Useless Coin rally at risk as whales and smart money start selling

Useless Coin’s price continued its strong rally this week, reaching a record high even as the broader crypto market retreated.

Useless Coin (USELESS), a Solana (SOL)-based meme coin, rose to a high of $0.25, up nearly 1,000% from its May low. The surge has pushed its market capitalization to $240 million.

As crypto.news wrote recently, the rally has been fueled by fear of missing out among retail traders and whales. Such speculative pumps are common among newly launched tokens.

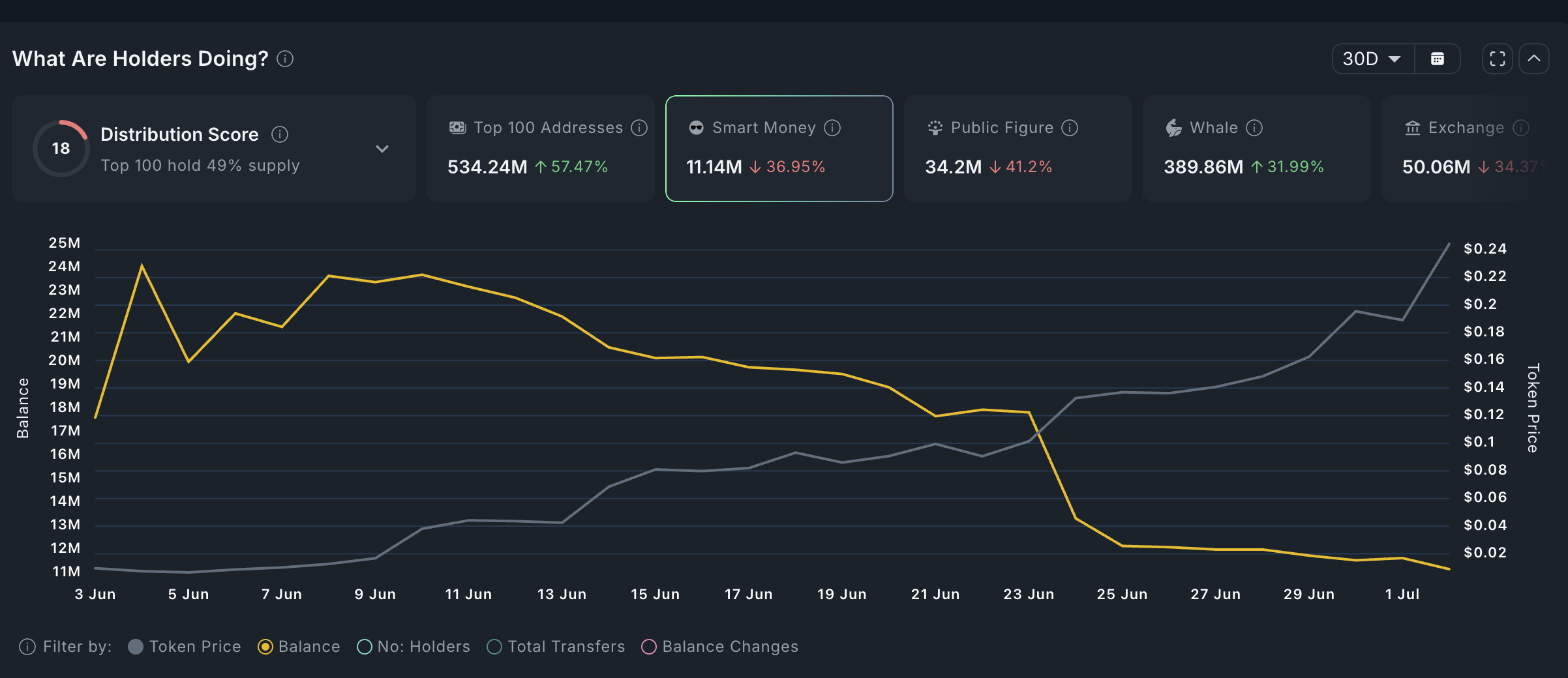

However, data from Nansen suggests that a reversal may now be underway. Smart money investors have significantly reduced their holdings, which have dropped to 11.4 million USELESS tokens from 24 million on June 4.

Nansen defines “smart money” as individual or institutional wallets with a strong track record of profitable trading. Additional data shows that public figures have also trimmed their USELESS holdings. Their total now stands at 32.4 million tokens, down from 70.96 million in June.

Whale activity shows a similar trend. Whale holdings have declined from a peak of 433 million tokens in June to 389 million currently. These reductions across sophisticated investor segments suggest increasing sell pressure, which could trigger a reversal.

Another bearish signal comes from the futures market. According to CoinGlass, the weighted funding rate has remained in negative territory throughout the recent rally. A negative funding rate indicates that traders expect the token’s price to decline.

Useless Coin price analysis

The eight-hour chart shows that Useless Coin has been in a sustained uptrend over the past few weeks. As a result, it now trades well above its 50-period moving average, increasing the risk of mean reversion. Mean reversion refers to an asset returning to its historical average after an extended move.

Additionally, the Relative Strength Index has formed a bearish divergence pattern, developing a descending channel even as price has moved higher. Taken together, these signals suggest that a reversal is likely as selling intensifies across whales, retail traders, and smart money. If this plays out, the next key level to watch will be $0.10.

You May Also Like

Coinbase CEO advocates for crypto legislation reform in Washington DC

Forex Expo 2025 Redefines the Trading Landscape