No Crypto Payments: Russia Draws Line On Bitcoin, Ethereum

Russia’s crypto payment rumor mill just got another hard “no.” Anatoly Aksakov, the chairman of the State Duma Committee on Financial Markets, said cryptocurrencies “will never” function as money inside Russia — and that if you’re paying for something domestically, it’s rubles or nothing.

“It must be understood that cryptocurrencies will never become money within our country. They can only be used as an investment tool. If you want to pay for something, you can only do so with rubles,” Aksakov said at a press conference hosted by TASS.

Russia Rejects Crypto Payments

That line lands because, for years, there’s been a steady drip of “maybe Russia will allow” crypto payments chatter — and it’s not always completely baseless. The country has been trying to route around sanctions pressure, and crypto keeps popping up in the conversation. When officials talk up “settlements” and “trade,” plenty of people hear “payments” and assume that means everyday retail use is next.

It isn’t. At least not in the way crypto Twitter likes to imagine. Aksakov’s comments track with the central bank’s position. Bank of Russia governor Elvira Nabiullina told lawmakers earlier this year that crypto can’t be used for domestic settlements, while also pointing to a separate experimental legal regime (ELR) that allows crypto to be used in foreign trade under controlled conditions.

That split — “no” at home, “maybe” abroad — is the whole story. Russia has been building carve-outs for cross-border use, including frameworks that allow exporters and importers to use crypto in international settlements under foreign trade contracts.

And officials have been unusually blunt about the motivation. In late 2024, Finance Minister Anton Siluanov said Russia had begun using bitcoin and other cryptocurrencies for international trade under a special legal regime. So yes, crypto gets used. Just not the “pay your landlord in ETH” version.

The other source of confusion is that policy tone has softened around investing — even while payment bans stay in place. In March that the central bank proposed an experimental program that would let “specially qualified” wealthy investors buy crypto, explicitly keeping the domestic payment ban intact.

And regulators have still shown they’re willing to swing a hammer at the retail plumbing when they want to, like the reported blocking of crypto-related services.

In other words: Russia’s message is basically “speculate if you must, trade if you’re authorized, settle cross-border if you’re inside the sandbox — but inside the country, the ruble stays the only checkout option.” And for anyone still clinging to the payment narrative: this was the door closing sound.

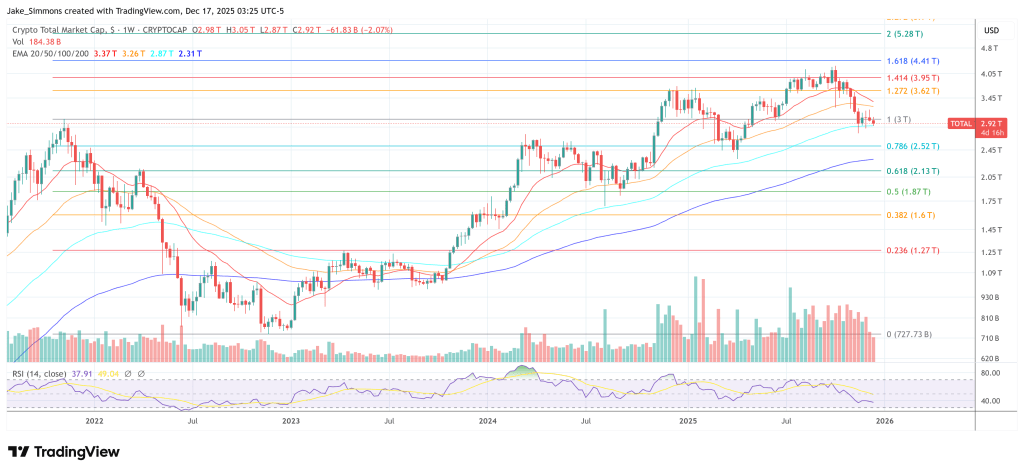

At press time, the total crypto market cap stood at $2.92 trillion.

You May Also Like

Trump to Announce Fed Chair Soon: "Someone Who Believes in Lower Interest Rates by a Lot"

XRP Price Falls Below $2, Deepening Investor Concerns