Solana’s Next Leg Higher Looks Strong, But Ozak AI Forecast Appears Far Steeper

Crypto market sentiment continues strengthening as Solana trades near $131 and prepares for what analysts believe could be its next major upside leg. Network activity remains high, developer traction is accelerating, and liquidity continues flowing into SOL as one of the fastest-growing Layer-1 ecosystems. With institutional interest rising and on-chain usage expanding across DeFi, gaming, and payments, Solana is well-positioned for another powerful surge.

Yet while SOL’s next run looks convincingly bullish, the long-term trajectory capturing the highest ROI expectations is Ozak AI (OZ). As a functioning AI-native intelligence engine with millisecond-level analysis, autonomous agents, and accelerating early-stage growth, Ozak AI introduces a far steeper expansion curve than even top-tier large-cap assets like Solana.

Ozak AI (OZ)

Ozak AI’s strength begins with its real, operational intelligence infrastructure—a rarity among presale projects. Its predictive engine uses HIVE’s ultra-fast 30 ms market signals to scan blockchain activity at a speed unreachable by human traders or conventional analytics tools. Above this predictive layer operate SINT-powered autonomous agents capable of analyzing multiple chains simultaneously, reacting to emerging patterns, and refining strategies without human intervention.

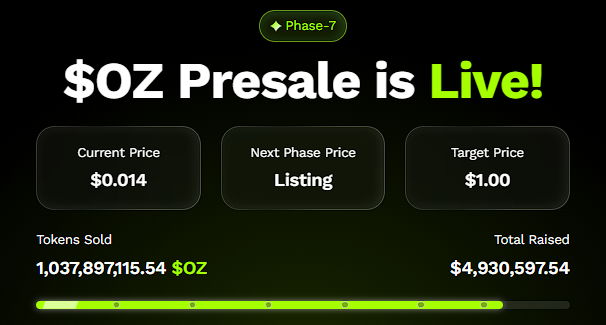

This growth model becomes even stronger through Perceptron Network’s 700K+ distributed nodes that continuously feed cross-chain intelligence into Ozak AI’s system, allowing the AI to improve every hour it runs. Unlike Solana, whose growth depends on adoption waves, Ozak AI grows through computation, meaning its value compounds as its intelligence deepens. The Ozak AI Presale has already surpassed $4.9 million, signaling intense early interest as investors position themselves before later pricing stages. With Ozak AI Presale demand accelerating rapidly, analysts increasingly project a 50x–100x upside range in the 2025–2026 window.

Solana (SOL)

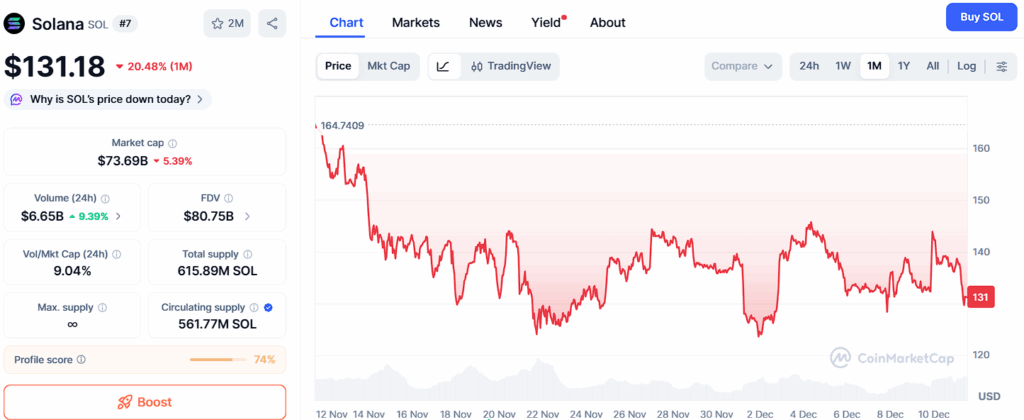

Solana’s position around $131 reflects a market steadily building pressure for a broader breakout. Key support sits around $129, reinforcing the current trend, while deeper structural stability is found at $124 and $119 — levels where accumulation has historically reappeared before significant upside movements. These supports provide SOL with a strong foundation as it approaches its next bullish wave.

On the resistance side, Solana faces important breakout points at $136, $141, and $148. Clearing these levels typically sends SOL into rapid acceleration phases, where liquidity floods in and multi-week rallies unfold. With its expanding developer ecosystem, fast execution speeds, and rapidly growing consumer footprint, Solana remains one of the most fundamentally strong blockchain assets heading into 2025. Analysts expect it to revisit $600–$850 in a full bull cycle—a powerful move, but still structurally limited compared to early-stage AI-native networks like Ozak AI.

Why Ozak AI’s Forecast Appears Far Steeper

Solana grows when user activity rises, when liquidity increases, and when ecosystem adoption expands. Ozak AI grows every time its intelligence engine processes new data—a compounding mechanism that strengthens the project even when market sentiment is neutral. Each predictive refinement, autonomous agent execution, and cross-chain scan enhances Ozak AI’s long-term capability, creating a trajectory that accelerates naturally over time.

This gives Ozak AI a fundamentally different growth curve. Solana’s upside is strong but linear, tied to measurable adoption cycles. Ozak AI’s upside is exponential, fueled by self-improving intelligence and massive cross-chain data ingestion. As more networks integrate with Ozak AI and the predictive models continue maturing, the system scales in value at a pace traditional L1 assets cannot replicate.

Solana may deliver one of the strongest large-cap rallies of the next cycle, but Ozak AI is positioned to deliver one of the strongest ROI outcomes. As 2025–2026 approaches, Solana looks powerful, yet Ozak AI appears transformational—the project most likely to outperform even top-tier blockchain leaders with a far steeper, intelligence-driven growth arc.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

- Website: https://ozak.ai/

- Telegram: https://t.me/OzakAGI

- Twitter: https://x.com/ozakagi

Disclaimer: TheNewsCrypto does not endorse any content on this page. The content depicted in this Press Release does not represent any investment advice. TheNewsCrypto recommends our readers to make decisions based on their own research. TheNewsCrypto is not accountable for any damage or loss related to content, products, or services stated in this Press Release.

You May Also Like

Unlocking Opportunities: Coinbase Derivative Blends Crypto ETFs and Tech Giants

Crossmint Partners with MoneyGram for USDC Remittances in Colombia