Falling into a debt crisis of nearly $200 million, the former star cross-chain project THORChain launched a restructuring plan to save itself

Author: Nancy, PANews

As a cross-chain star representative project in the last bull market, THORChain is now facing a severe survival crisis. The high debt of nearly 200 million US dollars has caused concern in the community. For this reason, THORChain plans to implement a restructuring plan to resolve the debt crisis.

Faced with an insolvency crisis, the agreement hides multiple problems

On January 24, TCB, a core member of THORChain, revealed that THORChain was facing serious insolvency, pointing out that the protocol had problems such as high leverage risks, excessive liquidity incentives, and overly complex protocols.

"If a large-scale debt redemption or depositor and synthetic asset deleveraging occurs, THORChain will be unable to fulfill its debts denominated in Bitcoin and Ethereum." TCB pointed out that the current total debt of THORChain includes approximately $97 million in lending liabilities (denominated in BTC and ETH) and approximately $102 million in depositor and synthetic asset liabilities. However, THORChain's assets only include $107 million worth of external liquidity injected into the liquidity pool.

“THORChain’s lending obligations are satisfied by minting RUNE and selling it into liquidity pools, which by design makes the protocol highly reflexive risky and the situation is worse than it appears.” TCB further disclosed that if any large debt redemptions and/or depositor and synthetic deleveraging occur, THORChain will be unable to meet its obligations denominated in BTC and ETH/

TCB revealed that he has been warning about the dangers of hidden leverage since he joined the community. Since the launch of Impermanent Loss Protection (ILP), he has been advocating deleveraging, and the protocol only needs less capital to fill because now active liquidity can participate in filling them. He believes that THORChain is too complicated and must return to basic principles to grow. Before that, no smart capital can buy RUNE or LP because the risk is too great. Overall, in many previous DeFi cases, a large public debt will become a bait for liquidation. If no action is taken and all redemptions are carried out in a chaotic manner, the "death switch" may be triggered. It will be a race to escape, and the value of the entire THORChain protocol will be wiped out.

In fact, THORChain also stated in its latest roadmap not long ago that it will focus on THORChain App Layer in the first quarter of this year to eliminate risks in the basic protocol layer. Specific goals include: integrating with Base and Solana networks; reducing THORFi - reducing risks in the basic layer and focusing on the application layer; adding a CosmWasm execution environment called App Layer; using IBC to bring more assets to the application layer; launching active income activities to improve the liquidity supply experience; and upgrading the transferOutAndCall of the Ethereum router.

Affected by this, THORChain tokens RUNE and TVL have fallen to varying degrees. CoinGecko and DeFiLlama data show that in the past 24 hours, THORChain tokens RUNE fell by 33.3%, while TVL fell by more than 8.9% to US$250 million.

The agreement captures revenue of more than $30 million and initiates a 90-day restructuring plan

“THORChain has gone bankrupt and suspended on-chain operations, similar to a bankruptcy freeze, to avoid capital outflows. Is this the first on-chain reorganization?” said Haseeb Qureshi, managing partner at Dragonfly.

Despite the risk of THORChain going bankrupt, TCB believes that the protocol is valuable. With a revenue capacity of approximately $200,000 per day, an annual transaction volume of more than $50 billion, and revenue of more than $30 million, THORChain has a good business model and only needs to remove the toxic debt on its balance sheet.

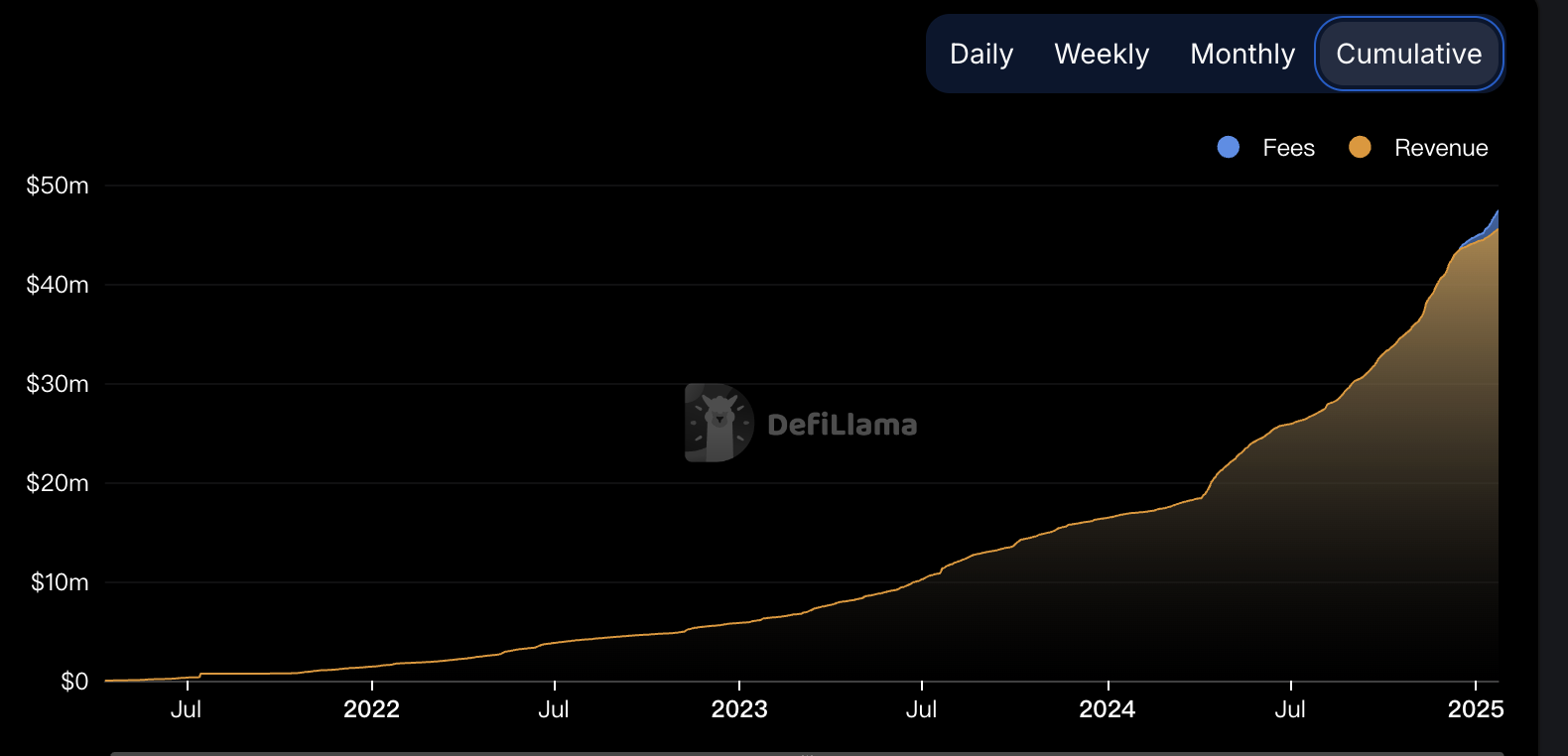

DeFiLlama data shows that as of January 23, THORChain's cumulative fees reached $47.45 million and its revenue was $45.54 million. Among them, in the past year alone, THORChain captured approximately $30.5 million in fees and $28.59 million in revenue.

TCB pointed out that THORFi, a non-liquidation loan, needs to be regarded as a mistake, and THORChain only needs to clear the toxic debt on the balance sheet and return to the original spirit: return to basic principles. At the same time, TCB proposed two solutions: one is to let the situation develop, about 5-7% of the value will be extracted by a few people first, RUNE will enter a downward spiral, and THORChain will be destroyed; the second is debt default, bankruptcy, rescue the valuable part, and develop it as much as possible to repay the debt without affecting the feasibility of the protocol.

TCB suggested that if THORChain wants to survive the crisis, it can increase the possibility of saving the protocol by permanently freezing all lending and depositor positions, tokenizing all lending and depositor claims, and deleveraging. He also proposed the establishment of an economic design committee to help THORChain succeed, including improving capital efficiency, never building leverage features into it, and ensuring that Rujira does not endanger the L1 ecosystem.

Currently, THORChain has suspended THORFi's lending business as part of a 90-day restructuring plan to reduce problems associated with the "savings and lending" project and prevent large-scale withdrawals. John-Paul Thorbjornsen, founder of Thorchain, said, "The protocol itself is still working well and earning a lot of money. Once restructured, it will be able to repay the debt."

You May Also Like

Trump foe devises plan to starve him of what he 'craves' most

3 Crypto Trading Tips That Work