Berachain airdrop "rich-poor disparity": NFT holders received up to $55.77 million, while testnet users received only $60

Author: Frank, PANews

Berachain, the first major project launched in the Year of the Snake, officially launched its airdrop distribution on February 6. From the market trend, its token BERA showed a low opening and high closing script after its launch, with the price soaring from US$7.5 to a maximum of US$15.5, and the initial circulation market value also reached a maximum of US$1.58 billion.

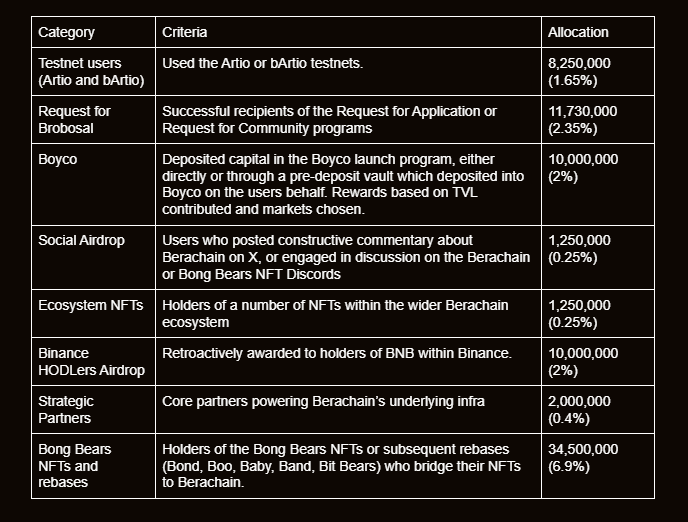

However, this airdrop distribution of Berachain has caused a lot of controversy on social media. Many testnet users said that the official distribution to testnet users was only 1.65%, while the proportions allocated to Binance users and NFT holders were 2% and 6.9% respectively, which caused dissatisfaction in the community.

Since Berachain has not launched a data dashboard for this airdrop, and the official browser does not support viewing specific airdrop smart contract statistics, PANews can only calculate and speculate on Berachain's airdrop situation based on some known data.

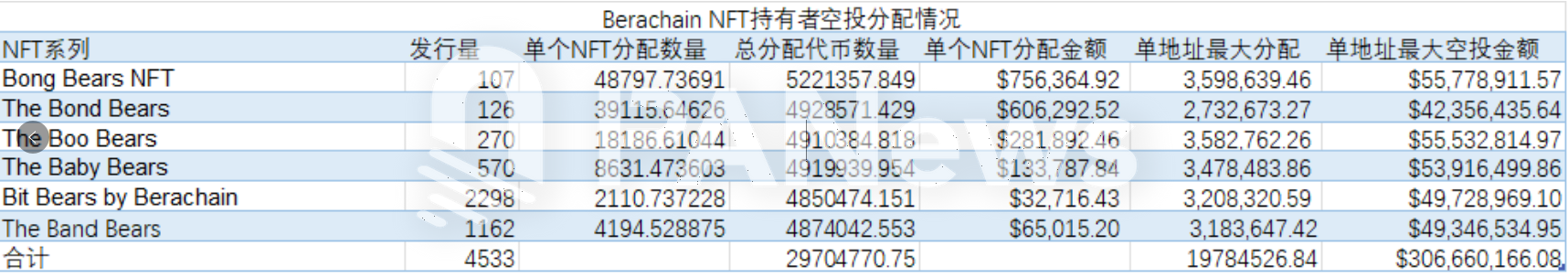

Six NFT holders received $306 million worth of NFTs, with the highest single address receiving $55.77 million.

According to the official airdrop instructions, holders of Bong Bears NFT or subsequent ones (Bond, Boo, Baby, Band, Bit Bears) can receive a total of 34.5 million tokens.

Let’s review how many NFTs there are. According to the official statement, there are 6 series of NFTs involved in this airdrop, namely Bong Bears NFT 107, The Bond Bears 126, The Boo Bears 270, The Baby Bears 570, Bit Bears by Berachain 2298, and The Band Bears 1162.

The total number is about 4,533 NFTs, and each NFT can get 6,553 tokens on average. Based on the highest price of $15.5, these NFT holders can get up to $101,000. Of course, this distribution should not be evenly distributed, but according to the scarcity of each NFT.

According to PANews, the NFT series with the largest single allocation is Bong Bears NFT, with each NFT receiving 48,797 tokens, with a maximum value of approximately $756,000. The Bond Bears is second, with 39,115 tokens, or approximately $606,000.

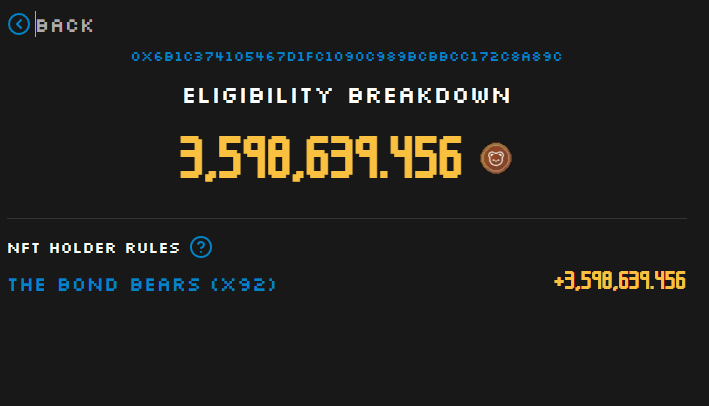

Since NFTs are often held by some big players, the address 0x6b1C...A89c holds 89 The Bond Bears, accounting for 70% of the total issued. After checking, the address received 3.598 million tokens, with a maximum value of approximately $55.77 million. The highest transaction price of this series of NFTs reached 140 ETH (worth $378,000) on the evening of February 6. Based on this calculation, the total value of 92 NFTs is approximately $34.77 million, which is still lower than the airdrop income. At present, the price of this series of NFTs has fallen to around 10 ETH.

According to PANews's query, the majority of the distribution of these NFT holders is concentrated in a few large holders. The six largest holders can allocate a total of 19.78 million tokens, with a maximum value of approximately US$306 million. The average number of tokens allocated to each address of these six large holders is 3.29 million. The number of tokens obtained by these six large holders alone far exceeds the total airdrop quota of 8.25 million tokens for millions of addresses on the test network.

The minimum allowance for testnet users may be $60

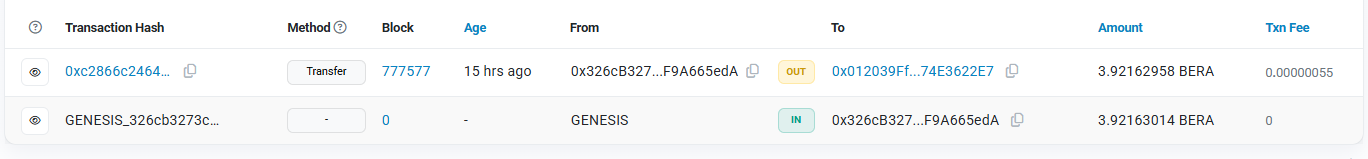

In contrast to the NFT holders' sudden wealth, the total allocation for testnet users is 8.25 million tokens. According to previous media reports, as of January 2, the cumulative number of wallets participating in Berachain's PoL mechanism has exceeded 2.38 million. The average number of tokens each wallet can receive is about 3.46 tokens, with a maximum value of approximately US$53.7.

Overall, the total number of airdrops is about 79 million tokens. As of February 7, there are about 730,000 addresses holding coins on the official website, and the average number of airdrops per address is about 108 (the actual data may be lower because some users did not receive them and there is a delay in unlocking the tokens). From the chain point of view, the minimum airdrop number should be 3.92, and the maximum value is about 60 US dollars.

However, compared with the recent airdrops, the total size of Berachain's airdrop is about 592 million US dollars (calculated at the opening price of 7.5 US dollars), which is similar to HYPE. In terms of the highest single address airdrop, the largest single address of Berachain received an airdrop amount of 55.77 million US dollars, which is the highest in recent projects. However, judging from the minimum guarantee of 3.92 tokens, this level may be the lowest among the recent large airdrop projects. From this perspective, the gap between the rich and the poor in Berachain's airdrops seems a bit large.

The gap between the rich and the poor is huge, can VC unlock it in a disguised way?

The airdrop ratio also caused dissatisfaction among many users who made a lot of contributions on the Berachain testnet in the early stage. In particular, the total airdrop for testnet users was only 1.65%, while the total number of Binance users was as high as 2%, and NFT holders reached 6.9%.

In this regard, the official explanation believes that "without Bong Bears and its subsequent derivatives, Berachain will never exist. NFT appeared before the chain, and NFT holders have always been one of the oldest and most supportive members of the Berachain community. Countless holders have developed to launch their own dApps or community programs within the ecosystem."

The explanation about Binance user allocation is: Berachain has great respect for the BSC chain.

The explanation about Binance user allocation is: Berachain has great respect for the BSC chain.

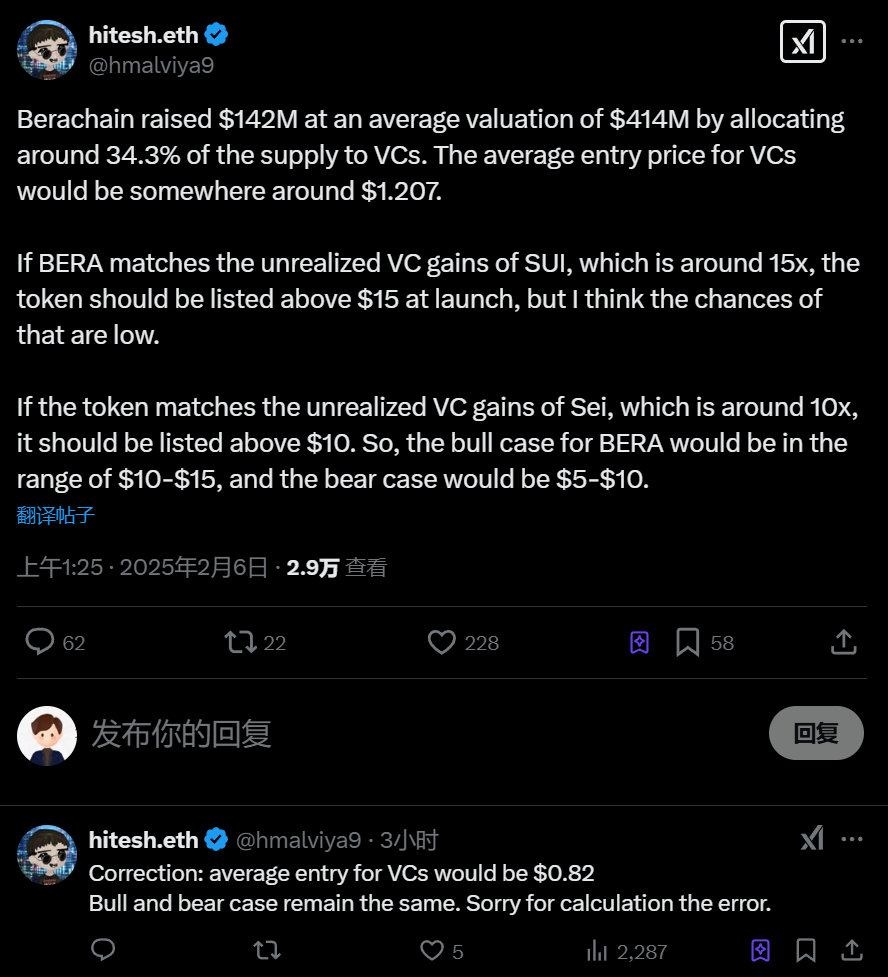

In addition, Berachain's VC earnings are also one of the focuses of market attention. DYθR founder hitesh.eth posted on X that Berachain allocated about 34.3% of the supply to VC, and the average VC entry price was about $0.82. If BERA matches SUI's unrealized VC earnings (about 15 times), the token price should be higher than $15 at launch, but hitesh-eth believes this possibility is low. If the token matches Sei's unrealized VC earnings (about 10 times), its listing price should be higher than $10. Therefore, BERA's bull market price will be between $10-15, and the bear market price will be between $5-10.

Judging from the subsequent price trend, the price of BERA did briefly exceed $15. However, the VCs still have one year to unlock the tokens, and it is difficult to predict what the price will be at that time. However, some KOLs said on social media that Berachain's unlocked tokens can be pledged to obtain rewards, which is undoubtedly another way to unlock the tokens. This behavior has also aroused doubts from the community.

After briefly breaking through $15.5, BERA began to fall rapidly, falling to $6.7, a correction of more than half. Rui of HashKey Capital believes that the reason for this phenomenon is: "On the one hand, the overall market liquidity is very poor, and on the other hand, the volume of short selling due to pessimism has reached its peak this time."

According to the data on the chain, the number of transactions on the first day of the Berachain mainnet launch exceeded 1.14 million, and the number of independent addresses exceeded 140,000. With the continuous application of airdrops, these data should continue to rise in a short period of time. However, in the face of the current widespread controversy in the community over the allocation of airdrops and the fierce short-selling sentiment in the market, can Berachain's on-chain activity still be maintained at a high level after the airdrop ends? Can the price trend continue the script of Hyperliquid? Everything is unknown.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates