Abra CEO Bill Barhydt Says Crypto Is Replacing the 60/40 Portfolio

Bond performance is in the gutter while bitcoin is reaching all-time highs. Savvy financial advisors are now telling their peers to throw out bonds and replace them with crypto.

Abra’s Barhydt Predicts Crypto Will Replace Classic 60/40 Asset Allocation

The decades-long rule of thumb for diversifying assets in a client portfolio by allocating 60% of the capital to equities and 40% to bonds, the so-called “60/40” model, may end up going the way of the dodo bird, thanks to crypto; at least that’s what Bill Barhydt, CEO of crypto wealth management platform Abra told Bitcoin.com News in an interview.

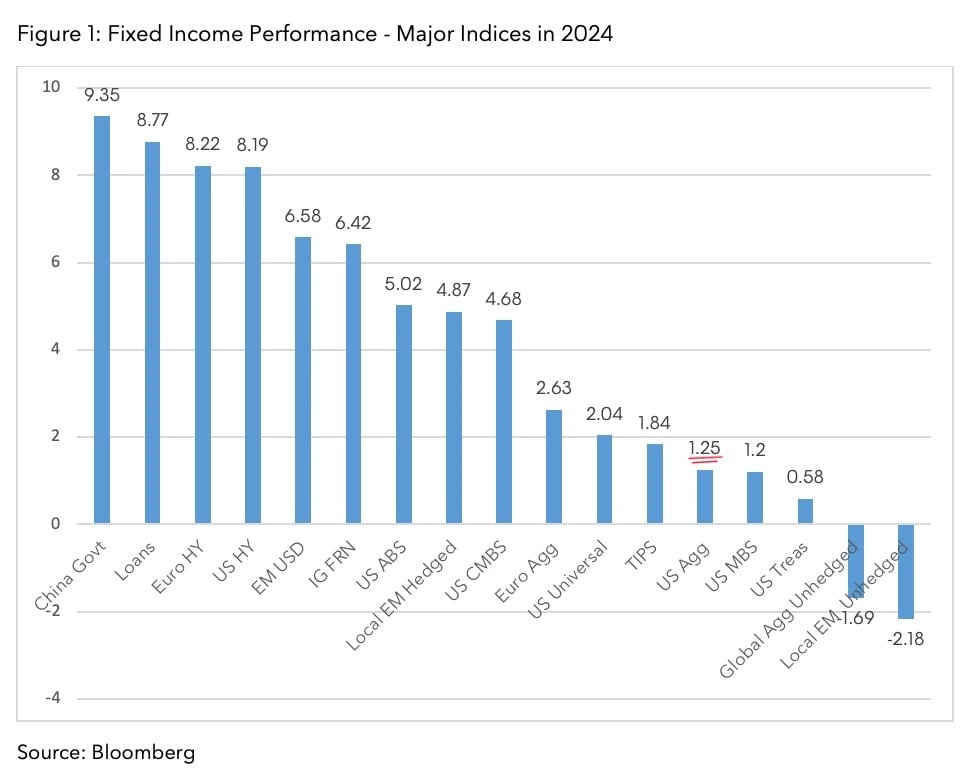

“Right now, the traditional model at a wealth advisor is the 60-40 model,” Barhydt explained. “And we know how well the ‘40’ has done,” he added, alluding to the dismal bond market performance over the past few years. Bloomberg’s U.S. Aggregate Bond Index returned a paltry 1.25% in 2024 and an even worse negative 0.05% over the past five years.

(Bloomberg’s US Aggregate Bond Index returned 1.25% in 2024 / Bloomberg)

(Bloomberg’s US Aggregate Bond Index returned 1.25% in 2024 / Bloomberg)

Barhydt, who has an eclectic background having worked for the CIA, NASA, Goldman Sachs, and 1990s web browser firm Netscape, initially launched Abra as a bitcoin-based remittance app. The company went through multiple pivots before landing on crypto wealth management.

“That’s what happens when you’re early,” said Barhydt. “The market tells you where to go if you’re listening.”

Barhydt made an appearance at the 7th Annual Vision Conference in Arlington, Texas on Tuesday to not only give a presentation but also to listen to what the investment advisor community had to say about crypto. The conference, organized by the Digital Assets Council of Financial Professionals (DACFP), typically attracts hundreds and sometimes even thousands of advisors interested in cryptocurrencies.

“The vibe has completely changed,” Barhydt said about the general sentiment at the conference. “It went from – when I first presented at this event five years ago – ‘sceptical magic Internet money nonsense,’ to ‘hey, we need to be offering this to our clients.’”

Barhydt explained that TradFi advisor turned crypto evangelist Ric Edelman, who also happens to be the founder of DAFCP, stood up and announced the death of the 60/40 model.

“The allocation model you’re familiar with – stocks and bonds – must now be replaced by one featuring stocks, crypto, and bonds” Edelman said, according to a press release from DAFCP. “The correct allocation now is to place 70% to 100% of the client’s portfolio into stocks and crypto, with no more than 30% in bonds, and potentially zero in debt securities.”

With a potential deluge of new business waiting in the wings, Abra wants to position itself as the go-to firm for advisors seeking crypto exposure for their clients’ portfolios. The company not only offers spot crypto, but also borrowing, lending, yield, and other services.

“If you’re on zero [allocation], now is the time to get off zero,” said Barhydt. “Bitcoin represents the best economic opportunity of our lifetime.”

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

The Next Bitcoin Story Of 2025