Bullish Bounce or Bearish Slip: Which Way Will BNB’s Market Mood Swing?

- BNB is trading at around $921.

- Daily trading volume stands at $2.51B.

Yesterday’s downtrend has eased but not fully reversed, leaving some crypto tokens still in the red under ongoing bearish pressure. Only a handful are trading in the green, trying to escape the bear’s grip. The largest assets, like Bitcoin and Ethereum, hover on the downside, while the native coin of the Binance ecosystem, BNB, has posted a 0.28% drop.

The asset’s lowest and highest trading ranges are noted at $920.76 and $931.80, respectively. At the time of writing, BNB is trading at the $921.25 level, and the market cap is settled at $125.73 billion. Moreover, the daily trading volume has likely reached the $2.51 billion mark, as reported by the CMC data.

Besides, the price chart of the BNB/USDT trading pair demonstrates weakness. If the price falls, the key support zone might be at $918.62. With an extended bearish correction, the death cross could emerge, driving the asset even lower. Assuming the asset’s ongoing momentum turns green, the BNB price might rise to the immediate resistance at around $924.53. Further gains on the upside would trigger the golden cross formation, which could take the price higher.

BNB Momentum Weakens as Bearish Signals Emerge

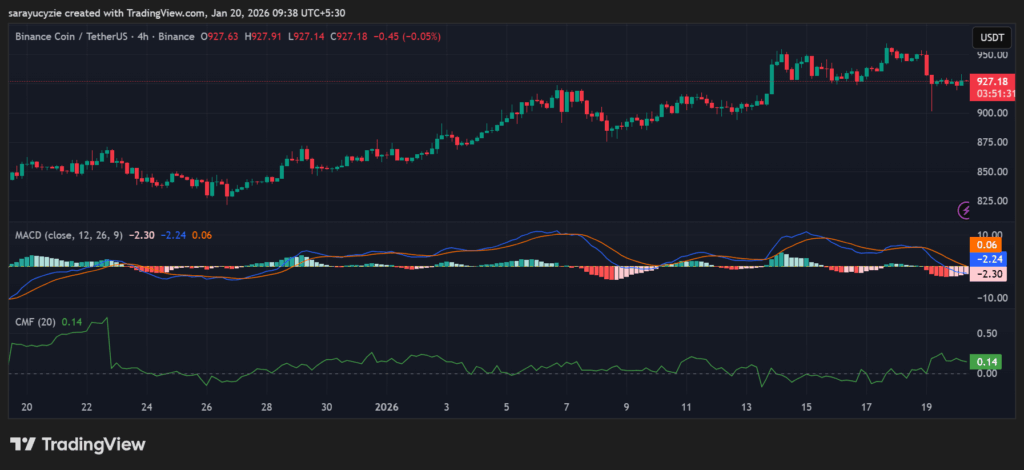

BNB’s Moving Average Convergence Divergence (MACD) line is below the zero line, indicating weak momentum. But the signal line stays above the zero line, displaying the improvement of the short-term momentum. With this setup, bearish pressure remains with an early sign of consolidation rather than a strong downside.

BNB chart (Source: TradingView)

BNB chart (Source: TradingView)

In addition, the Chaikin Money Flow (CMF) indicator is stationed at 0.14, which suggests strong buying pressure in the market. It shows that the capital is flowing into the asset, and accumulation is developing rather than distribution. This positive value supports the underlying demand, even if the price action looks weak.

The daily Relative Strength Index (RSI) at 44.58 signals the token’s neutral to slightly bearish sentiment. It is found beneath the 50 midline, not yet in the oversold territory. Also, this weak momentum has room for a bounce. Notably, BNB’s Bull Bear Power (BBP) reading of -8.26 implies strong bearish dominance. The sellers are in control, and the bulls are struggling to push the price higher. As heavy selling pressure is present, the risk of further downside rises unless momentum shifts.

Top Updated Crypto News

Crypto ETPs See $2.2B Weekly Inflows as Bitcoin, Ether Lead

You May Also Like

CME Group to launch options on XRP and SOL futures

XRP Yield Strategies vs. Traditional Staking: Which Offers the Highest Returns for Long-Term Holders?