AlphaTON Capital Advances Strategic Roadmap with Revenue Generation from Confidential Compute AI Infrastructure

AlphaTON Recently Raised Net $44 Million in Capital and is Generating Revenue with AI Infrastructure from Telegram’s Cocoon AI

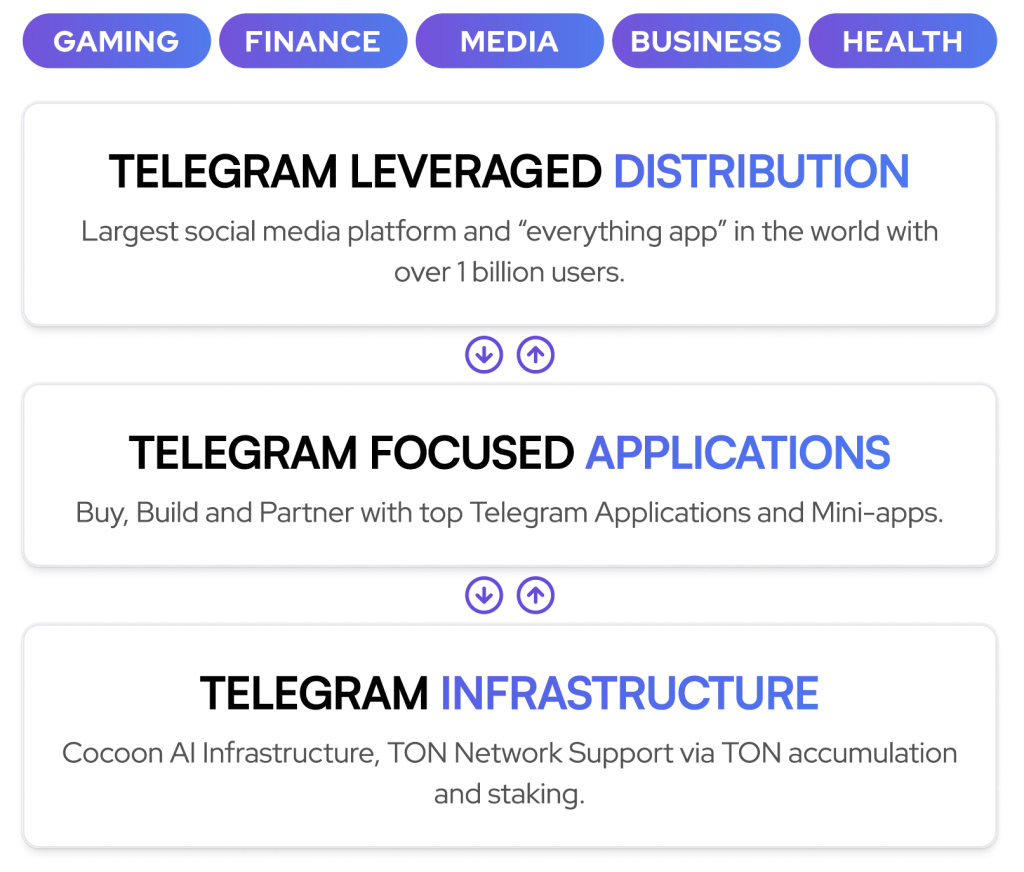

AlphaTON Capital Corp. (Nasdaq: ATON) (“AlphaTON” or the “Company”), the world’s leading public technology company scaling the Telegram super-app with an addressable market of one billion monthly active users, today provided a comprehensive update on strategic initiatives. The Company has raised net $44 million in capital, expanded its AI infrastructure deployment, and is establishing additional revenue-generating partnerships that position AlphaTON as a foundational infrastructure provider for privacy-preserving artificial intelligence.

Balance Sheet Update & Capital Markets Activity

AlphaTON has executed a disciplined capital strategy to fund infrastructure expansion while maintaining financial flexibility:

- Recent Capital Raise: Closed $15 million registered direct offering at $1.00 per share. Majority of net proceeds are allocated to GPU AI infrastructure scaling for Cocoon AI and working capital for the Company.

- Infrastructure Investment: Initiated a $46 million investment in AI infrastructure expansion on January 5, 2026, for a total of 576 NVIDIA B300 chips. This deployment, scheduled for delivery in March 2026, is projected to deliver a 27% IRR, 282% ROI, and a Net Present Value of $11 million.

- SEC Compliance Milestone: Exited SEC “baby-shelf” restrictions on December 3, 2025, filing a $420.69 million shelf registration statement, declared effective December 11, 2025. This provides enhanced financing flexibility for strategic acquisitions and infrastructure deployment.

AI Infrastructure Deployment & Revenue Generation

AlphaTON has rapidly deployed GPU infrastructure to capture the emerging opportunity in privacy-preserving AI compute:

- Cocoon AI Network Launch: Successfully deployed initial B200 GPU fleet on November 30, 2025, coinciding with Telegram’s official Cocoon AI network launch. The Company began generating revenue in December from AI inference processing.

- Advanced GPU Deployments: Deployed H200 GPUs on December 8, 2025, and secured first NVIDIA B300 chips with Supermicro HGX systems via Atlantic AI partnership on December 15, 2025. Launched #OwnYourNode program enabling retail and institutional access to fractionalized GPU ownership. Signed purchase order for first half cluster of 576 x B300s for delivery in March 2026.

- Data Center Infrastructure: Executed five-year enterprise colocation agreement with atNorth AB on December 11, 2025, securing 2.2 MW of high-performance computing capacity in Sweden powered by 100% renewable power.

Strategic Partnerships & Technology Integration

AlphaTON has established partnerships that are expected to create additional revenue streams and vertically integrate into the Company’s Confidential Compute AI Infrastructure:

- Midnight Foundation Partnership: Signed definitive agreement effective December 2025 establishing AlphaTON as a Founding Federated Node Architecture Provider for privacy-preserving AI. Agreement generates immediate monthly revenue and includes reimbursement for documented network growth costs.

- Claude Connector Launch: Launched AlphaTON Claude Connector on January 21, 2026, an open-source platform combining Anthropic’s Claude AI with TON blockchain technology via Telegram. The solution enables mainstream users to manage digital assets through natural-language conversations.

- Alpha Liquid Terminal: Developing Agentic trading and monitoring application that will utilize agents to seek best execution across multiple asset classes including tokenized securities, cryptocurrencies, equities, private shares and real world assets.

Management Commentary

About AlphaTON Capital Corp. (Nasdaq: ATON)

AlphaTON Capital Corp (NASDAQ: ATON) is the world’s leading public technology company scaling the Telegram super app, with an addressable market of 1 billion monthly active users, while managing a strategic reserve of digital assets. The Company implements a comprehensive M&A and treasury strategy that combines direct digital asset acquisition, validator operations, and strategic ecosystem investments to generate sustainable returns for shareholders.

Through its operations, AlphaTON Capital provides public market investors with institutional-grade exposure to the TON ecosystem and Telegram’s billion-user platform while maintaining the governance standards and reporting transparency of a Nasdaq-listed company. Led by Chief Executive Officer Brittany Kaiser, Executive Chairman and Chief Investment Officer Enzo Villani, and Chief Business Development Officer Yury Mitin, the Company’s activities span network validation and staking operations, development of Telegram-based applications, and strategic investments in TON-based decentralized finance protocols, gaming platforms, and business applications.

AlphaTON Capital Corp is incorporated in the British Virgin Islands and trades on Nasdaq under the ticker symbol “ATON”. AlphaTON Capital, through its legacy business, is also advancing first-in-class therapies targeting known checkpoint resistance pathways to achieve durable treatment responses and improve patients’ quality of life. AlphaTON Capital actively engages in the drug development process and provides strategic counsel to guide the development of novel immunotherapy assets and asset combinations. To learn more, please visit https://alphatoncapital.com/.

Forward-Looking Statements

All statements in this press release, other than statements of historical facts, including without limitation, statements regarding the Company’s business strategy, plans and objectives of management for future operations and those statements preceded by, followed by or that otherwise include the words “believe,” “expects,” “anticipates,” “intends,” “estimates,” “will,” “may,” “plans,” “potential,” “continues,” or similar expressions or variations on such expressions are forward-looking statements.

Forward-looking statements include statements concerning, among other things, the Company’s projections for its AI infrastructure expansion deployment; the Company’s expectations that its partnerships will create additional revenue streams and vertically integrate into the Company’s Confidential Compute AI Infrastructure; the Company’s belief that the assets it is building will drive significant long-term value; and other statements that are not historical fact.

As a result, forward-looking statements are subject to certain risks and uncertainties, including, but not limited to: the timing, progress and results of the Company’s strategic initiatives, the Company’s reliance on third parties, the risk that the Company may not secure additional financing or TON, the uncertainty of the Company’s investment in TON, the uncertainty around the Company’s legacy business, the operational strategy of the Company.

The Company’s executive management team, risks from Telegram’s platform and ecosystem, the potential impact of markets and other general economic conditions, and other factors set forth in “Item 3 – Key Information-Risk Factors” in the Company’s Annual Report on Form 20-F for the year ended March 31, 2025 and included in the Company’s Form 6-Ks filed with the Securities and Exchange Commission on September 3, 2025 and January 13, 2026.

Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them as actual results may differ materially from these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof, and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, except as required by law.

Investor Relations:

John Ragozzino, CFA

(203) 682-8200

Media Inquiries:

Richard Laermer

RLM PR

(212) 741-5106 X 216

Investor Relations and Media Inquiries

The post AlphaTON Capital Advances Strategic Roadmap with Revenue Generation from Confidential Compute AI Infrastructure appeared first on CaptainAltcoin.

You May Also Like

Mystake Review 2023 – Unveil the Gaming Experience

Strategic Move Sparks Market Analysis