Bitcoin (BTC) Price: Falls to $81,000 as $1.7B in Liquidations Hit Crypto Market

TLDR

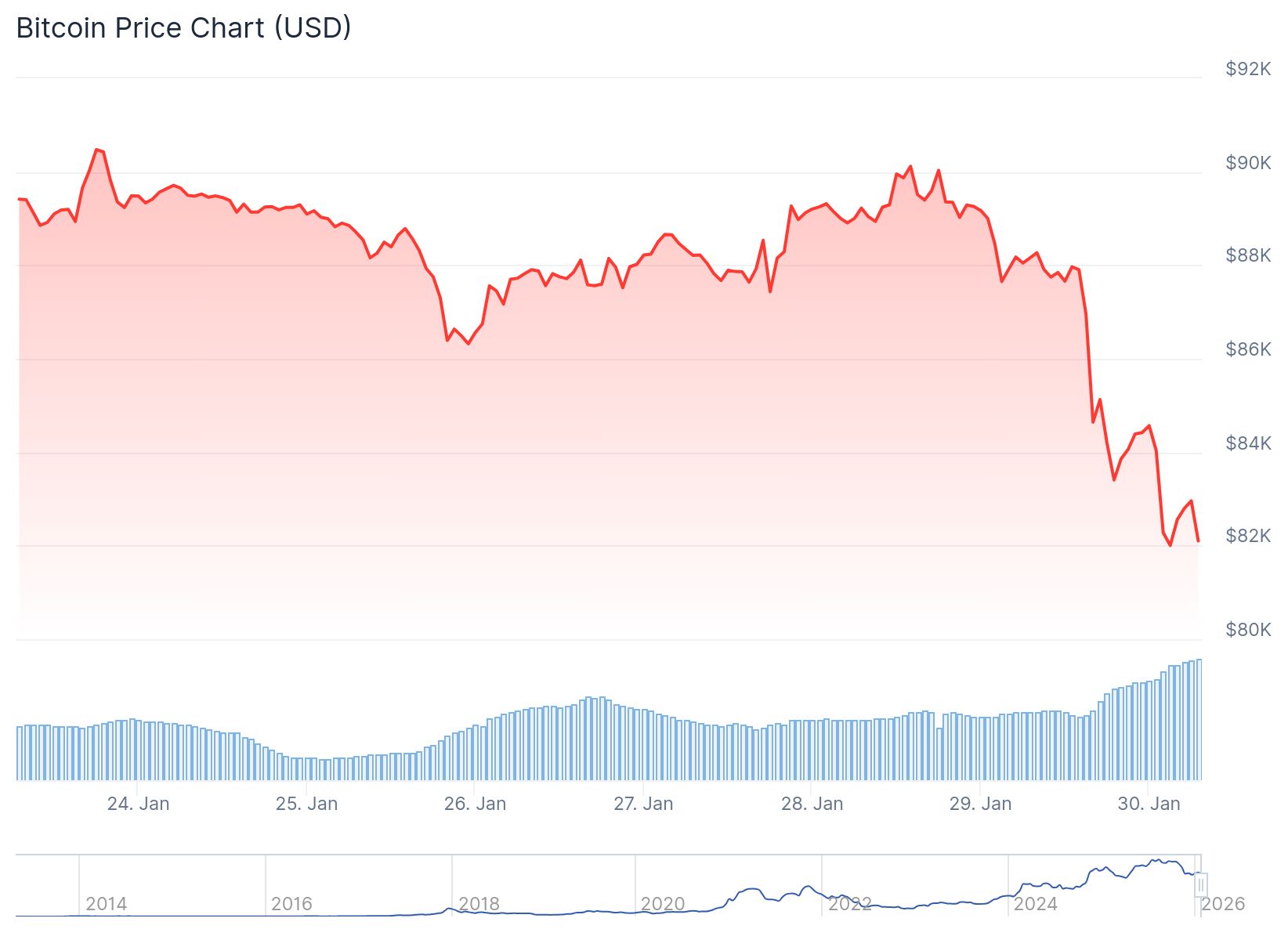

- Bitcoin dropped to $81,000, its lowest price since April 2025, marking a nine-month low

- Over $1.68 billion in leveraged positions were liquidated in 24 hours, affecting roughly 267,000 traders

- Long positions made up 93% of liquidations, with Bitcoin accounting for $780 million and Ethereum $414 million

- The selloff was triggered by Middle East tensions, Trump tariff threats, and weak Microsoft earnings

- Gold fell 9% and silver dropped 11.5% in the same period

Bitcoin crashed to $81,000 on Friday morning, reaching its lowest point in nine months. The drop erased $200 billion from the total crypto market in just 24 hours.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The cryptocurrency fell to $81,058 on Coinbase during early trading. This represents a 35% decline from Bitcoin’s all-time high of $126,000 reached in October.

The sudden price drop forced 267,370 traders out of their positions. Total liquidations across the crypto market hit $1.68 billion in 24 hours.

Long positions took the hardest hit. They accounted for $1.56 billion of the liquidations, representing 93% of the total. Short positions made up just $118 million.

Source: Coinglass

Source: Coinglass

Bitcoin led the liquidation damage with $780 million wiped out. Ethereum followed with $414 million in forced position closures.

The largest single liquidation was an $80.57 million BTC-USDT position on the HTX exchange. This shows that even large positions with deep liquidity got caught in the downturn.

Geopolitical Events Spark Selloff

Multiple factors combined to trigger the market crash. The US sent additional warships to the Middle East as tensions with Iran increased.

President Trump told reporters that powerful ships were sailing toward Iran. He expressed hope they wouldn’t need to be used.

Trump also signed an executive order Thursday declaring a national emergency. The order imposes tariffs on goods from countries that sell or provide oil to Cuba.

These geopolitical developments created uncertainty in traditional and crypto markets. Gold dropped 9% from its Thursday high of $5,600 per ounce. Silver fell 11.5% during the same period.

Tech Earnings Add to Market Pressure

Microsoft’s poor earnings report contributed to the crypto selloff. The tech giant’s stock dropped 10% on Thursday, its worst single-day decline since March 2020.

Jeff Mei, chief operations officer at BTSE exchange, pointed to the Microsoft earnings as a key factor. The company reported record spending but slowing cloud sales growth.

Investors worried that weakness in AI-related tech stocks would spread to other markets. This led traders to reduce risk across their portfolios.

Hyperliquid saw the most liquidations at $598 million. Over 94% of these were long positions. Bybit recorded $339 million in liquidations, while Binance logged $181 million.

The cascade effect played out as prices fell. Forced selling pushed prices lower, which triggered more liquidations. This created a feedback loop that amplified the decline.

Liquidations happen when leveraged traders can’t meet margin requirements. Exchanges close these positions to prevent further losses. In fast-moving markets, this process becomes self-reinforcing.

The heavy concentration of long positions showed how one-sided trader positioning had become. When nearly everyone holds long positions, the market doesn’t need major bad news to correct.

Funding rates and open interest have now reset after the liquidation event. The clearing of speculative excess removed weak hands from the market. Bitcoin now sits at a crucial support level on the monthly timeframe.

The post Bitcoin (BTC) Price: Falls to $81,000 as $1.7B in Liquidations Hit Crypto Market appeared first on CoinCentral.

You May Also Like

Bitcoin Mining Stocks Rally: Bitfarms Surges 162%, Cipher Mining 40% in September

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth