Hyperliquid Valuation Is Drawing Comparisons to Solana: Here is Why

This article was first published on The Bit Journal.

Hyperliquid valuation has quietly become one of the most serious debates in crypto finance. What started as a decentralized trading protocol is now being discussed in the same breath as large financial infrastructure platforms. That shift alone says something important about where the market may be heading next.

The discussion gained momentum after a major institutional research report framed Hyperliquid as infrastructure rather than speculative DeFi. According to the source, the protocol’s fee design, validator economics, and capital flows resemble those of a platform business more than those of a typical token project. That framing has caught the attention of analysts who usually avoid DeFi narratives.

A DeFi Platform Built Around Real Usage

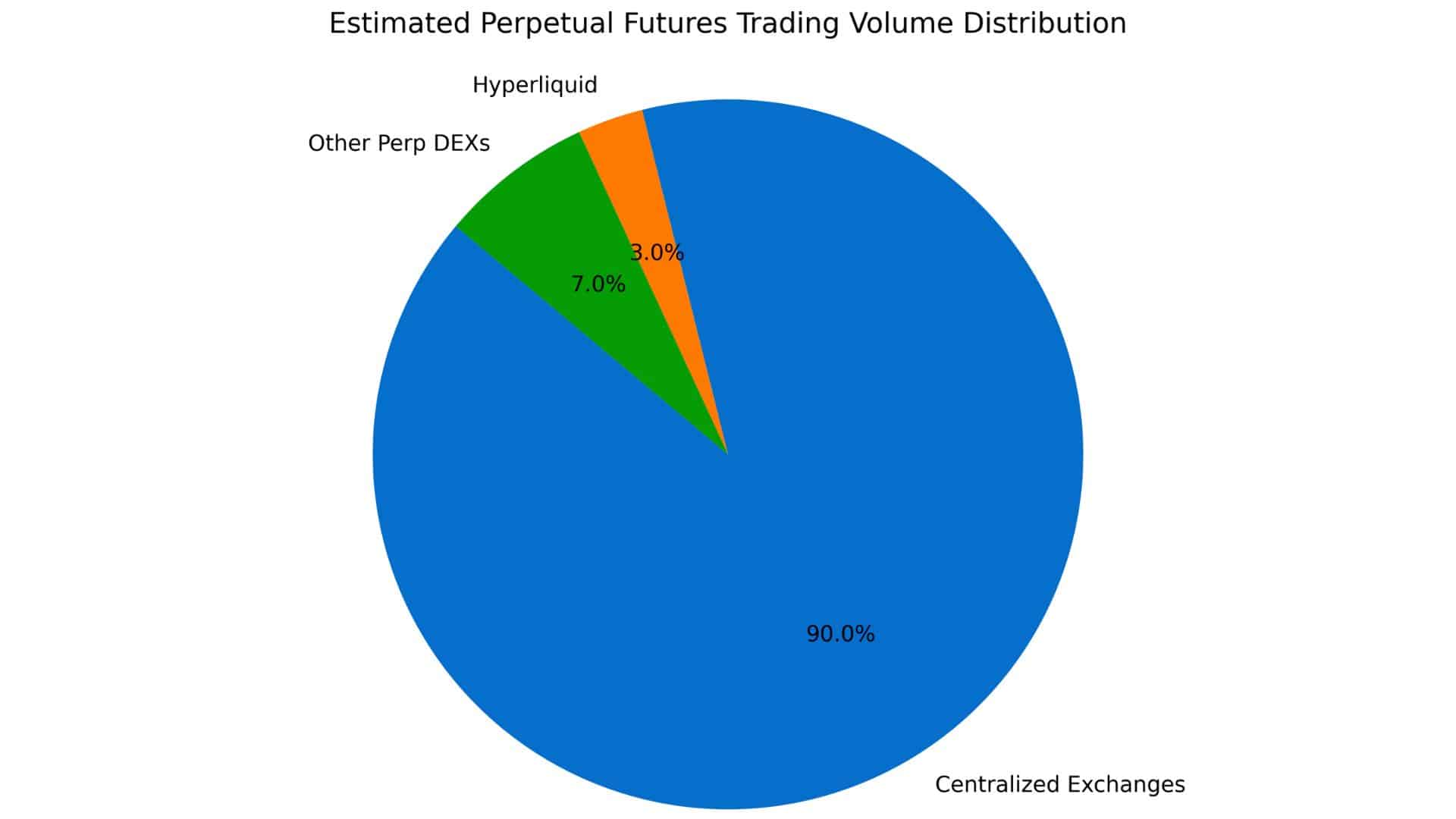

The Hyperliquid DeFi ecosystem stands out because it earns revenue the old-fashioned way. It charges fees on real trades. CoinMarketCap data shows that crypto perpetual futures reached $60 trillion in total volume in 2025. Most of that activity still flows through centralized exchanges.

Hyperliquid targets the existing market instead of chasing new demand. That matters. History shows platforms grow faster when they pull users from established venues. One well-cited market study notes that “liquidity follows execution quality, not incentives.” That idea sits at the heart of Hyperliquid’s strategy.

CEXs Still Dominate Perp Trading as Hyperliquid Emerges

CEXs Still Dominate Perp Trading as Hyperliquid Emerges

Why Hyperliquid Valuation Keeps Getting Compared to Solana

The Hyperliquid valuation debate often circles back to Solana’s last major cycle. Early Solana investors focused on speed and throughput. Over time, the conversation shifted toward cash flow, developer stickiness, and settlement value.

A similar change is now happening with Hyperliquid DeFi. Instead of emissions, nearly all protocol revenue is allocated to token buybacks. That means growth reduces supply. Analysts view this structure as closer to traditional equity logic than typical DeFi reward models.

Fees That Change the Long-Term Equation

The fee model sits at the center of the Hyperliquid valuation thesis. When trading volume rises, buybacks increase. This creates a clear link between usage and value. Financial studies on market design suggest buyback-driven systems tend to attract longer-term capital because they reduce dilution risk.

CoinMarketCap figures show that even modest gains in market share from centralized exchanges could generate hundreds of millions in annual fees. That scale explains why institutional desks now take the model seriously.

Competition Exists, but Liquidity Has Memory

Rival platforms have challenged Hyperliquid, including incentive-heavy derivatives exchanges. Some briefly posted higher monthly volume. Analysts noticed unusually high volume-to-open-interest ratios. That often signals reward-driven activity rather than conviction trading.

As incentives fade, traders usually return to platforms with deeper liquidity and tighter spreads. Research on exchange competition shows this pattern repeating across markets. That behavior continues to support the Hyperliquid DeFi growth outlook.

A Valuation Model Still Under Debate

A 50x multiple remains controversial. Critics question whether a leverage-driven trading network deserves infrastructure-style pricing. Supporters argue that decentralized trading systems with sustainable fees should be analyzed using the same analytical framework as payment rails.

This tension now defines the Hyperliquid valuation conversation. It is no longer about hype cycles. It is about whether decentralized finance can produce durable, predictable revenue.

Conclusion: A Signal Bigger Than One Protocol

The real story behind Hyperliquid valuation goes beyond price targets. It signals how markets may value DeFi platforms in the future. If fee-based models continue to outperform incentive-driven systems, Hyperliquid DeFi could become a reference point for future projects. That shift would reshape how crypto infrastructure is built and priced.

Glossary of Key Terms

Perpetual Futures: Derivatives with no expiration date.

Token Buyback: Using revenue to reduce circulating supply.

Open Interest: Total active derivative positions.

DeFi Infrastructure: Blockchain systems supporting financial activity.

FAQs About Hyperliquid Valuation

1. What is Hyperliquid?

A decentralized perpetual futures trading platform.

2. Why is Hyperliquid valuation important?

It reflects a shift toward infrastructure-style pricing in DeFi.

3. Is Hyperliquid DeFi profitable?

It generates real trading fees linked to usage.

4. How can readers track Hyperliquid’s market performance?

Price data, volume trends, and market rankings can be followed through regularly updated listings on CoinMarketCap.

Sources & References

Coinmarketcap

Bisorg

Cfainstitute

Read More: Hyperliquid Valuation Is Drawing Comparisons to Solana: Here is Why">Hyperliquid Valuation Is Drawing Comparisons to Solana: Here is Why

You May Also Like

Where is the Bottom for Bitcoin?

Mysterious whales are accumulating these cryptocurrencies after market crash