Crypto Market Today Turns Red But LTH Data Signals Structural Stability

The post Crypto Market Today Turns Red But LTH Data Signals Structural Stability appeared first on Coinpedia Fintech News

The crypto market today is trading broadly lower, with Bitcoin hovering near $88,000, Ethereum around $2,950, and XRP defending the $1.89 zone. The decline follows heightened macro caution after the Federal Reserve’s rate decision, coupled with a large crypto options expiry that has amplified short-term volatility.

Macro Pressures Drive Risk-Off Sentiment Across Crypto Market Today

Selling pressure across the crypto market today has been driven by a combination of macro and structural factors rather than asset-specific weakness. The Federal Reserve’s decision to hold interest rates steady at 3.5%–3.75% provided little clarity on the timing of potential rate cuts. As a result, traders remained defensive, particularly with concerns around tariff-driven inflation still lingering.

Meanwhile, Deribit exchange highlighted a concern of more than $9.5 billion worth of crypto options that are expiring this Friday, prompting increased hedging activity. This has raised short-term volatility while keeping directional conviction muted. At the same time, capital has rotated into traditional safe havens, with gold (XAU/USD) pushing to record highs above $5,550 per ounce, reinforcing a broader risk-off environment.

Bitcoin Supply Data Shows Holder Conviction Despite Price Weakness

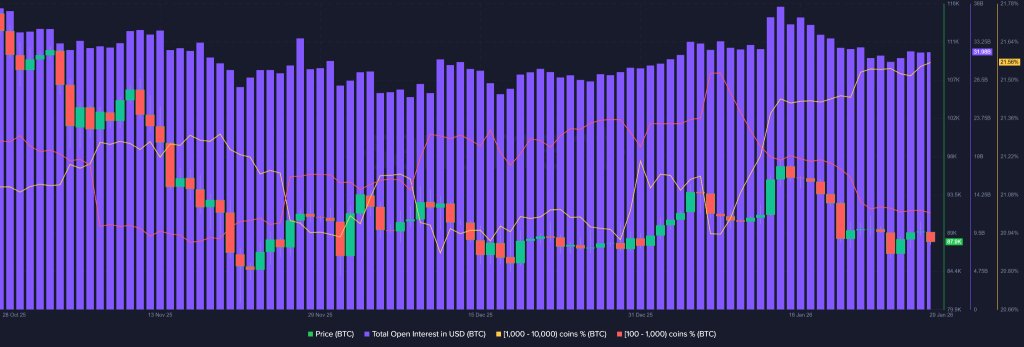

The current sentiment is defensive, and the crypto market is technically capped, as shiny metals rise. As a result, digital gold like Bitcoin continues to consolidate near $88,000, holding above the $87,000–$87,400 support zone, clearly indicating that investors still don’t view BTC as a risk-off asset, which is why its muted compared to shiny metals. While short-term pressure may persist, the chart is still holding on, which suggests selling pressure is being absorbed by big players rather than accelerating price bleeding.

At the same time, Bitcoin open interest remains structurally elevated, too. This combination of sideways price action but having a high derivatives participation is giving signals of confidence positioning happening rather than forced liquidation. Supply distribution data reinforces this view, as addresses holding 1,000–10,000 BTC continue to trend higher, indicating long-term accumulation behavior.

Meanwhile, holders with 100–1,000 BTC show controlled distribution rather than sharp exits. This rotation typically reflects healthy market restructuring rather than capitulation, even as the crypto market today remains under macro stress.

Ethereum Consolidation Reflects Supply Transfer to Stronger Hands

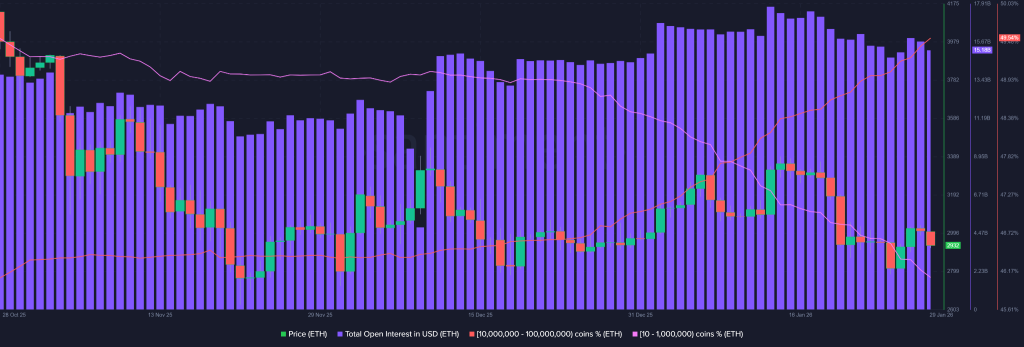

Ethereum is trading near $2,950, struggling to reclaim the $3,000 psychological level. Still, ETH price action remains range-bound above prior structural lows, forming higher reactions at demand zones. That said, Ethereum open interest continues to trend upward despite sideways movement, suggesting gradual position-building happening too.

Supply metrics offer additional clarity. Addresses holding 10,000,000–100,000,000 ETH remain stable, highlighting continued dominance among large holders. In contrast, mid-tier holders in the 10–1,000,000 ETH range have been reducing exposure. This transfer of supply from weaker hands to stronger hands often improves trend durability once expansion resumes.

XRP Shows Active Participation Across Holder Classes

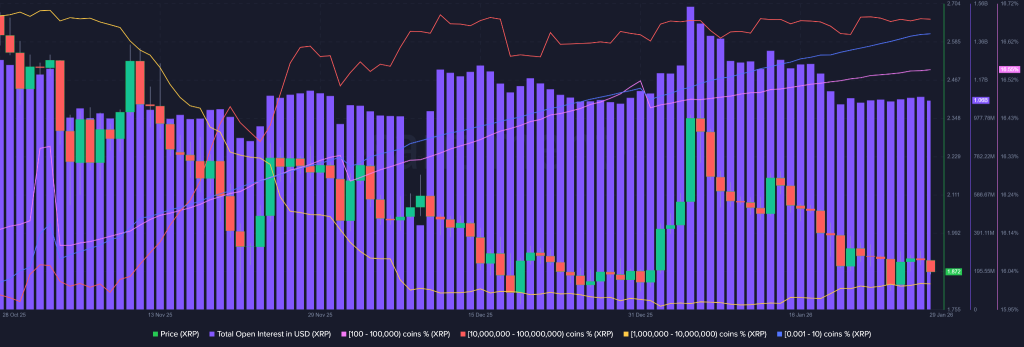

XRP has shown relative resilience compared to broader market weakness, holding above $1.89 despite elevated volatility. The price continues to react sharply at demand zones, suggesting active participation rather than disengagement.

Notably, XRP open interest remains elevated during consolidation, pointing to sustained trading activity. Supply distribution data shows growth among retail cohorts holding 0.001–10 and 100–100,000 XRP. At the same time, larger holders in the 1,000,000–10,000,000 and 10,000,000–100,000,000 ranges have also edged higher since January.

Taken together, the crypto market today reflects short-term caution driven by macro forces, while supply-side data across BTC, ETH, and XRP price continues to signal structural stability rather than distribution.

You May Also Like

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End

Fed rate decision September 2025