How Did Solana Stay Online During the 4th Largest DDoS Attack Ever Recorded?

The post How Did Solana Stay Online During the 4th Largest DDoS Attack Ever Recorded? appeared first on Coinpedia Fintech News

For most blockchains, a sustained DDoS attack at internet-scale would mean stalled transactions, missed blocks, and visible network stress. That didn’t happen this time.

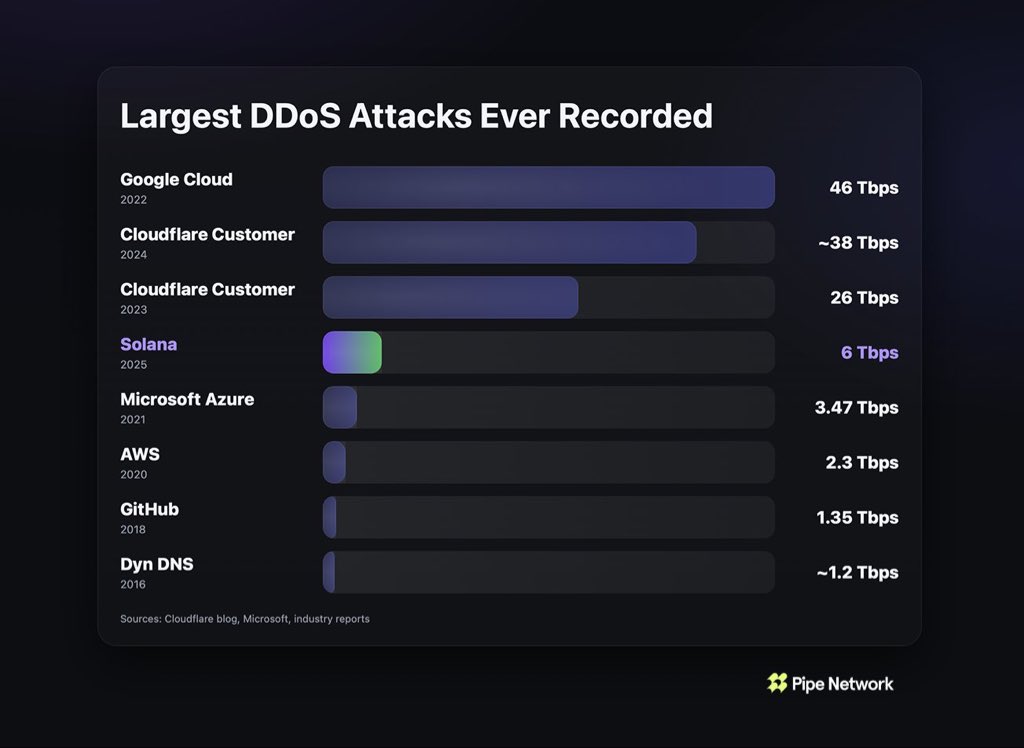

Over the past week, the Solana network has been operating under a massive distributed denial-of-service (DDoS) attack that peaked near 6 terabits per second, ranking it as the fourth-largest DDoS attack ever recorded on any distributed system.

Despite the scale, on-chain data shows the network continued to function normally.

A Week Under Attack With No Network Slowdown

A DDoS attack is designed to overwhelm a network by flooding it with traffic, usually causing slowdowns or outages.

SolanaFloor reported that the Solana network had been facing a “sustained DDoS attack for the past week, peaking near 6 Tbps,” while noting that data showed “no impact, with sub-second confirmations and stable slot latency.”

Pipe Network described the scale as unusual even by internet standards.

Transaction Speeds Remain Steady Under Pressure

Data shared showed that transactions continued to confirm in under a second, with block production staying on schedule throughout the attack. In simple terms, users were able to send and confirm transactions as usual, even while the network was being flooded with attack traffic.

DDoS attacks of this scale have historically targeted cloud providers such as Google Cloud and Cloudflare, making Solana’s ability to stay online stand out.

A Clear Contrast With Other Blockchain Disruptions

According to reports, the episode also contrasts with a recent DDoS attack on the Sui network, which resulted in block production delays and degraded performance.

As details of the attack spread, the crypto community took to X to point out the scale of the event and the lack of visible impact on the network.

This has reinforced Solana’s strong reputation as a trustworthy network built to handle heavy demand.

You May Also Like

Tether’s Uruguay Bitcoin Mining Plans Could Be Over

Oil jumps over 1% on Venezuela oil blockade