- Trump claims inflation “totally neutralized,” economic details revealed.

- White House cites 2.7% inflation, significant economic progress.

- Federal Reserve optimistic on goods inflation amid regulatory changes.

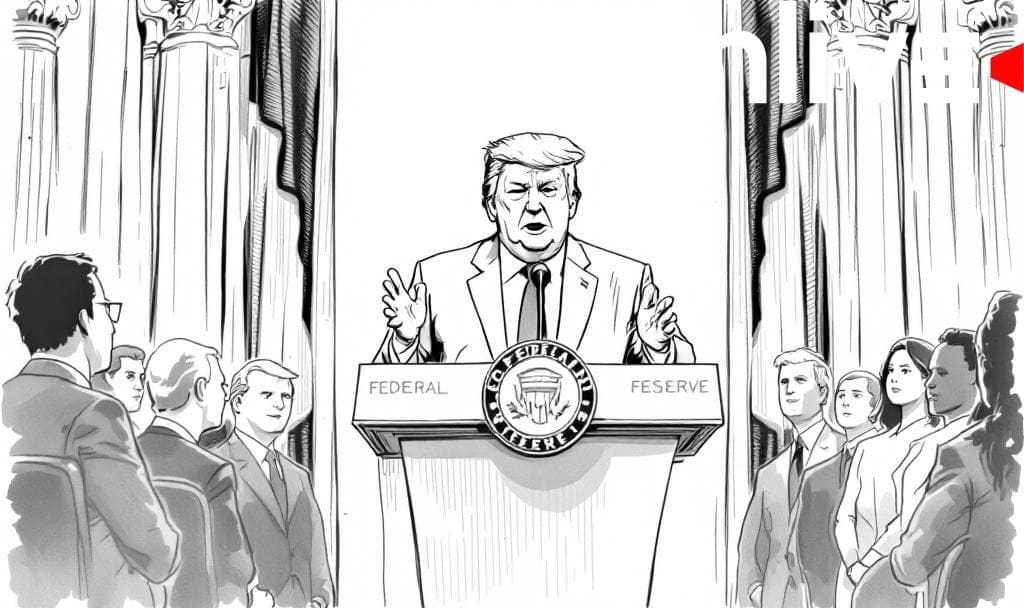

President Trump Claims Inflation Is Neutralized

President Trump Claims Inflation Is Neutralized

On December 14, 2025, President Trump claimed that inflation is ‘totally neutralized,’ amid his administration’s efforts to reduce inflation to an average of 2.7% during his second term.

The claim highlights ongoing economic strategies, but lacks a direct correlation to cryptocurrency markets, although broader economic improvements can indirectly influence risk assets.

President Donald Trump announced earlier today that inflation is “totally neutralized,” according to a speech reported on December 14, 2025. Economic details in a recent White House statement show inflation has been reduced to 2.7% during his term. Donald J. Trump, President of the United States, remarked, “inflation has been cut by more than half” and is “working to bring it down further.”

Trump’s statement was not directly attributed to any social media post. The White House article highlights Trump’s economic strategy, mentioning spending cuts and tariff adjustments to tackle inflation challenges.

The broader economic impact is significant, with wage growth approaching 4% and gas prices declining nationwide. These figures illustrate the potential benefits felt across various sectors and household budgets. Shelter inflation also reached a four-year low, according to White House data.

Experts like Federal Reserve Governor Steven I. Miran recognize improved goods inflation prospects due to deregulation. In his Columbia University speech, Miran highlighted factors driving positive economic momentum, without directly addressing Trump’s inflation neutralization claims.

Current cryptocurrency markets have not shown any direct response to these announcements, with no on-chain data indicating shifts. Experts haven’t linked changes in crypto assets such as ETH or BTC to inflation claims.

The path forward for financial and regulatory outcomes may hinge on prolonged economic measures. Analysts believe inflation reductions could influence risk assets, though direct impacts on cryptocurrency remain speculative. Historical patterns and economic trends provide vital context for ongoing analysis.