The Only New Crypto Under $0.04 That Could Be the Final High-Upside Entry of Q4 2025

Not all crypto projects come with sound. They develop tactfully, step by step, as minds remain focused elsewhere. Capital enters steadily. Participation is a thing that is established without headlines. Then at some stage, visibility becomes quick. What was previously ignored gets put under scrutiny.

One Ethereum-based DeFi crypto seems to be undergoing that change already. Mutuum Finance (MUTM) has 2025 most of the time been working at developing. Q4 shows that the project is no longer in the quiet phase and is in an infantry where the access, timing, and awareness begin to meet.

What Mutuum Finance (MUTM) Has Been Doing

Mutuum Finance is building a real-usage lending and borrowing protocol. They have their two lending markets that serve to ensure that capital is not idle.

Users will have the ability to lend and borrow funds on varying terms using collateral or without collateral to generate yield. The rate of interest is adjusted according to the demand, and it assists in correcting the liquidity in the entire system. Loan-to-Value ratios and liquidation rates are used to deal with risk in times of price fluctuations.

Such a design is not to work once only in the conditions of the rallies but in quite various situations on the market. Such pragmatic orientation, in turn, explains the reason why evolution has persisted without attention cycles.

The transition point is V1. The original version of the protocol would be deployed on Q4 2025 on the Sepolia testnet, according to statements made by the Mutuum Finance (MUTM) team on X. This release introduces liquidity pools, mtTokens, debt tokens and an automated liquidator into live testing, where initially ETH and USDT are developed. It is the time when silent growth is noticeable.

Expansion of the Audience

The development proceeded, but there was an increasing level of participation. Mutuum Finance has gathered $19.4M USD and grown to frequently above 18,500 holders. These numbers were not the results of one jumped wave. They piled up stage after stage.

This pattern matters. Slow growth usually shows an interest of the long-term but not an acceleration over the short-term. Market commentators go on to refer to this stage as accumulation. The investment comes before the mass attention has been concentrated on.

MUTM is now priced at a price of $0.035 USD and in Phase 6 which is now more than 99% deployed. The token started at $0.01 at the beginning of 2025, and its present value is a 250% increment since its initial release.

Under Forced supply is 4B MUTM tokens. The reserved amount of that, 45.5%., or nearly 1.82B tokens, are allocated to early distribution. Over 820M of tokens have already been sold.

With each completion of a phase, the price increases. The subsequent step will increase the token price by an estimated 20% closer to the eventual launch price of $0.06. It is a building with a changing behavior. Uncertainty increases at the known price when the supply becomes tight.

Security Stack and the Ultimate Shift to Visibility

A security preparation is usually an indication of a project that is about to be exposed on a larger scale. Mutuum Finance has undergone a CertiK Token Scan of 90/100. Simultaneously with it, Halborn Security is carrying out an independent audit of finalized lending and borrowing contracts.

Another review layer is introduced through the use of a $50k bug bounty, which means that the external developers would test the code. These processes are usually done prior to projects passing through more prominent stages.

The reason this moment is not similar to earlier stages

Phase 6 is nearly complete. The amount that can be allocated at the prevailing price is small. The bigger allocations have started showing up with the channeling of supply getting narrow.

Interaction tools strengthen this change. The drive to contribute in real-time is motivating because every day will see the number one depositor individual win $500 in MUTM. The usage and the visibility of the token are increased by MUTM card payment access. Phase 1 users are placed to see 500% MUTM growth as compared to the opening price of $0.06. Every successful phase minimises the barrier to new entrants.

This mixture is the reason why the visibility is becoming different. The silent build up is being replaced by the proactive positioning. By Q4 2025, Mutuum Finance will no longer be working under the curtains. This could be the last high upside entry point at less than $0.04 USD to the new cryptocurrency projects, which those following the best crypto to purchase are currently tracking.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

You May Also Like

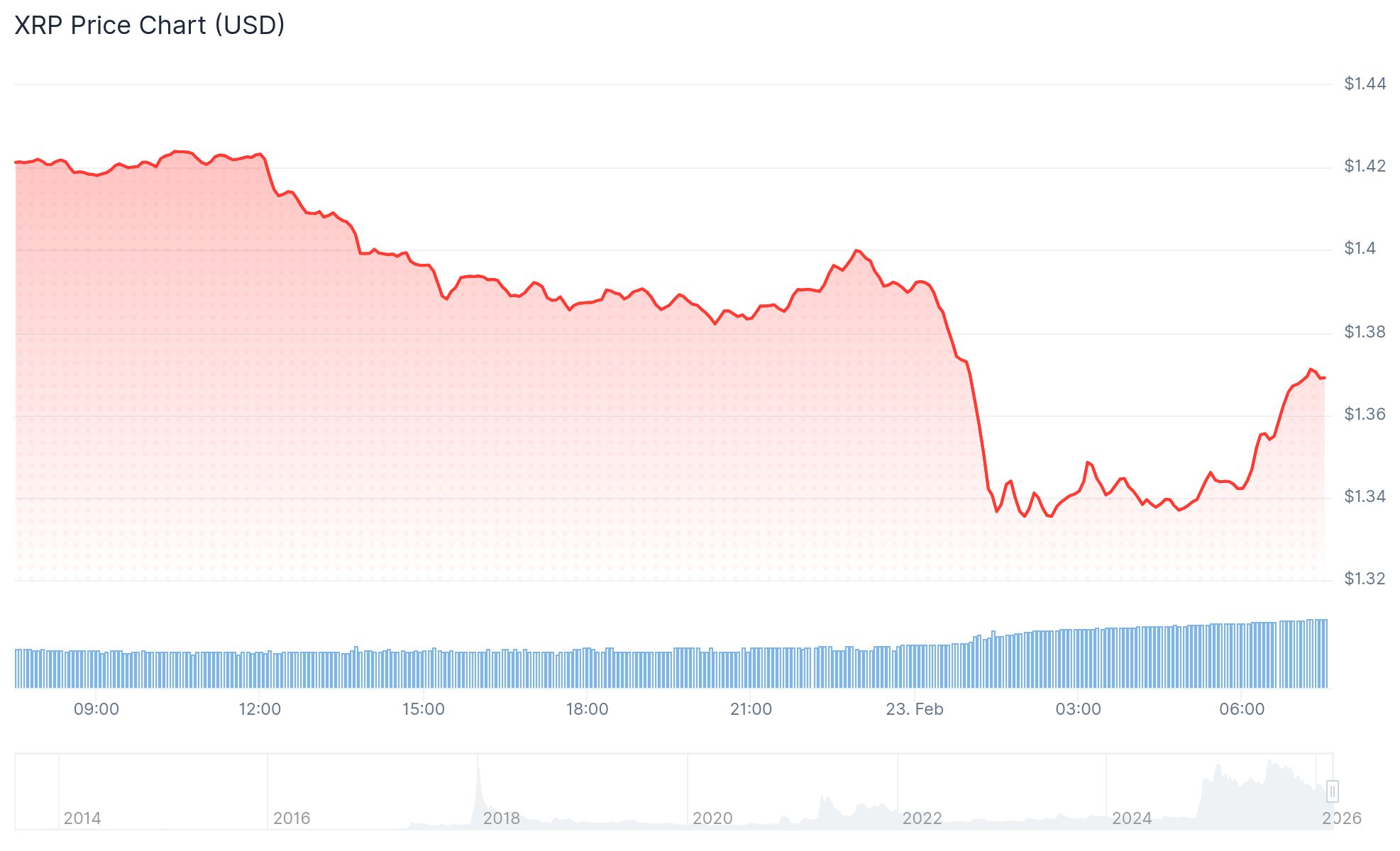

XRP Price Crashed 69% From its Peak

XRP Price: Falls to $1.33 as Realized Losses Hit 39-Month High – Watch These Levels