Deutsche Bank AG

- HDFC Bank Ltd.

- ICICI Bank Ltd.

- The Bank of New York Mellon Corporation

- DBS Bank Ltd.

- Commerzbank AG

- State Street Bank and Trust Company

- Northern Trust Corporation

- Hang Seng Bank Limited

- Kotak Mahindra Bank Limited

- Standard Chartered plc

- Yes Bank Ltd.

- Societe Generale Securities Services GmbH

- Stock Holding Corporation of India Ltd.

- Julius Baer Group AG

- Brown Shipley & Co. Limited

- RBC Investor & Treasury Services

- Edelweiss Custodial Services Ltd.

- Orbis Financial Corporation Ltd.

- Axis Bank Ltd.

- Brown Brothers Harriman & Co.

For more information about this report visit https://www.researchandmarkets.com/r/8jdrhg

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

- Custody Service Market

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

The post Custody Service Business Research Report 2026: $75+ Bn Opportunities, Trends, Competitive Landscape, Strategies, and Forecasts, 2020-2025, 2025-2030F, 2035F appeared first on Crypto Reporter.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise