Slow Rug? Trump-Associated World Liberty Fi Accused Of Value Extraction

A governance vote at World Liberty Financial (WLFI), a DeFi project marketed around the Trump brand, is drawing allegations of “slow” value extraction after a prominent trader claimed affiliated wallets pushed through a proposal while many public holders remained unable to access or vote with their tokens.

DeFi^2 (@DeFiSquared), who describes himself as the #1 ranked trader on Bybit in 2023 and 2024, wrote on X that he was “bringing up an alarming governance vote by World Liberty Fi this month that appears to be the start of a slow extraction of value from WLFI holders by the team.”

World Liberty Fi Hit With ‘Rigged Vote’ Claims

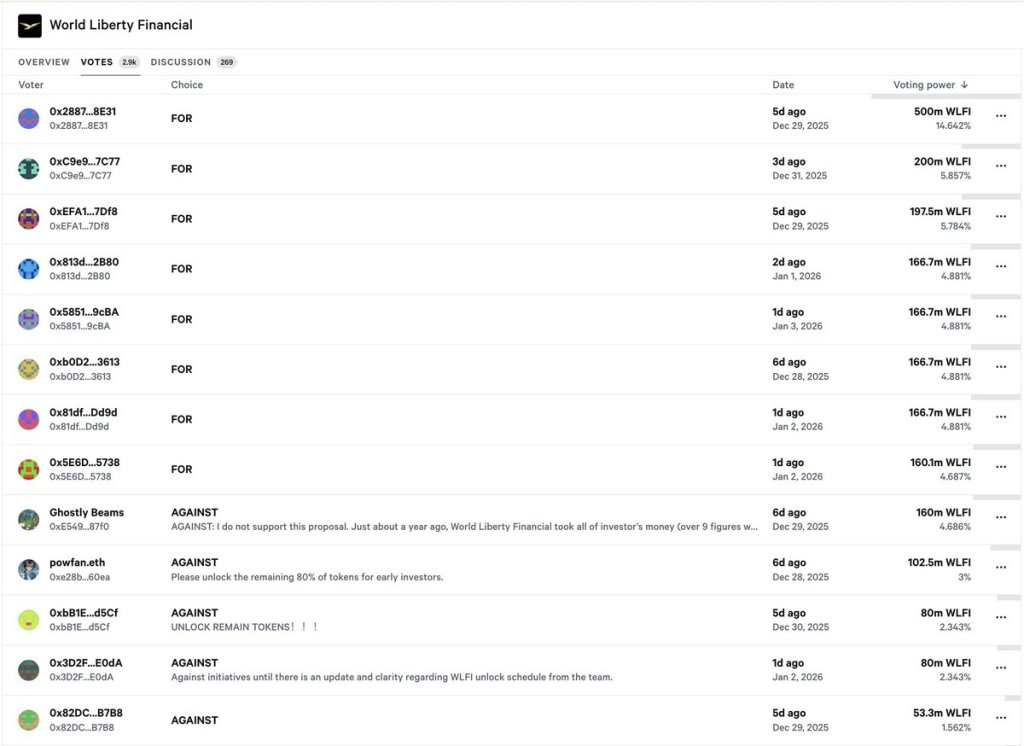

DeFiSquared wrote: “What you see above appears to be a rigged vote, where the majority of top voters are indicated to be team wallets or strategic partner wallets by Bubble Maps. This is in contrast to the real voters lower in the screenshot, who have all been locked from accessing their WLFI tokens since TGE, and unable to vote on an unlock until the team allows it.”

The proposal at the center of the thread is what he calls the “USD1 growth proposal.” He argues it reads as “fairly mundane” on its face, but says the governance sequencing is the tell: “why would the team go out of their way to force this vote through, instead of voting on the WLFI token unlock that the majority of holders are asking for?”

His thesis hinges on WLFI economics. DeFiSquared claims WLFI holders “are not entitled to ANY protocol revenue at all,” and says the project’s “Gold Paper” specifies revenue routing: “75% of protocol revenue goes to the Trump family, and 25% goes to the Witkoff family.” In his framing, that creates a perverse incentive: “It’s actually as crazy as it sounds: the team is forcing a vote to sell WLFI tokens at the expense of locked holders, in order to fund protocol revenue that goes only to themselves.”

He also alleges the vote’s outcome was manufactured late in the process. “This vote was actually failing by the time it reached quorum with a majority of votes rejecting the proposal, until the team / partners forced the vote through,” he wrote, adding token allocation context: “the WLFI team is allocated 33.5% of all tokens and strategic partners another 5.85%, while the public sale was allocated only 20%.”

Post-vote, he points to on-chain flows as corroboration, citing “fresh transfers such as this one of 500 million WLFI tokens to Jump Trading,” while “investor WLFI allocations remain forcibly locked.”

DeFiSquared closes with a valuation and positioning call: “it’s difficult to see the intrinsic value behind a 17 billion dollar token that has no real governance power, no revenue share, and new foundation sell pressure occurring for their own benefit.” He adds he has shorted WLFI “on and off since pre-market prices above $0.34,” and expects continued downside “due to dilution, intentional extraction,” and “other factors related to Trump’s final term in office.”

At press time, WLFI traded at $0.1608.

You May Also Like

The Channel Factories We’ve Been Waiting For

Will XRP Price Increase In September 2025?