A bumper year for RWA: the gains and prospects of a leading project in the track

Author: Weilin, PANews

2024 is an important year for the real world asset (RWA) tokenization space in the real estate industry, especially as this space is increasingly integrated with Web3 technology. As one of the leading projects in this space, Propy has achieved many achievements. Since the launch of PropyKeys on Base in March, Propy has successfully minted more than 285,000 property addresses, driving the digital transformation of real world assets. PropyKeys integrates Chainlink automation on BuiltOnBase to provide secure staking rewards, and there will be more developments in the future.

In addition, Propy and Coinbase jointly launched a custody service, providing a safer and more efficient solution for real estate transactions.

Looking ahead to 2025, Propy is accelerating its global strategic plan. Propy has launched a new on-chain real estate loan product that allows buyers to obtain instant on-chain loans by using BTC as collateral, unlocking scalability. This move removes consumer barriers to real estate ownership and enables buyers to purchase real estate using USDC, ETH, or BTC, while also providing the option of 100% instant cryptocurrency-backed loans. This product makes real estate transactions more convenient and smooth, staying true to Propy's founding mission.

Building on this success, Propy is currently actively seeking lending partners to further expand its cryptocurrency-backed lending model. By partnering with innovative lenders, Propy aims to create more opportunities for buyers and make real estate ownership more accessible, all made possible by blockchain technology.

2024 report card: PropyKeys launched, multiple partnerships reached, and the leadership team added heavyweights

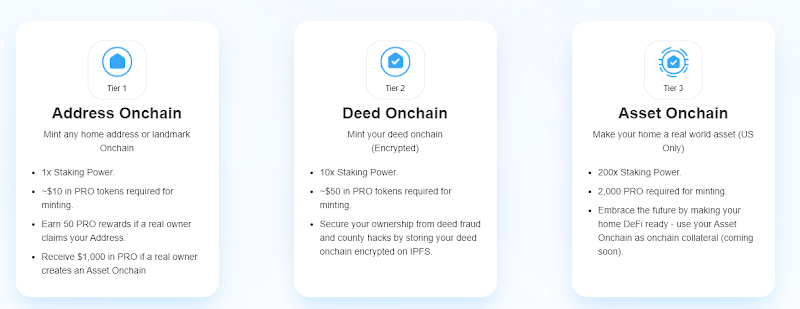

In 2024, Propy achieved breakthroughs in multiple areas. In March, Propy's innovative product PropyKeys was officially launched on Base, allowing users to mint digital addresses and deeds for real-world properties, with more than 285,000 mintings to date. Subsequently, PropyKeys AI-generated landmark NFT minting and a novel staking mechanism created a gamified experience that makes home ownership more accessible, secure, and interactive.

Subsequently, Propy successfully deployed Chainlink Automation technology to distribute staking rewards. After PropyKeys integrated Automation, Automation allows developers to automate key on-chain functions at timed intervals or in response to external events. Based on Chainlink Automation, Propy achieves highly reliable, high-performance and decentralized automation, and transactions can be quickly identified and confirmed even in periods of severe network congestion.

In addition, Propy also announced a strategic partnership with the decentralized real estate derivatives protocol Parcl to improve the quality of on-chain real estate analysis and valuation. Propy uses Parcl’s API to improve the valuation and analysis capabilities associated with PropyKeys.

In terms of user experience, Propy has partnered with Coinbase to launch a cryptocurrency escrow service. If homebuyers hold Bitcoin, they can safely put it into escrow through Propy's certified title escrow service, conduct real estate transactions, and only redeem it when the transaction is completed. This avoids unnecessary fees and taxes.

Propy also continues to strengthen its team building, and the board of directors has welcomed two heavyweights: former SEC commissioner and financial regulatory expert Dr. Michael Piwowar and Coindesk Chief Content Officer, blockchain pioneer and media veteran Michael Casey.

Over the past year, Propy has been widely recognized by the industry. Propy was cited in the Messari blockchain report and participated in many high-profile events, sparking Vitalik Buterin's discussion on blockchain property rights at the EthCC conference. Through technological innovation and leadership, Propy's CEO Natalia Karayaneva won the 2024 Inman Best Real Estate Technology Award "Entrepreneur" award.

Propy also hosted the Propy Summit 2024. This was more than just a summit, it was a microcosm of building the future together. The event brought together leading innovators and visionaries in blockchain and real estate, including Senator Cynthia Lummis, Mayor Francis Suarez, Tim Draper, Anthony Scaramucci, and many other industry leaders.

2025 Vision: Launch RWA on-chain assets, launch DeFi loans, and expand to the global market

In this new year, Propy will expand its blockchain real estate solutions, having already launched a DeFi lending program in the first quarter.

Propy will accelerate its presence in the U.S. market, planning to become a national blockchain title and escrow company by the end of the year. By acquiring additional licenses and advancing its blockchain-based settlement services, Propy is on track to become the first fully blockchain-licensed title and escrow provider in the U.S. According to a report by research firm IBISWorld, the U.S. title insurance market is worth $22.6 billion in 2023. Meanwhile, data from software company Debut Infotech predicts that blockchain adoption in real estate is expected to grow at a compound annual growth rate (CAGR) of 64.8% until 2028. Propy is ready to lead the industry in this new era, bringing greater efficiency, transparency, and innovation.

From the perspective of the Propy token, PRO will be an asset that benefits from both the U.S. real estate and crypto markets. With the upcoming new policies of the U.S. government, including the proposal to abolish capital gains tax on U.S. crypto transactions, the United States may become the next major crypto hub. Currently, crypto investors face a 20% long-term capital gains tax or up to 37% short-term capital gains tax, depending on holding period and income level. According to Investing in the Web, 13.22% of Americans (about 44.96 million people) currently own cryptocurrencies, and real estate is increasingly seen as a way to diversify crypto portfolios. The abolition of capital gains tax will greatly increase the number of crypto-real estate transactions.

As the first blockchain-based real estate token in the United States, PRO tokens will drive the adoption of cryptocurrency in RWA transactions and incentivize investors to invest in cryptocurrency, supporting the broader ecosystem of tokenized real estate.

At the same time, Propy will also begin a global expansion plan into non-U.S. markets, with announcements expected in the first quarter of 2025. This expansion is well-timed, especially in regions such as Asia and Latin America where real estate fraud is rampant. In India, for example, 66% of civil cases stem from real estate disputes, while in Indonesia, approximately 40% of real estate documents are affected by fraud. Similarly, Argentina faces a long-standing problem of property corruption and irregular documentation, with historically unreliable registration systems and bureaucratic transparency issues that have weakened property rights and hindered economic progress.

Through blockchain technology, Propy addresses the need for trust, efficiency, and integrity in real estate governance. For governments facing outdated systems and public distrust, Propy's technology provides a path to modernization and accountability, streamlining processes while protecting citizens' rights. As countries seek to attract foreign investment, increase transparency, and align with global best practices, they are increasingly willing to work with innovators like Propy.

On January 29, Propy launched a new loan option that supports the purchase of Hawaiian condos with collateralized crypto assets. The starting price of the condo is 250,000 USDC. As an on-chain RWA asset, buyers can skip the traditional 30-day transaction process and achieve almost instant transactions by paying cryptocurrencies. If buyers are reluctant to sell mainstream crypto assets, they can also choose to use Bitcoin or Ethereum as collateral to complete the payment, and pay a 10% loan interest rate.

This is a two-year loan. If the value of the provided cryptocurrency drops by more than 50%, the buyer will be subject to a margin call; in the worst case, the crypto assets may be liquidated and the real estate auctioned off for resale. However, if the cryptocurrency price doubles, the buyer can easily pay off the loan with its proceeds. The interest payments and the loan itself can be repaid in Bitcoin, Ethereum, or USDC. This provides an attractive option for buyers who wish to keep their crypto assets.

On February 2, Propy announced the successful sale of Hawaii’s first on-chain real estate asset — a transaction completed through multiple on-chain bids and ultimately the first Bitcoin-backed loan.

In addition to this, Propy has expanded its service offering and is partnering with real estate developers to provide comprehensive title and escrow solutions specifically tailored for their residential projects.

In terms of community building, Propy will also launch the "Web3 Property Rights - Trailblazer Spotlight" series to showcase industry innovation leaders every week. A series of weekly shows will be launched to highlight pioneers who believe that the world can be changed by putting property rights on the blockchain. From blockchain innovators and investors to technical thinkers, this series will showcase individuals who are driving change.

Looking back to 2024, Propy has not only achieved many breakthroughs in the tokenization of the real estate sector, but is also helping the industry redefine the ownership and value of assets. In 2025, with the launch of RWA on-chain assets and the launch of DeFi loan programs, Propy may continue to drive innovation and change in the global real estate market in 2025.

You May Also Like

What Would Happen If Amazon Were To Incorporate XRP Into Its Services?

UK Looks to US to Adopt More Crypto-Friendly Approach