Bitcoin Open Interest Falls 31% From 2025 Peak as Derivatives Deleverage

This article was first published on The Bit Journal.

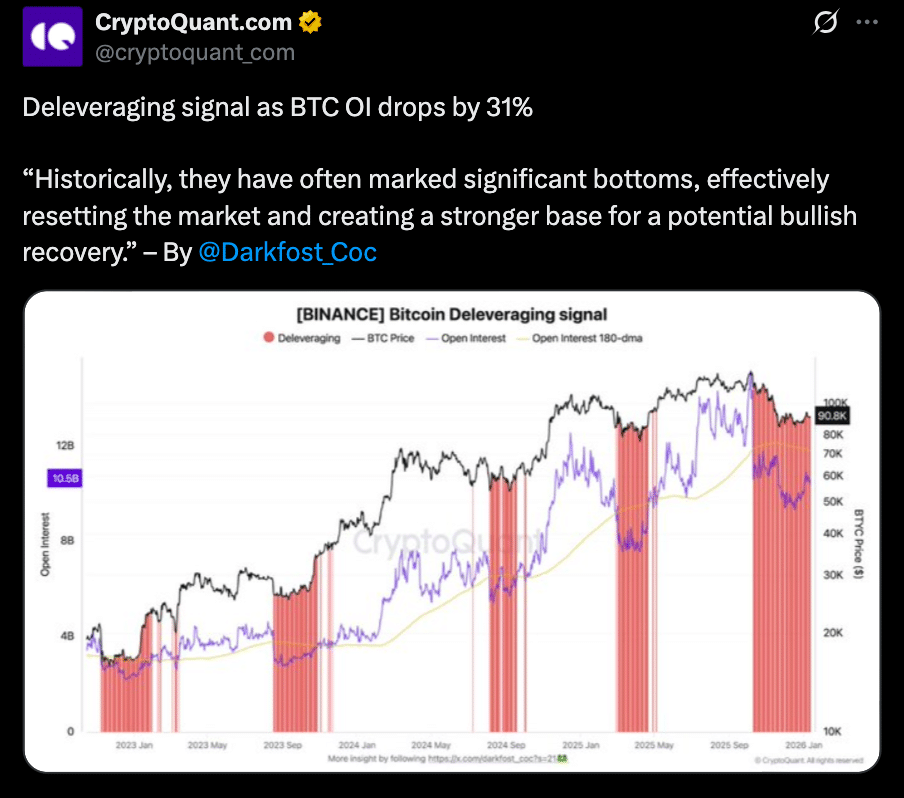

The Bitcoin derivatives market is starting to see a reduction in open interest, with a roughly 30-31% drop from the 2025 peaks. Blockchain analytics platform CryptoQuant calls this drop a sign of deleveraging, typically associated with market bottoms and sustainable pricing.

Bitcoin open interest is the total number of outstanding derivatives contracts, such as futures or options, that have not been settled yet.

When open interest soars, it means more capital is at stake and leverage is expanding. On the other hand, if it plunges, then existing positions are being closed, with speculative influence receding.

Derivatives Open Interest Defined and Recent Trends

According to CryptoQuant, Bitcoin derivatives open interest has dropped approximately 31% from its peak in Oct. 2025 when it exceeded the $15 billion mark to around $10-$11billion on major exchanges. This decline is due to deleveraging after heavy speculation in 2025.

In 2025, the Bitcoin open interest greatly increased. The number hit an all-time high past $15 billion on October 6, nearly tripling the peak reached in November 2021 when Binance’s OI was at $5.7 billion at Bitcoin’s former bull-market highs. That surge was fueled by record speculation and futures trading volumes that year.

Deleveraging Phase and Market Reset

The fall of Bitcoin open interest is a period of deleveraging in which leveraged positions (long & short) are getting unwound. Analysts say this is a reset of excessive leverage in the system, something that is associated more with market bottoms than deeper structural declines.

CryptoQuant contributor “Darkfost” noted that “historically, they have often marked significant bottoms, effectively resetting the market and creating a stronger base for a potential bullish recovery.”

Bitcoin Open Interest Drops 31% as Deleveraging Signals Market Reset

Bitcoin Open Interest Drops 31% as Deleveraging Signals Market Reset

This deleveraging takes place when traders exit positions with losses, or as risk appetite wanes, and exchanges cut back the open contracts. As leverage decreases in the derivatives, the chances of cascading liquidations where forced exits trigger falling prices do too.

Analysts argue that this washout can leave the market in a stronger position with healthier fundamentals, especially since spot volumes have stayed relatively steady.

Short Squeezes and Spot Market Behavior

The declining open interest accompanied by rising spot prices suggests that the market may be experiencing short covering rather than the arrival of fresh bullish inflows.

When price rises with open interest contracting, it generally means short positions are being liquidated or closed, removing selling pressure. Even as open interest contracts, the prevailing spot price of Bitcoin is up nearly 10% from early January 2026.

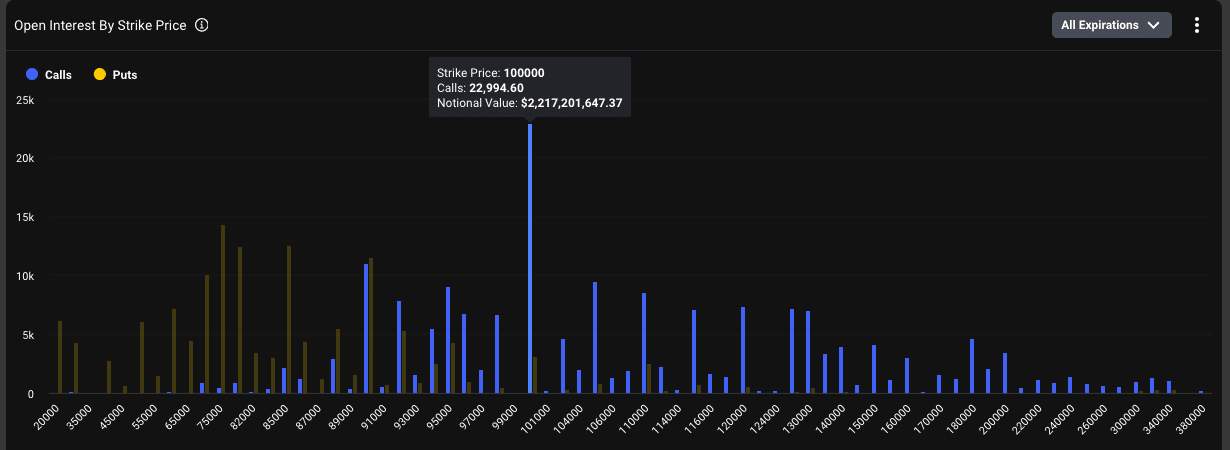

Options market data support this reading. The largest open interest on Deribit sits at the $100,000 strike for Bitcoin options meaning more traders have long call contracts as opposed to puts, a sign that points to bullish bets in derivatives markets but without outsized leverage expansion to match.

Bitcoin Open Interest Drops 31% as Deleveraging Signals Market Reset

Bitcoin Open Interest Drops 31% as Deleveraging Signals Market Reset

But while a short squeeze may be possible, derivatives analysts say that the market “has not yet entered a structurally bullish phase.” This is to say that, despite deleveraging potentially paving the way for a rally, structural bullish forces are not yet in operation.

Market Position in Early 2026

As deleveraging continues into 2026, there is also a change in market and on-chain dynamics indicating this participation shift. Total Bitcoin open interest on all exchanges and derivatives markets is now at around $65 billion, a decrease of about 28% from the high point of over $90 billion in early October 2025.

This decline includes both future and option contracts. The decline in leverage also comes as the spot market remains active. High spot volumes of high up to $60 billion in some trading windows suggest active trading but without the speculative extremes in derivatives positioning seen in late 2025.

Some analysts frame it as the maturation stage in which liquidity and participation are reset.

Importantly, a decrease in open interest below important long-term averages, say the 180-day MA, is frequently interpreted by institutional analysts as more of a structural reset than an outright bearish signal. This adjustment is consistent with previous cycles of market contraction before recoveries.

Why This Matters Now

The open interest decline in Bitcoin is important for several market participants. Less leverage means less systemic risk in derivatives markets and implies that much of the speculative froth from 2025 has been mopped up.

A cleaner market structure can help get back to a more sustainable price action driven by simple spot market dynamics rather than amplified derivatives flows.

Furthermore, this is in line with past bullish conditions. Analysts have also highlighted that extended periods of deleveraging is frequently associated with a major market bottom as they establish the groundwork for better constructive momentum once leverage returns to normalized ranges.

But for a sustained directional move to materialize, it is important that other market conditions, including overall liquidity and macro drivers, are in sync.

As of mid-January 2026, the price behavior for Bitcoin is mixed: strong spot activity with derivative markets cautious, indicating that markets are recalibrating rather than entering an immediate bull phase.

Conclusion

Deleveraging in derivatives markets seems obvious with the sizable 30-31% decline of Bitcoin open from 2025 peaks.

This has typically coincided with market lows and structural resets, and recent spot price gains in the face of declining open interest only reinforce this dynamic.

The decrease in the Bitcoin open interest does not outrightly mean a new uptrend as such, but it does depict a market ready to rise without excess speculative fuel. This, together with ongoing spot trading activity, could also provide a more solid base for price development as the year unfolds.

Glossary

Open Interest: The total volume or value of all active contracts that have not been closed.

Deleveraging: Leverage reduction, often by forced sales or exits, reduces the overall risk in the system.

Futures Contract: A contract calling for the future sale of an asset at a predetermined time and price.

Short Covering: A buying back of short positions, normally occurring during price rises, that reduces selling pressure.

Notional Value: The total value represented by a derivatives portfolio, often used to quantify open interest across markets.

Frequently Asked Questions About Bitcoin Open Interest

What does declining open interest for Bitcoin indicate?

A decline signals traders are unwinding positions and trimming leverage, usually presaging deleveraging and a reset of speculative energy.

Is the decline of open interest bullish?

In past times, sharp declines in open interest have defined market bottoms and tipped recoveries off, but by no means confirm a trend reversal.

Why is deleveraging significant?

Deleveraging decreases the risk of cascading liquidations and system stress in the event of excessive leveraged positioning.

Does an increasing spot price along with a declining open interest is scream strength?

When open interest declines while spot prices rise, more often than not it indicates short covering rather than new leveraged longs.

Is Bitcoin in a bull market?

The market has not structurally turned bullish despite signs of a deleveraging, according to derivatives providers.

References

Coinglass

Cryptoquant

Deribit

Read More: Bitcoin Open Interest Falls 31% From 2025 Peak as Derivatives Deleverage">Bitcoin Open Interest Falls 31% From 2025 Peak as Derivatives Deleverage

You May Also Like

South Korea Launches Innovative Stablecoin Initiative

Vitalik Buterin Questions the Continued Relevance of Ethereum’s Layer 2 Solutions