DOGE Might Rally 12x, Yet Analysts Say Ozak AI Has the Strongest Millionaire Potential

Crypto market momentum continues to intensify as Dogecoin shows signs of preparing for another major rally, with analysts projecting that DOGE could deliver up to a 12x return during the next bull cycle. Its strong community base, recurring meme-driven surges, and rising liquidity all support a bullish move from its current level near $0.1426.

Yet despite Dogecoin’s potential, the project capturing far more attention among high-ROI investors is Ozak AI (OZ)—the AI-native intelligence engine already operating with real-time predictive capability, autonomous agent-driven execution, and cross-chain analytics. Analysts increasingly believe Ozak AI holds the strongest millionaire-making potential heading into 2025–2026 due to its exponential, intelligence-driven growth curve.

Dogecoin (DOGE)

Dogecoin trades around $0.1426 and continues forming a stable bullish structure supported by strong long-term demand. Support at $0.1380 secures the near-term trend, while deeper zones at $0.1325 and $0.1270 provide reinforcement that historically initiates strong accumulation phases. DOGE begins generating upward continuation pressure as it approaches resistance at $0.1480, with higher breakout zones at $0.1550 and $0.1620 — levels often associated with large upward accelerations during previous meme-driven cycles.

DOGE’s technical strength supports a rally narrative, but its performance remains tied to hype cycles, social sentiment, and liquidity waves. Ozak AI, on the other hand, strengthens through measurable intelligence and real-time operational performance — a difference that forms the basis of its far larger upside expectations.

Youtube embed:

Ozak AI ($OZ) Project Review | A Look at Its AI-Driven Financial Platform

Ozak AI (OZ)

Ozak AI separates itself from meme assets by delivering actual, functioning infrastructure before launch. Its intelligence layer operates at millisecond speed, scanning market conditions, liquidity shifts, and cross-chain signals faster than human-driven analysis can react. HIVE’s 30ms execution-grade data feeds the system with high-resolution insight, while SINT-powered autonomous agents interpret blockchain conditions and adjust strategies in real time. Perceptron Network’s 700K+ distributed nodes reinforce this core, feeding Ozak AI deep multi-chain visibility.

This evolving intelligence framework creates compounding utility—as more data flows into the system, Ozak AI becomes smarter, faster, and more accurate. This self-improving dynamic is why analysts model Ozak AI as a potential 50x–100x performer, far beyond DOGE’s expected 10x–12x upward move.

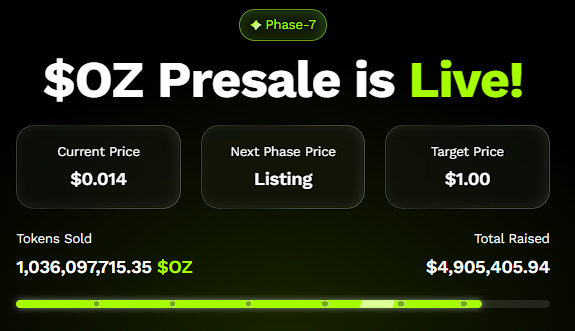

Ozak AI Presale Momentum

Ozak AI Presale momentum surpassing $4.9 million reflects a rare level of early conviction typically seen only in cycle-leading projects. Investors who normally avoid presales are entering early because Ozak AI is already operational—delivering millisecond predictive insights, autonomous cross-chain agents, and real-time analytical power before listing. This drastically reduces early-stage risk and amplifies ROI potential, making Ozak AI a standout among all AI-themed and infrastructure-focused tokens.

Analysts also note a rising trend of meme-coin holders—including DOGE traders—rotating a percentage of their gains into Ozak AI to capture its early exponential potential. This rotation mirrors the behavior seen during earlier cycles when high-ROI projects like LINK, MATIC, and SOL emerged from presale or early-market phases.

Why Ozak AI Holds the Strongest Millionaire Potential

DOGE may still deliver impressive returns, and a 12x rally remains entirely plausible during peak bullish conditions. Its viral strength, community loyalty, and meme-cycle patterns guarantee it remains a major player in the next bull market. But millionaire strategies require asymmetric upside — and that is where Ozak AI becomes the clear leader.

DOGE grows through hype. Ozak AI grows through intelligence. This is the fundamental difference shaping investor expectations. Ozak AI’s early-stage valuation combined with its functioning predictive engine, autonomous AI agents, and multi-chain analytics creates a trajectory far sharper than meme-driven assets. For traders seeking life-changing ROI, analysts increasingly rank Ozak AI as the most promising millionaire-making asset of the upcoming cycle—the project with the clearest path to 50x–100x growth as AI and blockchain converge in 2025–2026.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release

The post DOGE Might Rally 12x, Yet Analysts Say Ozak AI Has the Strongest Millionaire Potential appeared first on Live Bitcoin News.

You May Also Like

SEC urges caution on crypto wallets in latest investor guide

Crucial Fed Rate Cut: October Probability Surges to 94%