Tezos (XTZ) Price Prediction 2026, 2027-2030

- Bullish XTZ price prediction for 2026 is $0.7467 to $1.2393.

- Tezos (XTZ) price might reach $5 soon.

- Bearish XTZ price prediction for 2026 is $0.2609.

In this Tezos (XTZ) price prediction 2026, 2027-2030, we will analyze the price patterns of XTZ by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

|

TABLE OF CONTENTS

|

|

INTRODUCTION

|

|

|

TEZOS (XTZ) PRICE PREDICTION 2026

|

|

| TEZOS (XTZ) PRICE PREDICTION 2027, 2028-2030 |

| CONCLUSION |

| FAQ |

Tezos (XTZ) Current Market Status

| Current Price | $0.5748 |

| 24 – Hour Price Change | 1.45% Up |

| 24 – Hour Trading Volume | $58.54M |

| Market Cap | $616.6M |

| Circulating Supply | 1.07B XTZ |

| All – Time High | $9.18 ( On Oct 04, 2021) |

| All – Time Low | $0.3146 (On Dec 07, 2018) |

What is Tezos (XTZ)

| TICKER | XTZ |

| BLOCKCHAIN | Tezos |

| CATEGORY | Blockchain Network |

| LAUNCHED ON | June 2018 |

| UTILITIES | Governance, security, gas fees & rewards |

Tezos (XTZ) is the native cryptocurrency of Tezos. Tezos is an open-source, smart contract-based blockchain that facilitates the creation and development of smart contracts and dApps.

The blockchain is secured by a modified proof-of-stake (PoS) called liquid proof-of-stake (LPoS). Transactions are added onto the blocks and validated by a group of validators called bakers and endorsers. Bakers are the ones who stake XTZ tokens and create new blocks. While endorsers validate the blocks.

Users can stake Tezos (XTZ) tokens to validate blocks and secure the blockchain. Token holders receive voting rights and participate in the network’s governance.

Recently, the new uranium trading platform, Uranium.io, was launched, powered by Tezos technology. It aims to make uranium trading accessible to all, previously limited to institutional investors. The platform is supported by Archax, the UK’s first registered crypto exchange, and Curzon Uranium, a leading uranium trading firm.

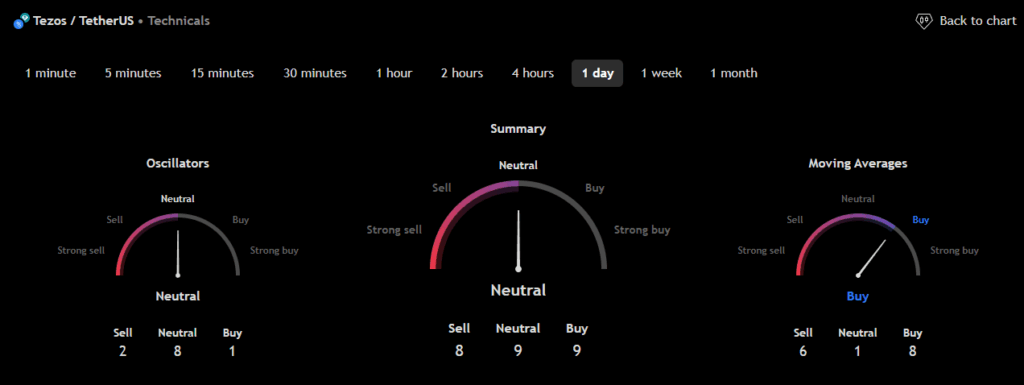

Tezos 24H Technicals

(Source: TradingView)

(Source: TradingView)

Tezos (XTZ) Price Prediction 2026

Tezos (XTZ) ranks 79th on CoinMarketCap in terms of its market capitalization. The overview of the Tezos price prediction for 2026 is explained below with a daily time frame.

In the above chart, Tezos (XTZ) laid out a Right Angle Descending Broadening Wedge pattern. A right-angled descending broadening wedge is a bullish reversal pattern. The pattern is an inverted ascending triangle because it is made up of two converging lines with a horizontal line for the resistance and a bearish downward slant for the support.

At the time of analysis, the price of Tezos (XTZ) was recorded at $0.5748. If the pattern trend continues, then the price of XTZ might reach the resistance levels of $0.6786 and $1.0799. If the trend reverses, then the price of XTZ may fall to the support levels of $0.5320 and $0.4184.

Tezos (XTZ) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Tezos (XTZ) in 2026.

From the above chart, we can analyze and identify the following as resistance and support levels of Tezos (XTZ) for 2026.

| Resistance Level 1 | $0.7467 |

| Resistance Level 2 | $1.2393 |

| Support Level 1 | $0.4254 |

| Support Level 2 | $0.2609 |

XTZ Resistance & Support Levels

Tezos (XTZ) Price Prediction 2026 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Tezos (XTZ) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current Tezos (XTZ) market in 2026.

| INDICATOR | PURPOSE | READING | INFERENCE |

| 50-Day Moving Average (50MA) | Nature of the current trend by comparing the average price over 50 days | 50 MA = $0.5142Price = $0.5853 (50MA < Price) | Bullish/Uptrend |

| Relative Strength Index (RSI) | Magnitude of price change;Analyzing oversold & overbought conditions | 56.2617 <30 = Oversold 50-70 = Neutral>70 = Overbought | Neutral |

| Relative Volume (RVOL) | Asset’s trading volume in relation to its recent average volumes | Below cutoff line | Weak volume |

Tezos (XTZ) Price Prediction 2026 — ADX, RVI

In the below chart, we analyze the strength and volatility of Tezos (XTZ) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of Tezos (XTZ).

| INDICATOR | PURPOSE | READING | INFERENCE |

| Average Directional Index (ADX) | Strength of the trend momentum | 34.0949 | Strong Trend |

| Relative Volatility Index (RVI) | Volatility over a specific period | 42.95 <50 = Low >50 = High | Low volatility |

Comparison of XTZ with BTC, ETH

Let us now compare the price movements of Tezos (XTZ) with that of Bitcoin (BTC), and Ethereum (ETH).

From the above chart, we can interpret that the price action of XTZ is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of XTZ also increases or decreases, respectively.

Tezos (XTZ) Price Prediction 2027, 2028 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Tezos (XTZ) between 2027, 2028, 2029, and 2030.

| Year | Bullish Price | Bearish Price |

| Tezos (XTZ) Price Prediction 2027 | $7 | $0.2 |

| Tezos (XTZ) Price Prediction 2028 | $8 | $0.1 |

| Tezos (XTZ) Price Prediction 2029 | $10 | $0.09 |

| Tezos (XTZ) Price Prediction 2030 | $11 | $0.08 |

Conclusion

If Tezos (XTZ) establishes itself as a good investment in 2026, this year would be favorable to the cryptocurrency. In conclusion, the bullish Tezos (XTZ) price prediction for 2026 is $1.2393. Comparatively, if unfavorable sentiment is triggered, the bearish Tezos (XTZ) price prediction for 2026 is $0.2609.

If the market momentum and investors’ sentiment positively elevate, then Tezos (XTZ) might hit $5. Furthermore, with future upgrades and advancements in the Tezos ecosystem, XTZ might surpass its current all-time high (ATH) of $9.18 and mark its new ATH.

FAQ

1. What is Tezos (XTZ)?

Tezos (XTZ) is the native crypto token of Tezos. Tezos is an open-source blockchain that facilitates the creation and development of smart contracts and dApps.

2. Where can you purchase Tezos (XTZ)?

Tezos (XTZ) has been listed on many crypto exchanges, including Binance, OKX, Bybit, DigiFinex, and Cointr Pro.

3. Will Tezos (XTZ) reach a new ATH soon?

With the ongoing developments and upgrades within the Tezos Platform, XTZ has a high possibility of reaching its ATH soon.

4. What is the current all-time high (ATH) of Tezos (XTZ)?

On October 04, 2021, XTZ reached its new all-time high (ATH) of $9.18.

5. What is the lowest price of Tezos (XTZ)?

According to CoinMarketCap, XTZ hit its all-time low (ATL) of $0.3146 on December 07, 2018.

6. Will Tezos (XTZ) reach $5?

If Tezos (XTZ) becomes one of the active cryptocurrencies that majorly maintain a bullish trend, it might rally to hit $5 soon.

7. What will be Tezos (XTZ) price by 2027?

Tezos (XTZ) price is expected to reach $7 by 2027.

8. What will be Tezos (XTZ) price by 2028?

Tezos (XTZ) price is expected to reach $8 by 2028.

9. What will be Tezos (XTZ) price by 2029?

Tezos (XTZ) price is expected to reach $10 by 2029.

10. What will be Tezos (XTZ) price by 2030?

Tezos (XTZ) price is expected to reach $11 by 2030.

Top Crypto Predictions

Ethereum (ETH) Price Prediction

Ethereum Classic (ETC) Price Prediction

Manta Network (MANTA) Price Prediction

Disclaimer: The opinion expressed in this chart is solely the author’s. It does not represent any investment advice. TheNewsCrypto team encourages all to do their own research before investing.

You May Also Like

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

Kalshi debuts ecosystem hub with Solana and Base