Humanity Protocol Surges 10%, Is the Rally Sustainable Ahead of Token Unlock?

- Humanity Protocol has surged over 10% in 24 hours, and trading volume is up by 63%

- Humanity Protocol’s token unlock worth $21 million is scheduled for January 25, as per Tokenomist data.

As the overall crypto market remains negative, Humanity Protocol (H) has emerged as a significant exception, achieving the second-highest top gainer among the top 100 cryptocurrencies in the last 24 hours. According to CoinMarketCap, H is currently trading at $0.2011, marking a 10.29% price increase despite a general decline in major cryptocurrencies.

This increasing momentum is bolstered by a substantial increase in trade volume, where the 24-hour trading volume grew by 63.76% to almost $48 million, showing greater market involvement. Meanwhile, the project’s market cap has increased to $463.03 million. But still, the H is trading lower around 48% from its all-time high of $0.3887 in October 2025.

Source: CoinMarketCap

Source: CoinMarketCap

On the 24-hour chart, despite a small fall earlier today near $0.176-$0.178 range was rapidly picked up, showing strong demand at lower levels and reassuring this area as a significant intraday support. While discussing the upside momentum, immediate resistance is located between $0.205; a clean breakout over this level might open the door for a short-term climb to $0.215 or higher.

Indicators Highlight Positive Momentum

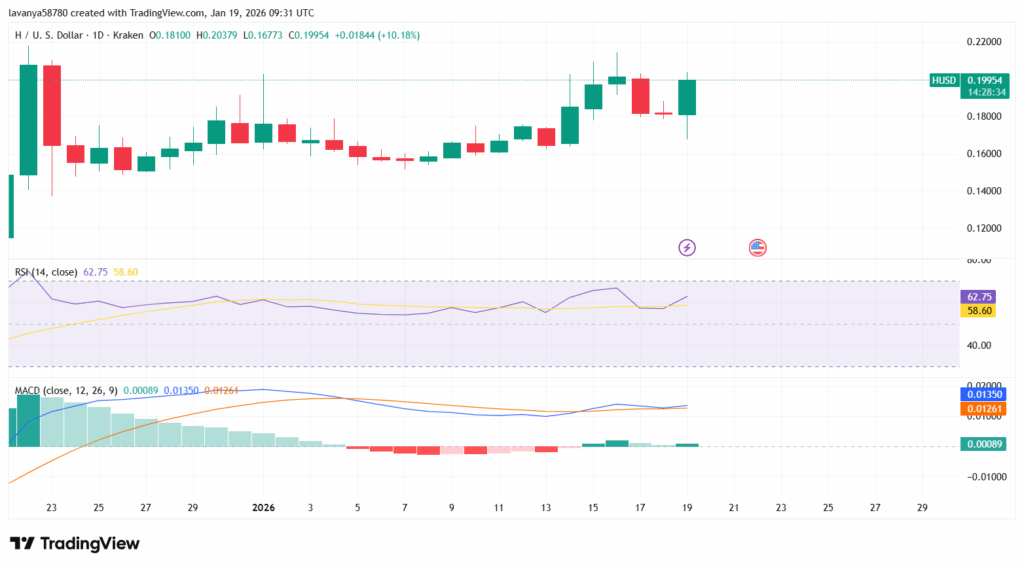

Source: TradingView

Source: TradingView

The MACD (Moving Average Convergence and Divergence) has moved slightly above its signal line, indicating that buyers are recovering control after a brief break, while the Relative Strength Index (RSI) is at 62, above the neutral level, indicating that upward momentum is still possible.

Token Unlock Poses Risk

Humanity Protocol is set to release H tokens worth around $21 million in less than a week, potentially causing more selling pressure if early investors choose to take gains, according to Tokenomist data.

While H has been trading near its short-term highs, it is still roughly 48% behind its all-time high. As a result, the abrupt rise in circulating supply can lead to a short-term price correction, even if the overall trend remains positive.

Highlighted Crypto News Today:

India Pushes BRICS CBDC Link to Boost Cross-Border Payments

You May Also Like

The Channel Factories We’ve Been Waiting For

Will XRP Price Increase In September 2025?