Crazy weekend: Crypto’s Solana moment in 10 charts

Author: Ignas , Crypto KOL

Compiled by: Felix, PANews

This past weekend was probably the craziest weekend in crypto. Here are 10 charts to help you understand:

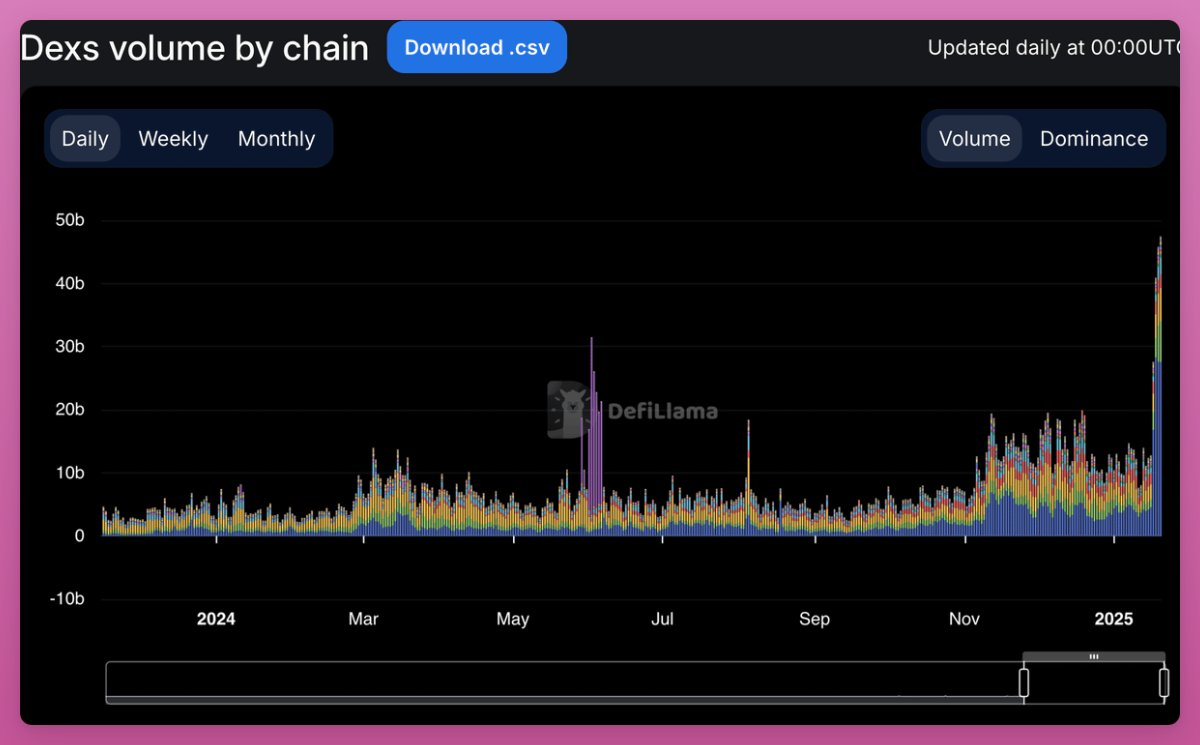

Record DEX trading volumes:

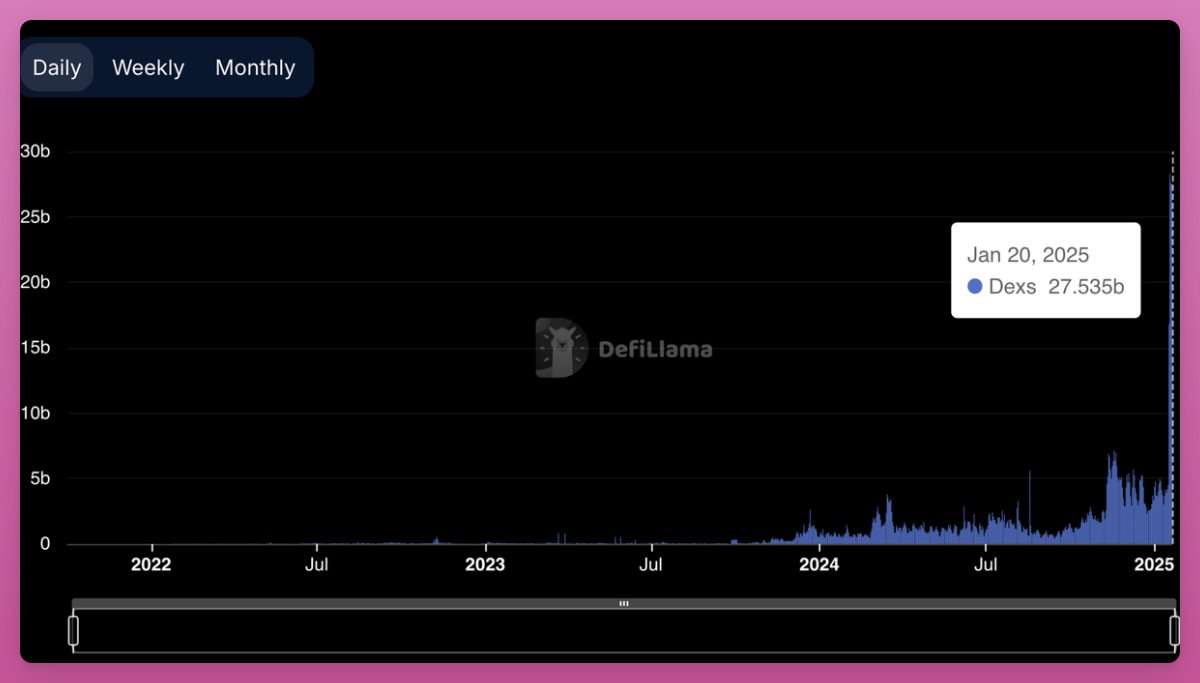

The Solana network DEX transaction volume reached 27 billion US dollars, far exceeding ETH's 5 billion US dollars.

DEX trading volume on Solana jumped from an average of approximately $5 billion to $27 billion, a 5.4x increase.

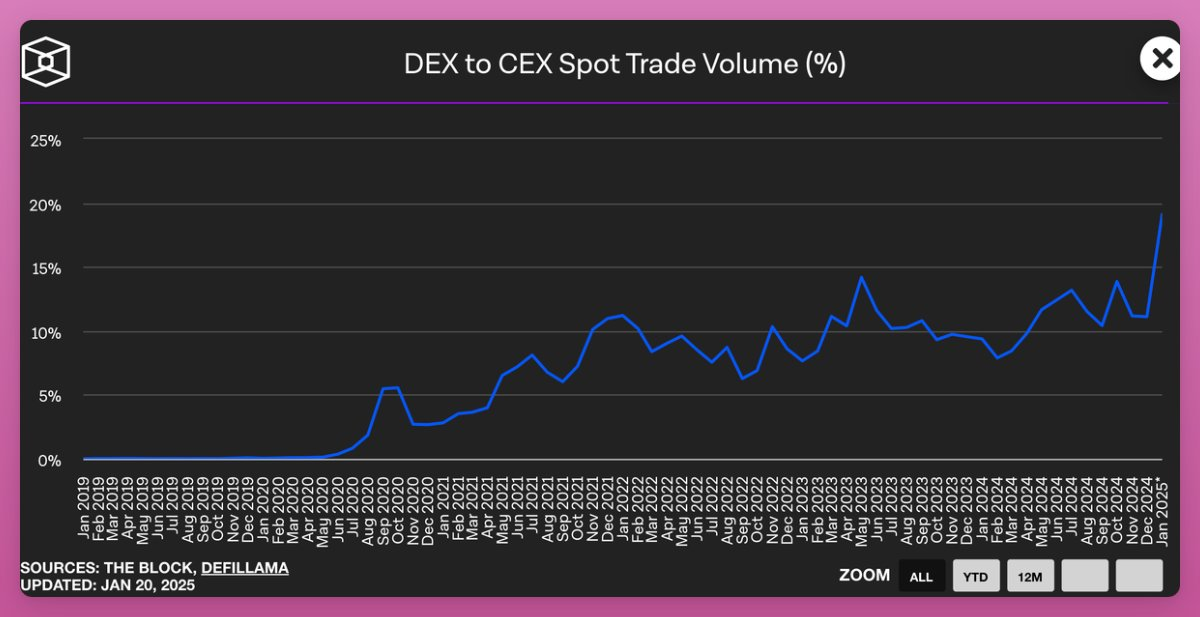

As a result, DEX’s share of CEX spot trading volume reached an all-time high of 19%.

Price discovery happens on DEXs, not CEXs.

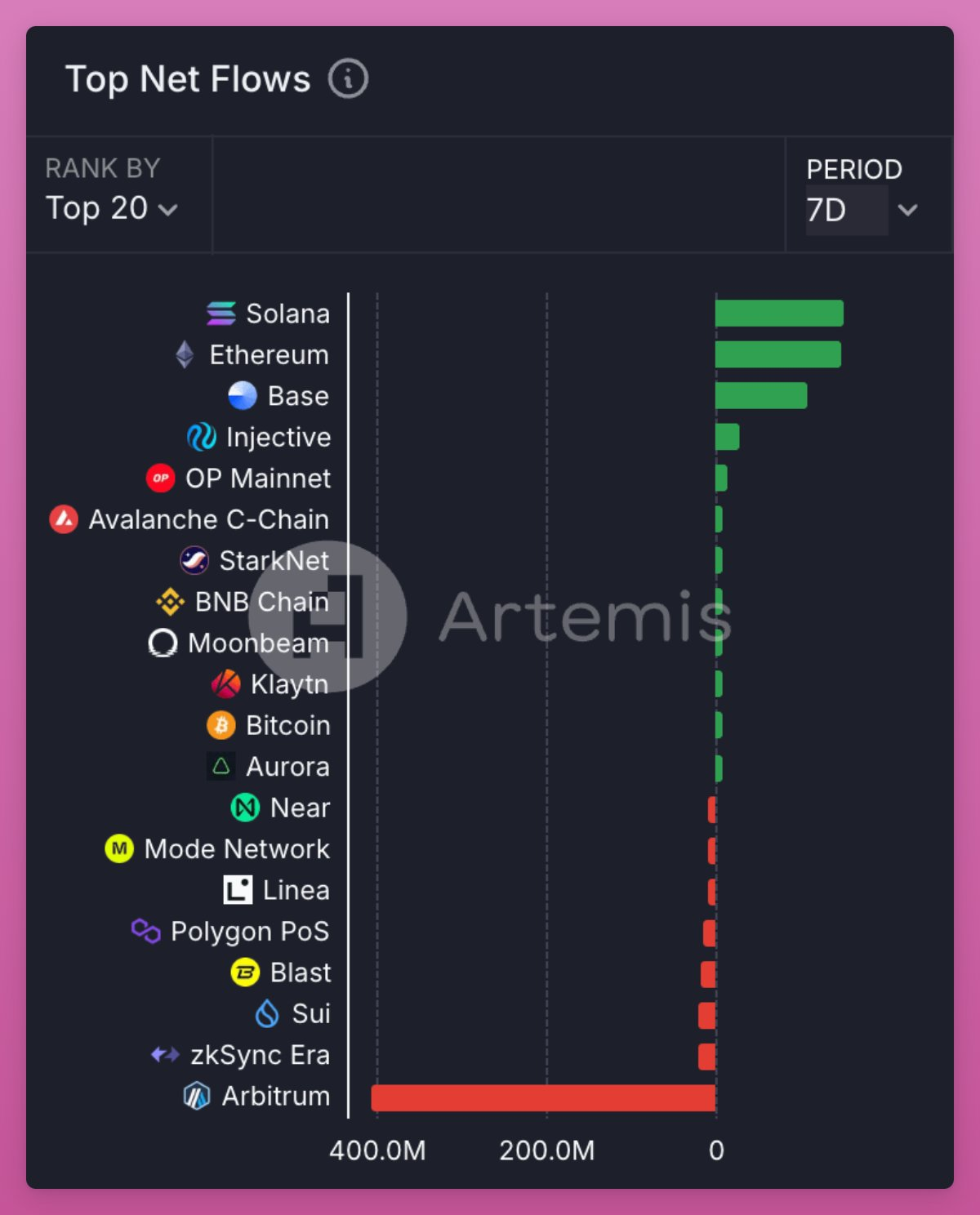

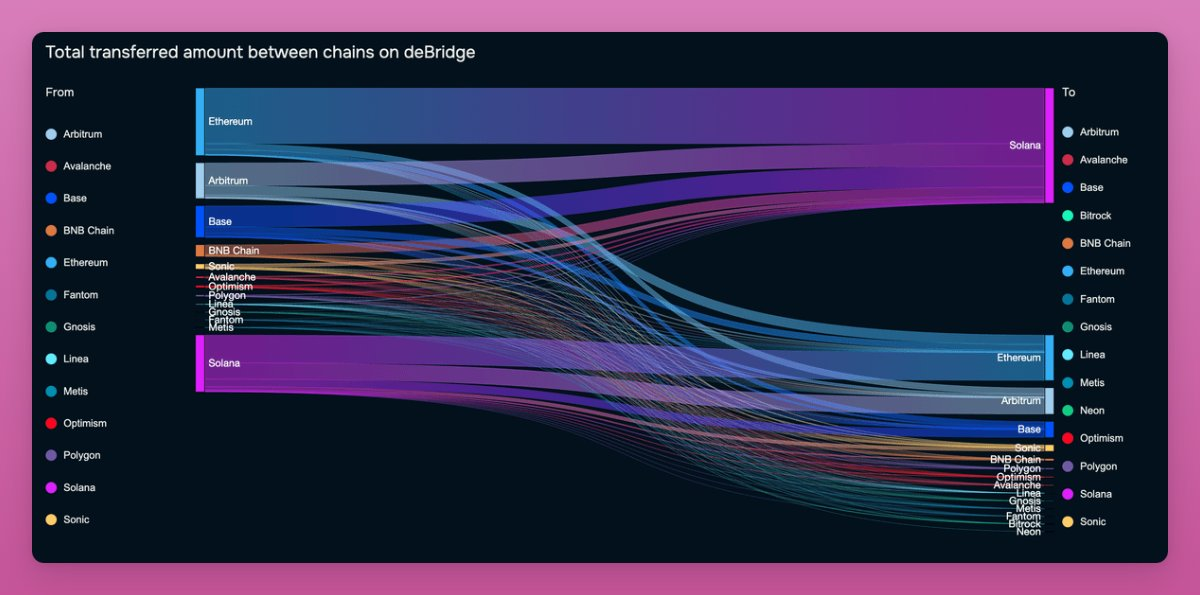

Funds flowed from Arbitrum to Solana, ETH, and Base.

The Solana network saw a net inflow of $153 million, while Arbitrum lost $405 million in the week.

The following figure is another way to visualize Solana traffic.

DeBridge analysis shows that about $300 million is flowing into Solana each week, mainly from Ethereum, Base, and Arbitrum.

Solana’s outflows reached approximately $140 million.

Phantom reports more than 8 million requests per minute.

Phantom users traded $1.25 billion in volume, with 10 million transactions.

Assuming Phantom’s current rate is 0.85%, the swap fee is $10.6 million.

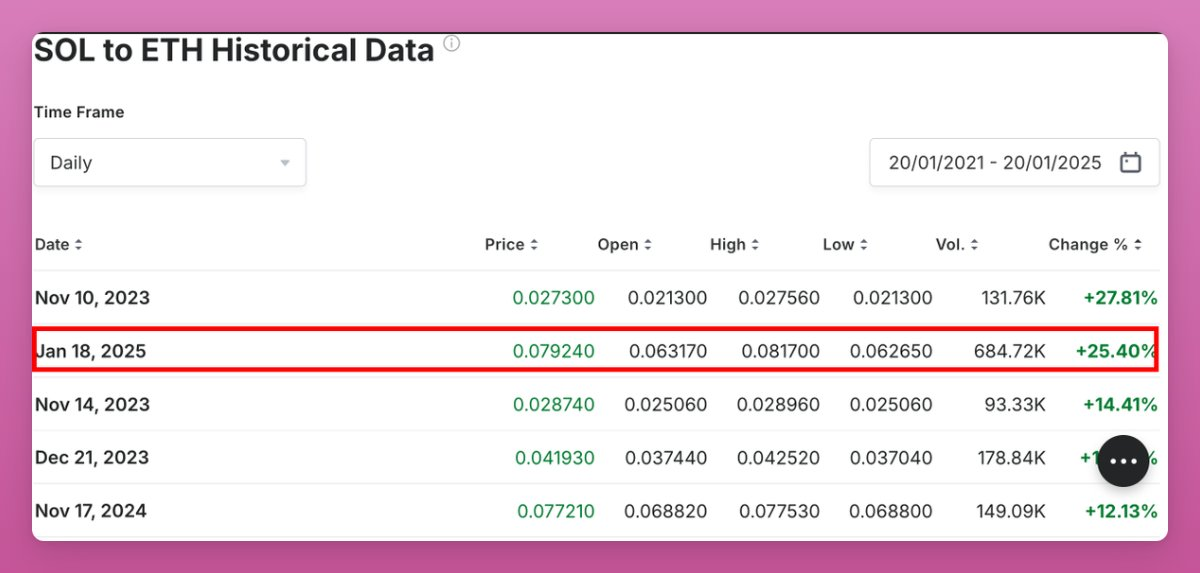

On the day the TRUMP coin was launched, SOL recorded its largest single-day increase against ETH since 2021. The 25% increase further hit the morale of the Ethereum community and increased pressure on internal reforms of the Ethereum Foundation.

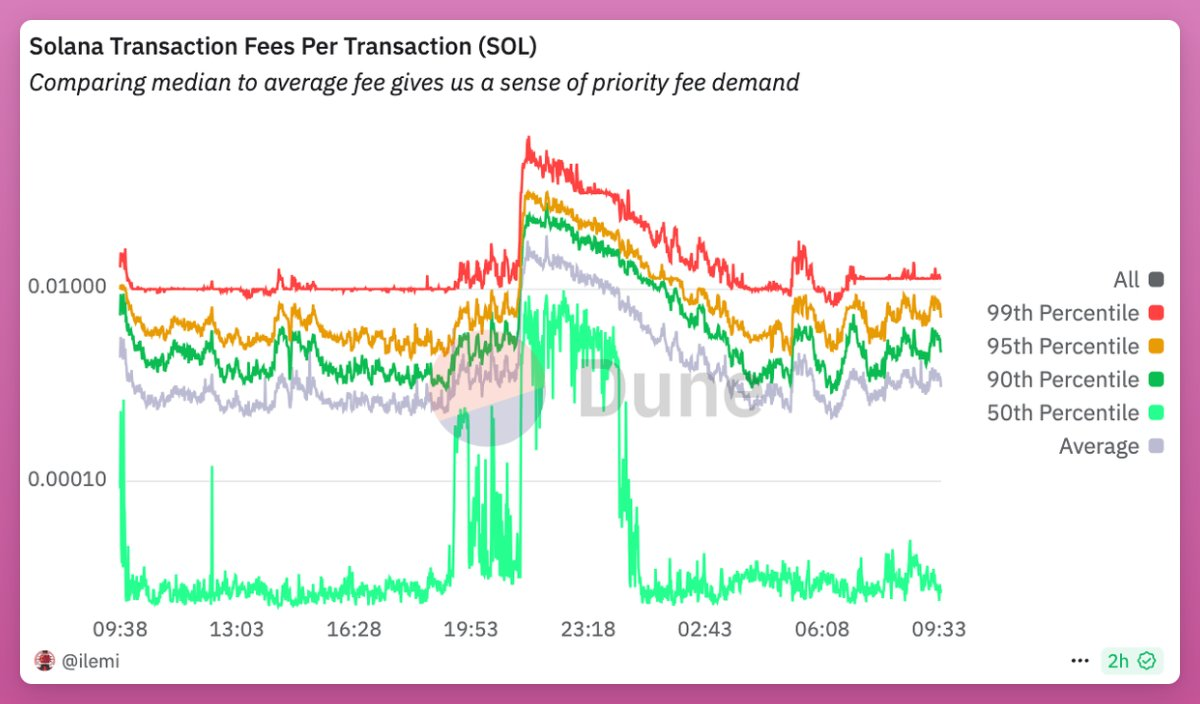

However, not all is good for Solana:

- Average cost increased 20 times

- Many people simply cannot complete the transaction

High fees are very beneficial for SOL stakers.

A total of $57 million in fees were paid, but the majority were $33 million in priority fees and $23.5 million in Jito Tips ( Jito verification tips).

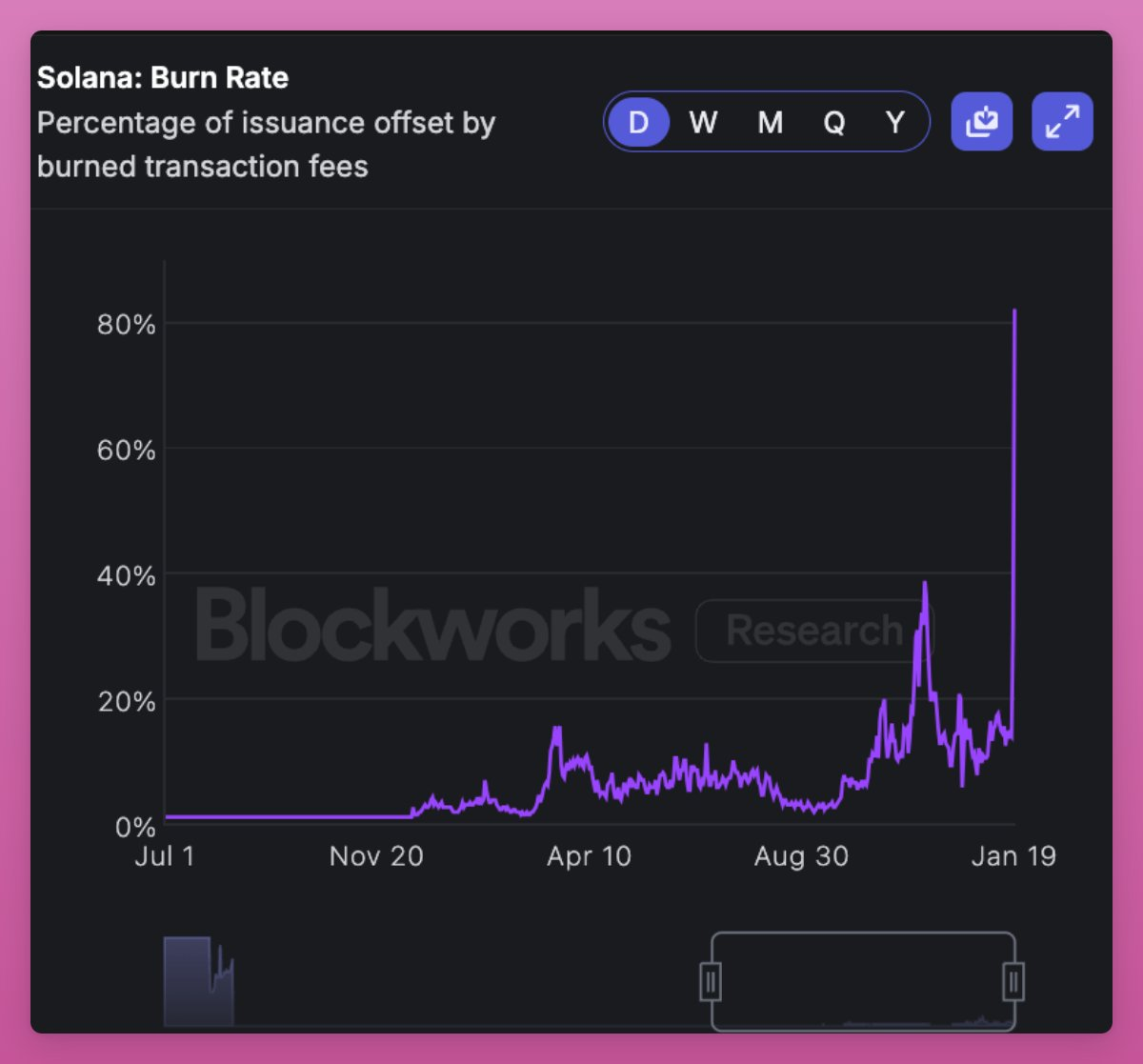

Importantly, SOL destroyed a record amount of approximately $16.7 million.

Don’t use “ultra-sound money” as an excuse, because weekend destruction accounts for 81% of SOL issuance, which is much higher than daily.

The following figure shows the Solana destruction rate:

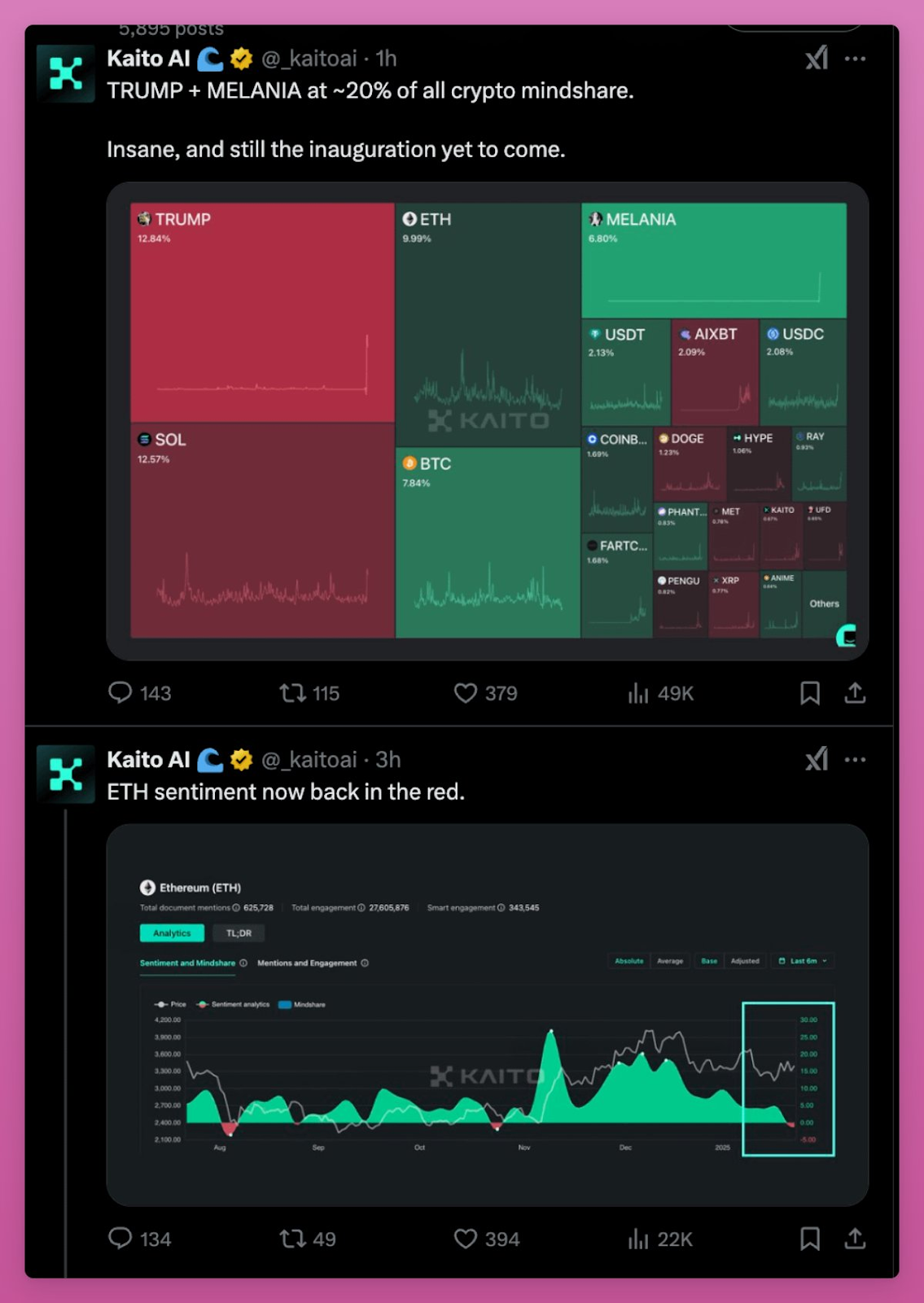

Overall, it was a wild weekend for Solana, with TRUMP, MELANIA, and SOL dominating the market. Meanwhile, sentiment on ETH turned negative again.

Related reading: Trump family is making a comeback! The market value of "First Lady Coin" MELANIA has exceeded 10 billion in a short period of time, and the details of multiple tokens have caused market controversy

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates